Defense stocks, also referred to as war stocks, are highly popular among professional portfolios, as they can protect the bottom line, staying true to their name. The primary customers of defense stocks are governments, which bring steady, long-term contracts, deep pockets, and a history of paying their bills on time. Pledges by NATO countries to boost defense spending provide a tailwind for earnings in the years ahead. Do you know what to look for in defense stocks?

What Are War Stocks?

War stocks, also known as defense stocks, refer to publicly listed companies that are actively engaged in the aerospace, space, and defense sectors. They form the backbone of defending sovereign countries and territories. Analysts expect demand to surge over the next decade, with global conflicts and geopolitical tensions rising.

Why Should You Consider Investing in Defense Stocks?

Defense stocks provide long-term, reliable income streams for companies. They outperform during market corrections and bear markets, as short-term economic cycles have a minimal impact on their business model.

Despite popular opinion, conflicts do not move the price of defense stocks. There will be a short-term bounce, which usually falters. Investors must understand the long-term nature of defense stocks, where research and development (R&D) remain crucial. Conflicts boost demand for replenishing stockpiles and hardware, create opportunities to test new weapons platforms, and attract future buyers. Still, R&D and cybersecurity services are where defense stocks receive their best margins.

Here are a few things to consider when evaluating defense stocks:

- The defense sector is seeking green alternatives, and stocks with a lead in sustainability could outperform peers

- Focus on defense stocks with excellent R&D capabilities

- Communications, electronic warfare, and cybersecurity defense stocks provide ongoing revenue and have excellent growth rates

- Defense stocks active in drone and anti-drone warfare rank among the fastest-growing defense companies

What Are the Downsides of Defense Stocks?

The biggest downside is the change in defense spending by governments. It can have a material impact on defense stocks, but developments over the past three years have nearly eliminated this risk.

Here is a shortlist of attractive defense stocks:

Lockheed Martin (LMT)

Northrop Grumman (NOC)

L3Harris Technologies (LHX)

AeroVironment (AVAV)

General Dynamics (GD)

RTX (RTX)

Leidos Holdings (LDOS)

Curtiss-Wright (CW)

Kratos Defense & Security Solutions (KTOS)

Astronics Corporation (ATRO)

Lockheed Martin Fundamental Analysis

Lockheed Martin (LMT) is a defense and aerospace manufacturer with four divisions: Lockheed Martin Aeronautics, Lockheed Martin Missiles and Fire Control, Lockheed Martin Rotary and Mission Systems, and Lockheed Martin Space. In 2024, LMT derived 73% of its revenues from the US government. Lockheed Martin is also a member of the S&P 100 and the S&P 500.

So, why am I bullish on Lockheed Martin following its post-earnings slump?

Besides being one of the largest global defense companies with reasonable valuations, LMT is also a significant supplier to NASA and other non-defense government agencies. It creates a well-diversified order book, and Lockheed Martin has its notorious R&D facility, which ensures this company remains at the forefront of innovation. The recent sell-off created an excellent long-term buying opportunity.

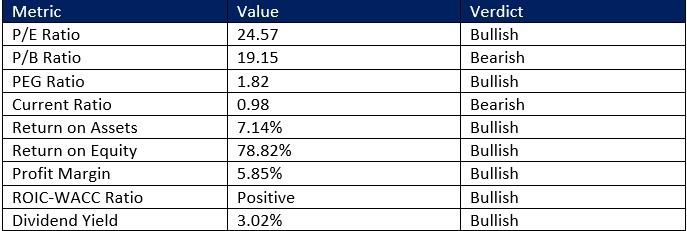

Lockheed Martin Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 24.57 makes LMT an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.85.

The average analyst price target for Lockheed Martin is 487.16. It suggests double-digit upside potential from current levels.

Lockheed Martin Technical Analysis

- The LMT D1 chart shows price action between its descending 50.0% and 61.8% Fibonacci Retracement Fan following a double breakout

- It also shows Lockheed Martin trading inside a bullish price channel

- The Bull Bear Power Indicator turned bullish and has been improving for over three weeks

Top Regulated Brokers

My Call

I am taking a long position in Lockheed Martin between 434.84 and 443.45. The valuation is reasonable, and the return on equity ranks among the best in the industry. LMT is a well-diversified defense stock with an excellent product and services portfolio. The dividend yield is a bonus, and LMT ranks among my top defense stock picks.

Leidos Holdings Fundamental Analysis

Leidos Holdings (LDOS) is a defense, aviation, information technology, and biomedical research company. LDOS is the largest government IT company following its merger with Lockheed Martin IS & GS in 2016. Leidos Holdings has contracts with the Department of Defense, the Department of Homeland Security, the Intelligence Community, and select commercial markets. LDOS is also a component of the S&P 500.

So, why am I bullish on LDOS after stalling?

I like the recent margin expansion and backlog at LDOS. The valuations are among the lowest in the defense sector and in the S&P 500. I also appreciate the hardware expansion to power autonomous ships. Leidos Holdings also has a growing portfolio of classified research for the intelligence and space communities. The cost control at LDOS is excellent, and this defense company noted robust government spending to modernize and digitize the defense and intelligence community.

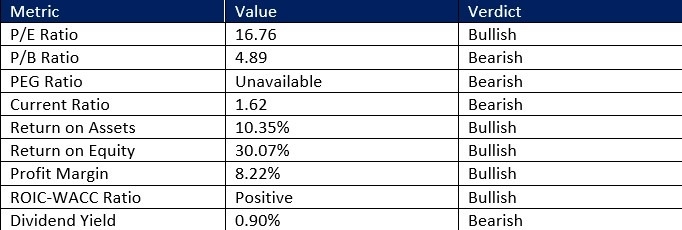

Leidos Holdings Fundamental Analysis Snapshot

The price-to-earnings (P/E) ratio of 16.76 makes LDOS an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.85.

The average analyst price target for LDOS is 186.69. It suggests moderate upside potential from current levels.

Leidos Holdings Technical Analysis

- The LDOS D1 chart shows price action between its ascending 0.0% and 38.2% Fibonacci Retracement Fan.

- It also shows Leidos Holdings inside a bullish price channel.

- The Bull Bear Power Indicator is bullish with an ascending trendline.

My Call

I am taking a long position in LDOS between 173.60 and 182.88. I like the backlog and valuations at this defense company. Future projects should contribute to ongoing growth, while the government modernization plans can boost revenues for the rest of the decade.

Ready to trade our analysis of the best war stocks to buy now? Here is our list of the best brokers for trading worth checking out.