- The natural gas market rallied pretty significantly during the trading session here on Thursday.

- As we continue to pay close attention to the 200 day EMA, if you followed me anywhere on the internet, you know that I'm bearish on natural gas, although not as bearish as I typically would be this time of year.

- After all, when you think about natural gas, it is a very cyclical market, meaning that the market tends to fall this time of year because there is less demand for heating in places like the United States and Europe, which are major consumers of the natural gas market.

Furthermore, you have to keep in mind that the contract that you're trading is in Henry, Louisiana, meaning it's an American one. That doesn't mean that there aren't exports. Obviously, they are.

Top Regulated Brokers

Are Things Different this Year?

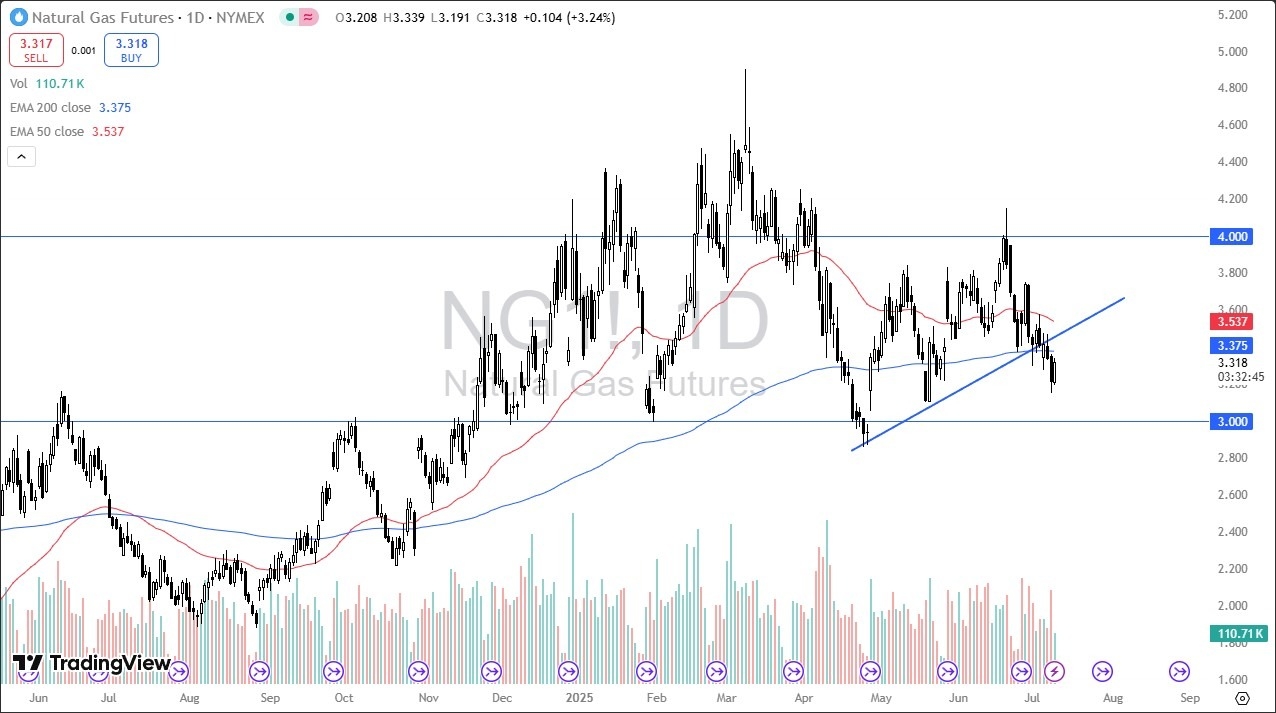

And this year is a little bit different because the European Union is basically importing a ton of this stuff from America. So, it kept the market a little bit more buoyant than typically would be this time of year. We also had a heat wave in the United States recently. So that caused a little bit of a blip, but as you can see from the chart, we have been grinding lower for a couple of weeks now. At this point, the 200 day EMA above is a barrier, and if we can break above there, then we'll start to look at the previous uptrend line as potential resistance, followed by the 50 day EMA, which is at the $3.53 level. I have no interest in buying natural gas. I think that if we do rally and show any signs of exhaustion, I am more than willing to be short of this market. And I do believe that eventually we try to get down to the $3 level, although that's going to be a grind. It's not going to be a collapse.

Ready to trade daily Forex analysis? We’ve shortlisted the best commodity brokers in the industry for you.