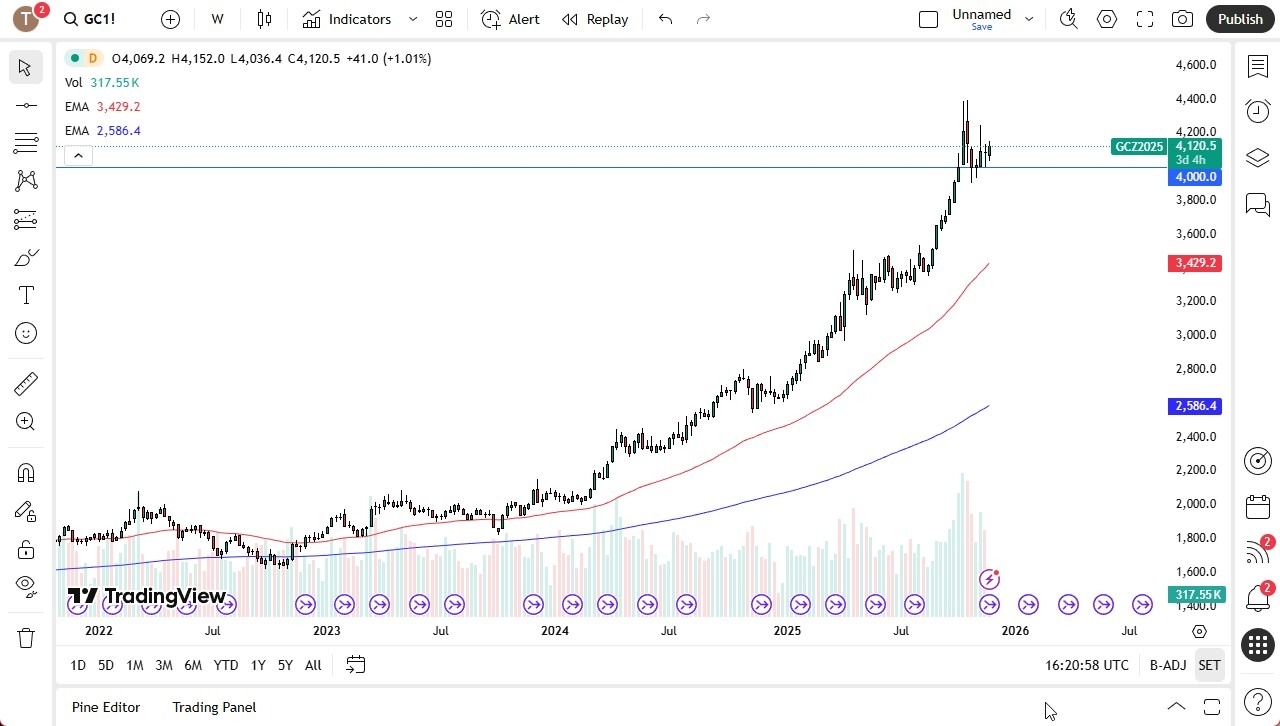

- Gold has been very noisy during the month of November as we have been bouncing around trying to calm the markets down after what had been a bit of an overextension of the uptrend.

- The $4,000 level is by far the most important number to pay close attention to as the market is currently trying to determine whether or not it is comfortable sitting around the $4,000 level.

At this point, if the market were to break down below $3,900, that could lead to a nasty correction down to the $3,500 level. On the other hand, if this market were to break to the upside, the $4,200 level is your first barrier, followed by the $4,400 level. Ultimately, this is a market that got way ahead of itself, and it may need to go sideways for a while. So, I suspect that between the push higher that we had seen and the possibility that there aren't that many people left to buy gold, we are setting out for a sideways month. This would make quite a bit of sense, considering that a lot of the volume will be gone anyway.

Top Regulated Brokers

Key Levels Defining December’s Gold Range

I don't have any interest in shorting gold, but below the $3,900 level, I could at least see the argument to do so, at least for a short-term swing trade. If we break above the $4,400 level, it's hard to tell where we go next. I imagine at that point you have to start thinking about $5,000 eventually, but that won't be overnight. This is a market that continues to see a lot of noisy behavior, and I think right now, it's just trying to determine whether or not the breakout above the $4,000 level matters and, more importantly, is something that the market can live with.

I think we are about to find out over the next couple of weeks, but I anticipate that most of December trading will be sideways, range-bound, back-and-forth type of setups. Pay close attention to the following levels: $4000, $3900, $4200, and $4400, as they will tell the story. All else is short-term trading and range-bound movement just waiting to happen.

Ready to trade our monthly forecast? Here’s a list of some of the best XAU/USD brokers to check out.