Fundamental Analysis & Market Sentiment

I wrote on 23rd February that the best trade opportunities for the week were likely to be:

- Long of the S&P 500 Index following a daily close above 6141.60. This did not set up.

- Long of Gold in USD terms. Unfortunately, Gold fell by 2.78% over the week.

- Long of Corn futures a daily close of the next ZC future at or above 502. This did not set up.

Top Regulated Brokers

The weekly loss of 2.78% equals 0.93% per asset.

Last week saw several data releases affecting the Forex market:

- US Core PCE Price Index – showed a 0.3% month-on-month increase as expected.

- US Preliminary GDP – showed an annualized rate of 2.3% as expected.

- German Preliminary CPI – showed a 0.4% month-on-month increase as expected.

- German Federal Election Result – the CDU will lead the next government, without the AfD, which is no surprise.

- Australia CPI – the Australian inflation rate came in a tick lower than expected, showing an annualized rate of 2.5%, which helped weaken the Aussie over the rest of the week.

- Canadian GDP – a tick lower than expected, showing a month-on-month increase of only 0.2%.

- US Unemployment Claims – this was a bit higher than expected.

Last week’s key takeaways were:

- It was a bad week for stock markets, especially in the USA, where major indices dropped sharply enough to shake out trend followers from long positions, with institutions either reducing or eliminating their exposure. Friday saw some gains, however. Many analysts see global equity markets facing headwinds from the Trump administration’s tariff threats plus other factors. It may also be the global rally in equities is simply overbought and due a major correction. However, the Atlanta Fed revised its GDP data to -1.5% on Friday, which may be a blip, or might be the first sign of an impending recession in the USA.

- Market sentiment has shifted firmly into risk-off mode, with commodities and commodity currencies taking a serious beating. Even Gold, which had been holding up relatively well, suffered a serious decline,

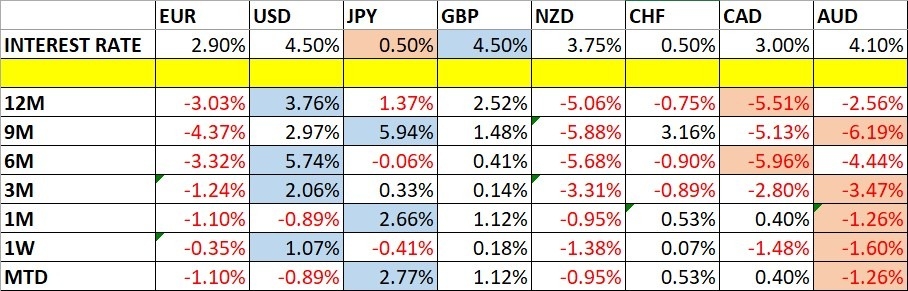

- In the Forex market, commodity currencies are very weak, and the Euro is also looking weaker. The Japanese Yen and US Dollar are currently strong, with the British Pound also showing some relative strength.

- Economic data releases last week were not the major story and had little impact.

The Week Ahead: 3rd – 7th March

The coming week has a similarly heavy schedule of releases, so we are likely to see a similar level of activity and volatility in the Forex market to last week.

The coming week’s important data points, in order of likely importance, are:

- US Average Hourly Earnings

- ECB Main Refinancing Rate & Monetary Policy Statement

- US Non-Farm Employment Change

- US ISM Services PMI

- US ISM Manufacturing PMI

- Australian GDP

- Swiss CPI (Inflation)

- US Unemployment Claims

- US Unemployment Rate

- Canadian Unemployment Rate

Monday is a public holiday in Japan.

Monthly Forecast March 2025

For February 2025, I forecasted that the EUR/USD currency pair would decline in value. The final performance is shown below.

For March 2025, I make no forecast, as there are no clear trends.

Weekly Forecast 3rd March 2025

Last week, I forecasted that the following currency pairs would rise in value over the week:

This was not a profitable call.

This week, I forecast that the following currency cross will fall in value:

The US Dollar was the strongest major currency last week, while the Australian Dollar was the weakest, putting the AUD/USD currency pair in focus. Volatility increased last week, with only 41% of the most important Forex currency pairs and crosses changing in value by more than 1%. It is likely to remain at a similar level over the coming week.

You can trade these forecasts in a real or demo Forex brokerage account.

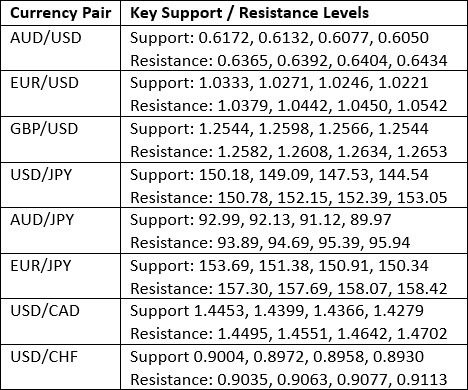

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a strongly bullish candlestick, completely engulfing the previous week’s candlestick, and closing near the high of its range.

Last week’s low was near a supportive confluence area.

The long-term trend is again bullish: the price is above its levels of 3 months and 6 months ago. The short-term momentum is also bullish.

Global markets have entered a strongly risk-off mode which should also benefit the greenback.

If there is any solid opportunity in the market right now, it is likely to be being long of the US Dollar.

EUR/USD

EUR/USD

The EUR/USD currency pair printed a fairly large bearish engulfing weekly candlestick, closing near its low. The Euro itself is in a weak long-term bearish trend while the USD is now back in a long-term bullish trend.

While there seem to be good reasons to be bearish here, we are not seeing a technically significant price breakdown yet. For that to happen, I would want to see the price trading below the big quarter number at $1.0250.

If you have faith that the USA will shortly hit the EU hard with new import tariffs, you might have a stronger reason to be short of the Euro.

If you are going to be long of the USD in the Forex market right now, the commodity currencies such as the AUD, NZD, and CAD are probably the best currencies to use on the short side.

AUD/USD

The AUD/USD currency pair printed a large bearish engulfing weekly candlestick, closing near its low. The Aussie is the weakest major currency, being hit hard by the dominant risk-off sentiment as a key risk barometer and commodity / exporting currency, while the USD is now back in a long-term bullish trend.

While there seem to be good reasons to be bearish here, we are not seeing a technically significant price breakdown yet. For that to happen, I would want to see the price trading below the big quarter number at $0.6132.

Trends in this currency pair have historically been unreliable, but if you are convinced that the world is on the brink of an economic slowdown, being short of this currency pair could be an excellent move.

USD/CAD

The USD/CAD currency pair printed a large bullish weekly candlestick, closing near its high. The Loonie is one of the weakest major currencies, being hit hard by the dominant risk-off sentiment as a key risk barometer and commodity / exporting currency, while the USD is now back in a long-term bullish trend.

Another reason for the Canadian Dollar’s weakness is that the imposition of a 25% tariff on its imports to the USA is back on the table and due on 2nd July, according to President Trump. If this position does not change, we can expect this currency pair to break out to reach a new multi-year high price by then.

While there seem to be good reasons to be bullish here, we are not seeing a technically significant price breakout yet. For that to happen, I would want to see the price trading above $1.4551.

Trends in this currency pair have historically been unreliable, but if you are convinced that the Trump tariff is really going to happen next month, being long of this currency pair could be an excellent move.

Bottom Line

I see the best approach this week as staying out of the market and just getting money market interest from cash, as markets are in deep retracements but have not yet achieved stable trend reversals. Being in USD should be a good move generally.

Ready to trade our weekly Forex forecast? Check out our list of the best Forex brokers for you.

EUR/USD

EUR/USD