- The British pound initially rallied against the U S dollar during trading again on Tuesday but then fell rather hard as we continue to get tariff headlines.

- With that being said, the market is likely to continue to see a lot of noise overall.

- Why wouldn't it? Because at this point, it’s absolute chaos over the news wires and the overall direction of trade talks.

Whether or not that continues remains to be seen, but that has had a major influence on the US dollar in general. The US dollar, of course, if you get it correct, you basically get most of Forex correct. And I think you have to look at this through the prism of what is the green bank is doing overall.

Top Regulated Brokers

GBP Has Outperformed Many Others

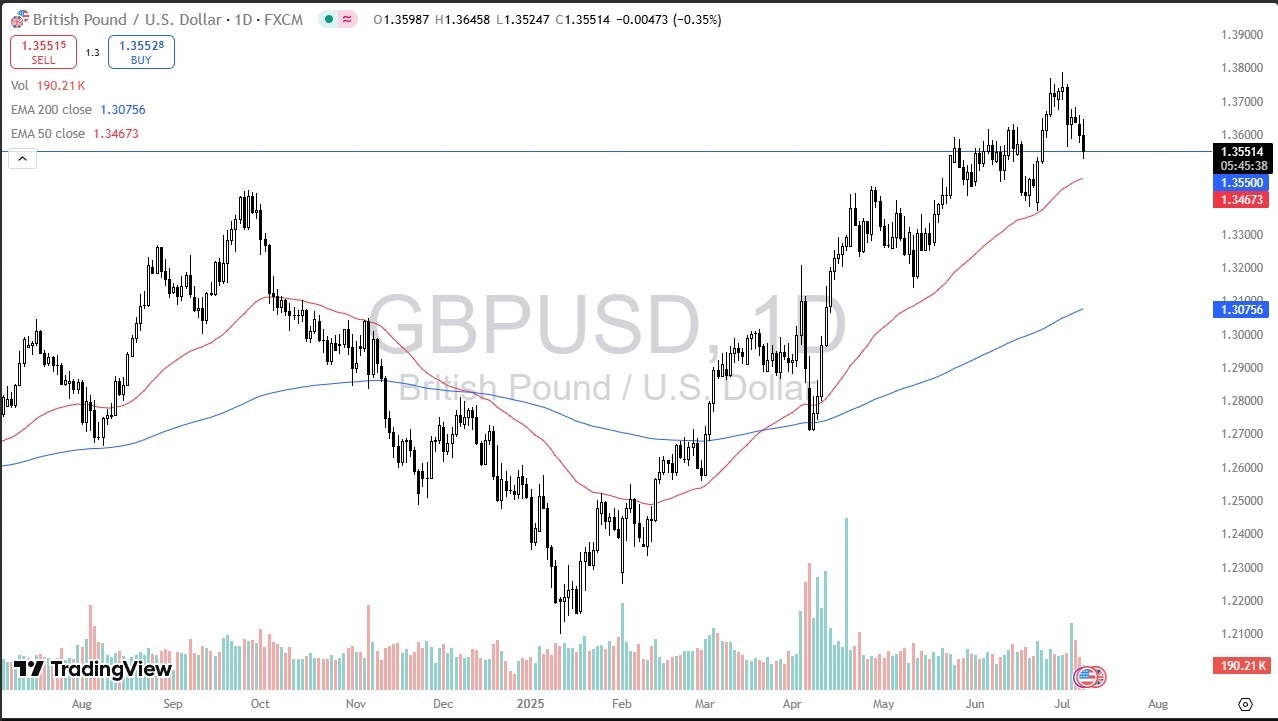

The British pound itself has outperformed most other currencies against the greenback for a while now. So it should not be a huge surprise to think that perhaps we're in an environment where if the U S dollar sells off again, this is one of the first places you should be looking. The 1.3550 level has been major resistance as well as now support. And of course, we have the 50 day EMA underneath there offering potential support as well. As long as we can stay above the 50 day EMA, not much will have changed.

I think we have a scenario where traders continue to look at this through the prism of finding value on dips. I do not want to go short of this market anytime soon, but if we broke down, below the 1.3350 level, then I might consider shorting other currencies against US dollar just simply because observation the last time the US dollar strengthened the British pound actually fared better, or maybe a better way to put it is less bad. So this is a one way market for me. We'll just have to see if I get the bounce and set up.

Ready to trade the GBP/USD Forex analysis? Check out the best forex trading company in UK worth using.