Long Trade Idea

Enter your long position between $128.17 (the lower band of its horizontal support zone) and $132.20 (the upper band of its horizontal support zone).

Market Index Analysis

- Extra Space Storage (EXR) is a member of the S&P 500 Index.

- This index trades inside a bearish chart pattern with rising bearish indicators.

- The Bull Bear Power Indicator for the S&P 500 Index is bearish with a descending trendline.

Market Sentiment Analysis

Equity markets rallied yesterday, building on Friday’s reversal, amid Federal Reserve Bank of New York President John Williams’ comments on a potential December interest rate cut. AI stocks led last week’s sell-off and reversal and are dragging equity futures lower this morning on the back of a contraction in NVIDIA. The AI bellwether is sliding after reports that Meta Platforms will spend billions to purchase chips from Google parent Alphabet’s AI chips. Investors will also get delayed US PPI and retail sales data today, while bond yields remain high, flashing warning signs for equity markets amid the worrying AI bubble trend.

Extra Space Storage Fundamental Analysis

Extra Space Storage is a real estate investment trust (REIT), the largest US owner of self-storage units, and the largest self-storage property manager. It has over 4,000 locations in 43 states, and Washington, DC, with more than 2.6 million units and over 283.4 million square feet of net rentable space.

So, why am I bullish on EXR following its post-earnings price slump?

EXR delivered a beat in its core funds from operations (FFO), upbeat full-year guidance, and improving profit margins. I am bullish on the fresh $600 million strategic collaboration to invest in self-storage units in partnership with Blue Vista Capital Management and UBS’s Unified Global Alternatives – Real Estate. Same-store occupancy improved by 30 basis points, and I expect the trend to continue in the current quarter.

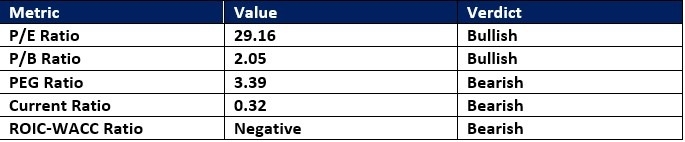

The price-to-earning (P/E) ratio of 29.16 makes EXR fairly valued. By comparison, the P/E ratio for the S&P 500 Index is 29.85.

The average analyst price target for EXR is $155.15. It suggests good upside potential with manageable downside risks.

Extra Space Storage Technical Analysis

Today’s EXR Signal

Extra Space Storage Price Chart

- The EXR D1 chart shows price action inside a horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline that could force a bullish crossover.

- The average bearish trading volumes rose during the most recent selloff but began to stabilize.

- EXR corrected more than the S&P 500 Index, a bearish trading signal, but bullish catalysts began to accumulate.

My Call on Extra Space Storage

I am taking a long position in EXR between $128.17 and $132.20. The latest earnings report showed promising developments, and I remain bullish, driven by the fresh $600 million strategic collaboration to invest in self-storage units and the ongoing margin expansion.

Top Regulated Brokers

- EXR Entry Level: Between $128.17 and $132.20

- EXR Take Profit: Between $149.31 and $155.15

- EXR Stop Loss: Between $117.40 and $121.03

- Risk/Reward Ratio: 2.16

Ready to trade our analysis of Extra Space Storage? Here is our list of the best stock brokers worth checking out.