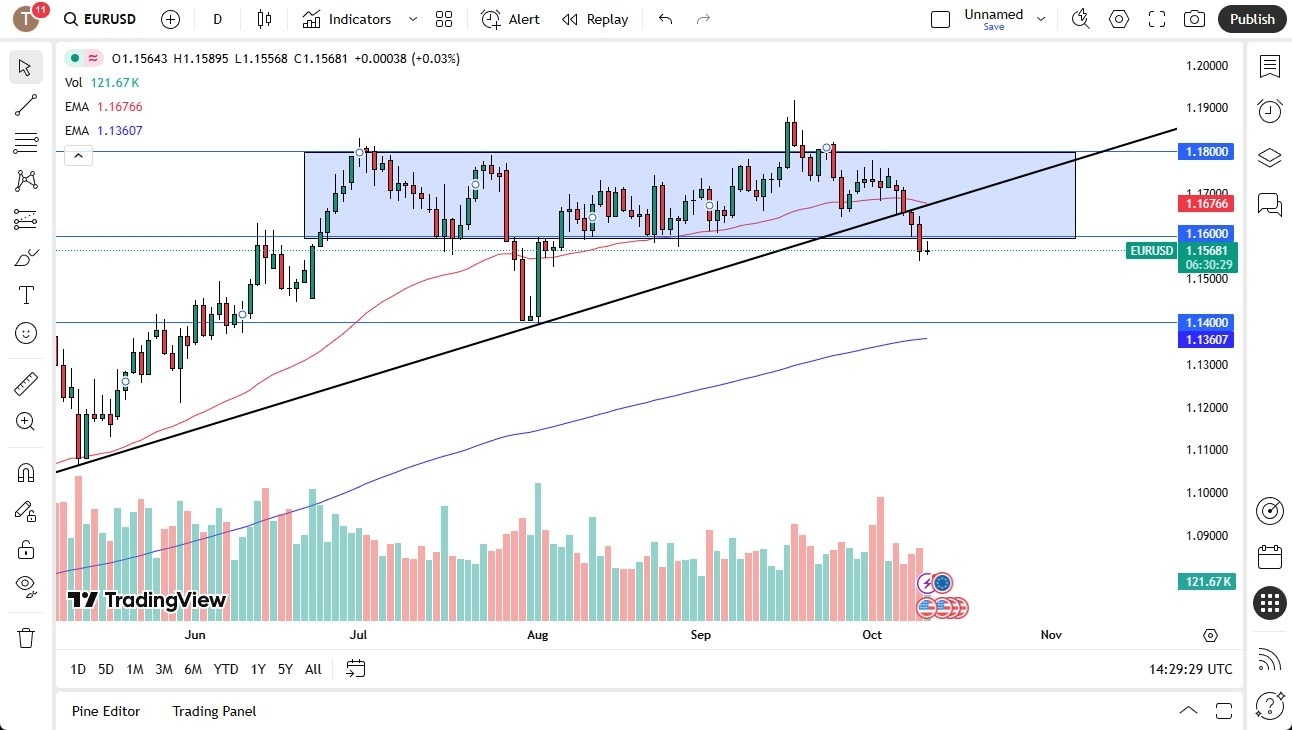

- The Euro tried to rally a little bit during the trading session here on Friday, but it looks like the 1.16 level is in fact going to continue to offer a bit of resistance. At this point in time, if it does, the Euro probably drops down to the 1.15 level. And then after that, the 1.14 level, which of course has an area that I think a lot of people will be watching as it's been important previously, and it was where the market tested an uptrend line. Furthermore, the 1.14 level is also an area that the 200 day EMA is racing towards. With this being said, any rally at this point in time, I look at with suspicion until we can break above the 50 day EMA, and that of course being broken to the upside then could reassert the potential of the upside. But I think at this point, it really looks like the Euro is starting to roll over. And it's worth noting that the US dollar is strengthening against most currencies.

US Dollar

This isn't just a Euro situation. This is a US dollar situation. This market got the FOMC press conference on September 17, and we've done nothing but fall with the occasional short term bounce since then. Remember, we were told that the US dollar was over and that it was going to fall apart. And now once we got that crescendo somewhere in this area, I started to think maybe we're getting closer to the top because everybody thinks that the US dollar is history. I'm starting to hear reports from people who don't even trade in currencies about how the US dollar is falling. Once you get to that point, I can't tell you how many times I've made money just going in the other direction. I have been short of this pair for quite some time. And if we can really break down below the bottom of the candlestick from the Thursday session, then I think we will accelerate. I have no interest in buying this pair.

Top Regulated Brokers

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.