Short Trade Idea

Enter your short position between 138.91 (yesterday’s intra-day low) and 142.13 (yesterday’s intra-day high).

Market Index Analysis

- Globe Life (GL) is a member of the S&P 500 Index.

- This index trades near record highs with a rising wedge formation, a bearish chart pattern.

- The Bull Bear Power Indicator of the S&P 500 shows a negative divergence.

Market Sentiment Analysis

Futures remain mixed after NVIDIA reported earnings after the bell yesterday. Despite beating on the top and bottom line, shares dropped amid a second consecutive miss in its data sales segment. Total revenues reached a record, but the growth rate was the slowest since the first quarter of 2024. It fueled concerns about spending in the AI sector and raised concerns over a bubble. GDP data could inject volatility today, but investors await tomorrow’s PCE and Chicago PMI reports.

Globe Life Fundamental Analysis

Globe Life is a financial services holding company. Its subsidiaries, Globe Life Liberty National Division, Globe Life and Accident Insurance Company, United American Insurance Company, American Income Life Insurance Company, and Globe Life Family Heritage Division, provide life insurance, annuities, and supplemental health insurance products.

So, why am I bearish on GL after its price target increase?

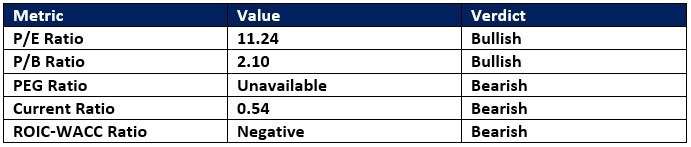

Globe Life was accused in 2024 of insurance fraud, among other things, but I am concerned about its long-term growth prospects. Its annualized revenue growth rate over the past five years was 5.1%, which trails its competitors. GL reported a net premium growth rate of 4.1% annualized over the past two years, which is also behind the insurance industry average. Its balance sheet is shaky, and investors must accept a destruction of shareholder value.

Globe Life Fundamental Analysis Snapshot

The price-to-earning (P/E) ratio of 11.24 makes GL an inexpensive stock. By comparison, the P/E ratio for the S&P 500 is 29.84.

The average analyst price target for GL is 160.18. It suggests double-digit upside potential, but downside risks outweigh it.

Globe Life Technical Analysis

Today’s GL Signal

- The GL D1 chart shows price action breaking down below its horizontal resistance zone.

- It also shows price action completing a breakdown below its ascending 61.8% Fibonacci Retracement Fan levels.

- The Bull Bear Power Indicator is bullish, with a descending trendline, and approaching a bearish crossover.

- The average bearish trading volumes are higher than the average bullish trading volumes.

- GL flatlined as the S&P 500 Index pushed higher, a bearish trading signal.

My Call on Globe Life

I am taking a short position in GL between 138.91 and 142.13. Global Life reports below-average metrics, destroys shareholder value, has a shaky balance sheet, and bullish volumes remain below its bearish counterparts. I believe the double-breakdown will yield more downside.

Top Regulated Brokers

- GL Entry Level: Between 138.91 and 142.13

- GL Take Profit: Between 119.94 and 125.19

- GL Stop Loss: Between 145.44 and 149.80

- Risk/Reward Ratio: 2.91

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.