Short Trade Idea

Enter your short position between $71.71 (the lower band of its horizontal support zone) and $73.16 (the upper band of its horizontal support zone).

Market Index Analysis

- The Coca-Cola Company (KO) is a member of the Dow Jones Industrial Average, the S&P 100, and the S&P 500.

- All three indices recover from massive AI-led selloffs, but bearish factors dominate.

- The Bull Bear Power Indicator of the S&P 500 Index turned bearish but shows a descending trendline.

Market Sentiment Analysis

Equity markets look poised to extend their rally, led by the AI rebound. Markets ignore the slump in consumer confidence and focus on renewed hopes for a December interest rate cut. Also, retail sales came in well below expectations, confirming a slowing consumer, and retailers flagged pressures on low and middle-income households. Valuations remain stretched, and no developments materialized to change the valuation or AI-bubble narrative this week. The third quarter earnings season is slowly winding down, as over 95% of S&P 500 companies have reported earnings.

Coca-Cola Company Fundamental Analysis

The Coca-Cola Company is one of the world’s largest beverage companies, with a recent push into healthy alternatives and bottled water. It began paying dividends in 1920 and, as of 2019, has increased its dividend for 57 consecutive years. It also has a high brand loyalty.

So, why am I bearish on KO after its recent rally?

While Coca-Cola announced plans to revive its iconic Diet Cherry Coke, banking on consumer nostalgia, I am bearish on its backwards-looking approach. Competition is heating up in the beverage sector, and the negative impacts of tariffs and currency fluctuations are likely to eat into operating margins, which have been contracting over the past few years. Valuations are now too high to buy into consumer loyalty trends. Health and sugar regulations add to significant operating pressures, while the reliance on bottlers remains an underpriced risk.

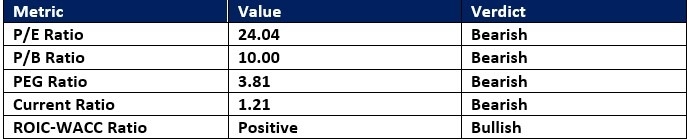

Coca-Cola Company Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 24.04 indicates KO is an expensive stock in its industry. By comparison, the P/E ratio for the S&P 500 is 29.85.

The average analyst price target for KO is $79.13, suggesting moderate upside potential, but downside risks have risen.

Coca-Cola Company Technical Analysis

Today’s KO Signal

Coca-Cola Price Chart

- The KO D1 chart shows price action inside its horizontal resistance zone.

- It also shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish but shows a negative divergence.

- Bearish trading volumes have spiked once price action moved into its horizontal resistance zone.

- KO outperformed the S&P 500 Index over the past month, a bullish trading signal, but bearish factors have accumulated.

My Call on Coca-Cola Company

I am taking a short position in KO between $71.71 and $73.16. KO has reached high valuations, and the 5-year PEG ratio suggests further downside. Changing consumer preferences, stiff competition, and declining operating margins add to my bearish outlook.

Top Regulated Brokers

- KO Entry Level: Between $71.71 and $73.16

- KO Take Profit: Between $64.04 and $65.35

- KO Stop Loss: Between $75.12 and $78.83

- Risk/Reward Ratio: 2.25

Ready to trade our analysis of Coca-Cola? Here is our list of the best stock brokers worth reviewing.