Long Trade Idea

Enter your long position between $39.39 (the lower band of its horizontal support zone) and $41.02 (the upper band of its horizontal support zone).

Market Index Analysis

- Copart (CPRT) is a member of the NASDAQ 100 and S&P 500 indices.

- Both indices are in bearish price channels with more bearish catalysts emerging.

- The Bull Bear Power Indicator for the S&P 500 Index is bearish with a descending trendline.

Market Sentiment Analysis

NVIDIA’s earnings reports, guidance, and outlook on the health of AI were unable to reverse rising AI bubble fears. The sole reason for a late-day market reversal was Federal Reserve Bank of New York president John Williams’ suggestion about a potential December interest rate cut, which countered numerous contrary comments. September’s delayed NFP report made monetary policy more complex, but economic indicators confirm a slowing economy, decreasing consumer strength, and stubbornly high inflation. Earnings from Alibaba Holdings, Dell Technologies, Kohl’s (KSS), and Best Buy (BBY) will provide AI and consumer spending insights this week.

Copart Fundamental Analysis

Copart is an online auction platform for the automobile sector. It holds weekly and bi-weekly auctions for consumers and automotive companies. It is active in eleven countries, enabling buyers to purchase clean-title vehicles through its patented virtual auction technology (VB3).

So, why am I bullish on CPRT following its earnings report?

Third-quarter revenues of $1.16 billion narrowly missed estimates of $1.18 billion, while earnings per share of $0.41 were just above estimates of $0.40. Operating margins improved to 37.3%, and vehicle sales totaled $163.2 million, easily beating the $149.0 million estimate. I remain bullish on CPRT at current levels, driven by solid auction results, rising international buyer activity, and continued operational efficiency improvements supported by strong cash levels.

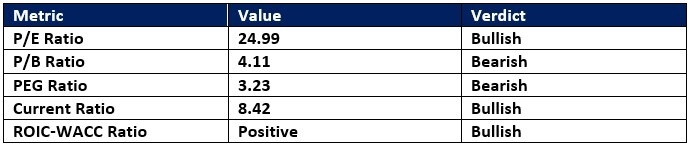

Copart Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 24.99 indicates CPRT is fairly valued. By comparison, the P/E ratio for the S&P 500 is 29.47.

The average analyst price target for CPRT is $50.22. It suggests excellent upside potential with acceptable downside risks.

Copart Technical Analysis

Today’s CPRT Signal

Copart Price Chart

- The CPRT D1 chart shows price action inside a horizontal support zone.

- It also shows price action between its descending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bearish with an ascending trendline.

- The average bullish trading volumes during positive sessions are higher than the average bearish trading volumes.

- CPRT corrected more than the S&P 500 Index, but downside risks are decreasing.

My Call on Copart

I am taking a long position in CPRT between $39.39 and $41.02. CPRT is a free cash flow machine, average car selling prices have risen, and operational metrics remain excellent across the board.

- CPRT Entry Level: Between $39.39 and $41.02

- CPRT Take Profit: Between $50.22 and $52.73

- CPRT Stop Loss: Between $35.55 and $37.42

- Risk/Reward Ratio: 2.82

Ready to trade our analysis of Copart? Here is our list of the best stock brokers worth reviewing.