Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6400.

- Add a stop-loss at 0.6500

- Timeline: 1-2 days.

Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6500.

- Add a stop-loss at 0.6400

The AUD/USD exchange rate remained under pressure on Monday as investors waited for the upcoming Australian consumer inflation and US consumer conduct report. It dropped to a low of 0.6425, its lowest level since August 22, down by 3.75% from its highest level this year.

Australia Inflation and Consumer Confidence Report

The AUD/USD exchange rate has retreated in the past few months as the US Dollar Index (DXY) rebounded.

The next important for the pair will be the upcoming Australian inflation data, which will come out on Wednesday.

Economists expect the report to show that the headline Consumer Price Index (CPI) rose 3.5% in October, while the trimmed and weighted moving averages moved to 3% and 2.8%, respectively.

Top Regulated Brokers

These numbers will be the first time that the Australian Bureau of Statistics (BLS) will publish a comprehensive monthly inflation report like most countries do.

The data will mean that inflation has remained above the target of 2.0%, a sign that the Reserve Bank of Australia (RBA) will maintain a hawkish tone in the next few meetings.

Meanwhile, the pair will react to the upcoming US consumer confidence report on Tuesday. Economists polled by Reuters expect the report to show that the country’s consumer confidence eased from 94.6 in October to 93.3 in November.

The consumer confidence report is an important number because their spending is the biggest part of the economy. As such, highly confident consumers spend more money, boosting the economy.

The other important data that will impact the AUD/USD exchange rate will be the upcoming US retail sales and house price data on Tuesday. Also, the US will release the latest pending home sales data.

AUD/USD Technical Analysis

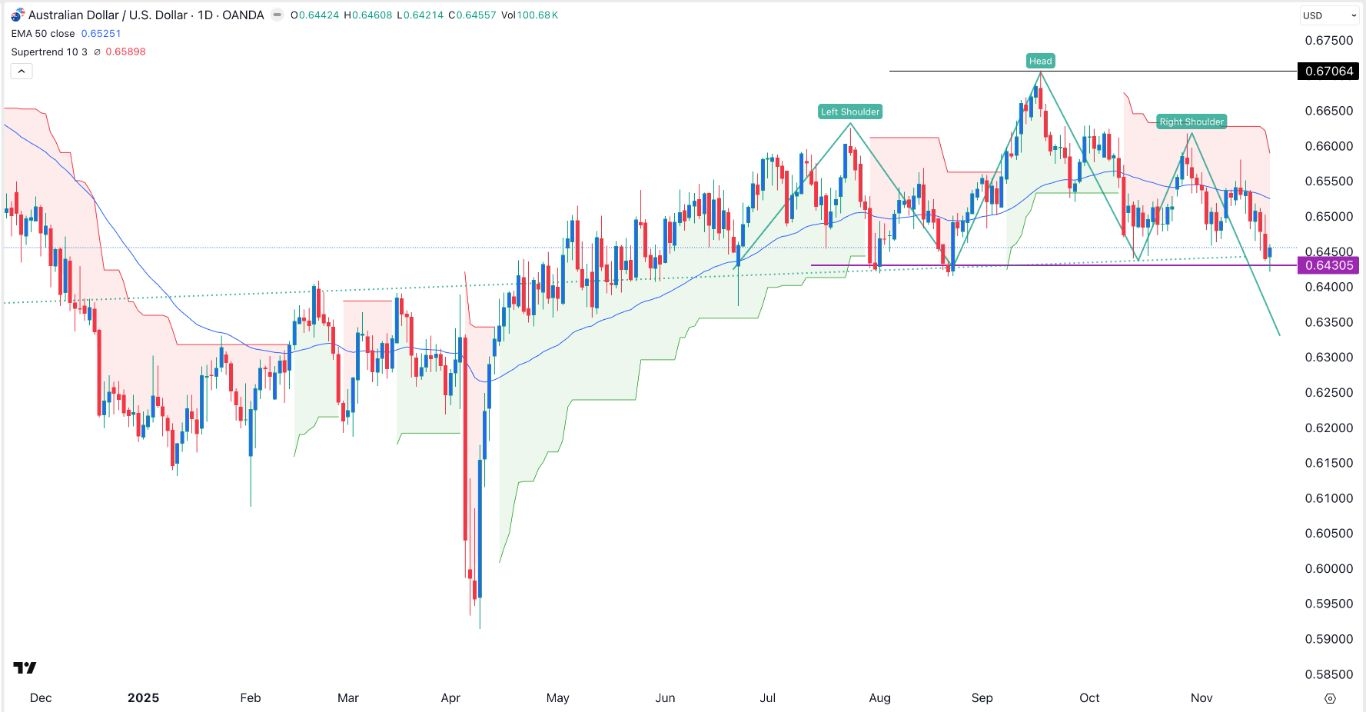

The daily timeframe chart shows that the AUD/USD exchange rate has remained under pressure in the past few months. It has dropped from the year-to-date high of 0.6706 to the current 0.6455.

The pair has moved below the 50-day and 100-day Exponential Moving Averages (EMA). It also formed a head-and-shoulders pattern and is now hovering near the neckline.

It has moved below the Supertrend indicator, a sign that bears remain in control. Therefore, the pair will likely have a bearish breakdown, potentially to the next key support level at 0.6400. This view will be confirmed if it moves below the neckline at 0.6430.

On the other hand, a move above the key resistance level at 0.6500 will invalidate the bearish outlook.

Ready to trade our free trading signals? We’ve made a list of the top forex brokers in Australia for you to check out.