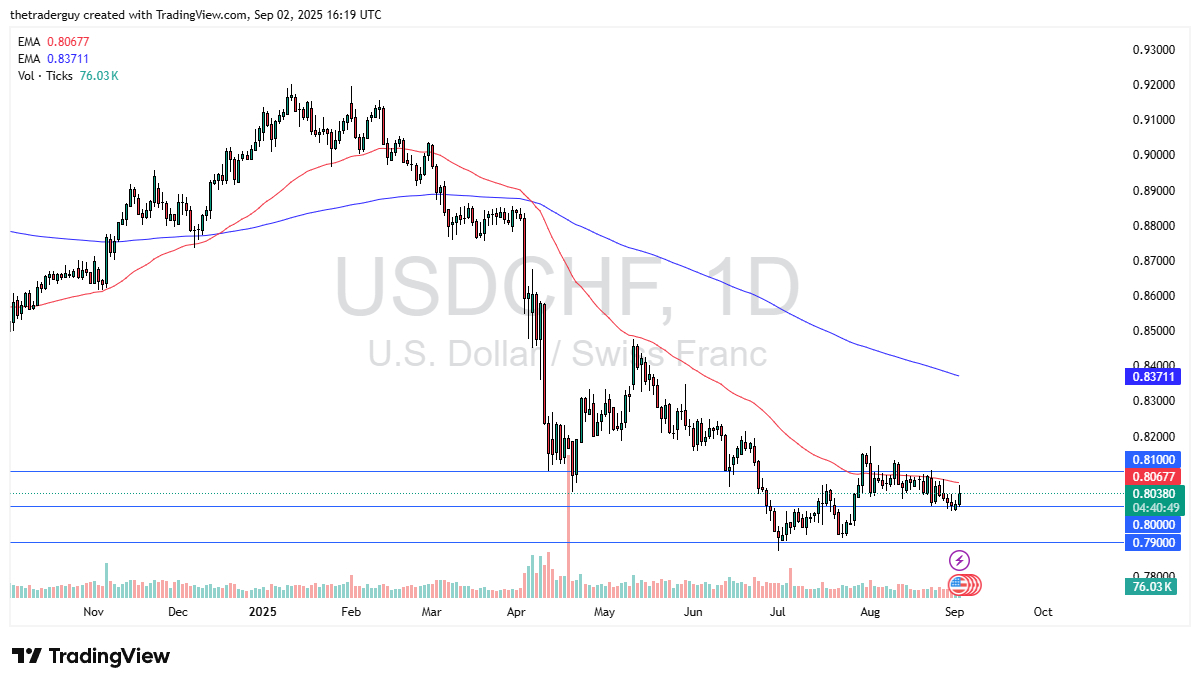

- The US dollar has seen significant buying pressure during the trading session on Tuesday, not only against the Swiss franc, but multiple currencies around the world.

- That being said, in the USD/CHF pair, it looks as if the 0.80 level has offered enough of a reason to start buying again to get people looking toward the upside.

Technical Analysis

The technical analysis for this market is somewhat sideways, after falling rather drastically. The 50 Day EMA sits just above current trading, so it could offer a bit of resistance, but above there we have the 0.81 level offering even more resistance. Anything above the 0.81 level probably has people looking to buy this market, as it would be a significant break out in what looks to be a bit of a bottoming pattern.

Top Regulated Brokers

The 0.80 level being broken to the downside opens up the possibility of a move down to the 0.79 level, which we saw a bit of support, and therefore the level will continue to be important. In fact, we ended up forming a bit of a “double bottom” at that level. That being said, this is going to be a difficult turn around if in fact that’s what we are getting ready to see.

Safety Currencies

The biggest trouble here is that both of these currencies are considered to be “safety currencies”, suggesting that if we are going to start to see some type of economic malaise worldwide, even in a very pro-US dollar environment, we may see more of a grind higher here than anything else. On the other hand, if we see the US dollar start to fall apart, we are close enough to massive support that I think will be a slow grind as well.

Because of the risk appetite profile of both of these currencies, I believe at this point in time the pair is more or less sideways, and therefore we need to see a certain amount of momentum to break out. At this point, I look at this as a market where you can trade on short term charts in both directions.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.