WTI Crude Oil traders may show nervousness quickly on Monday depending on the mindset and actions of larger players in the energy sector, as they try to navigate the coming tariffs from the U.S White House on Canada and Mexico.

Top Regulated Brokers

Both Canada and Mexico supply plenty of energy to the U.S, but it is not clear if the nations intend on trying to retaliate with price hikes in the energy sector.

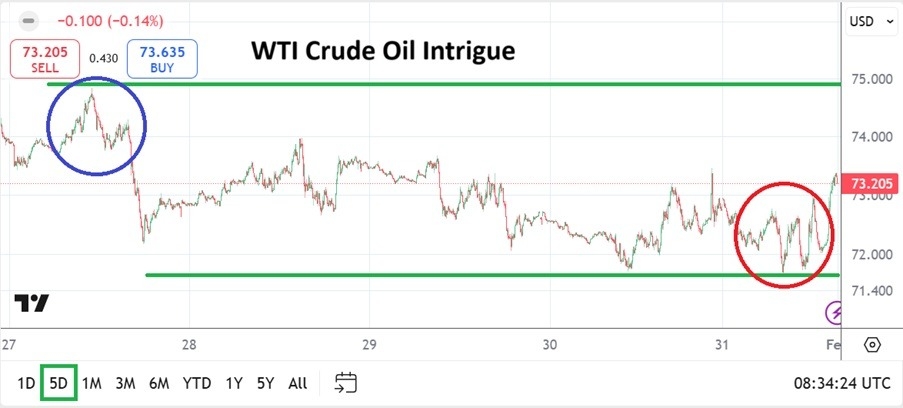

WTI Crude Oil went into this weekend lower than it started the week. The closing price of WTI was near the 73.200 level, and in fact the week’s low was hit on Friday when the 71.700 vicinity was challenged. WTI Crude Oil opened last week’s trading above the 74.000 level. The ability to end lower with large traders knowing that Trump tariffs would start this weekend may be a clue regarding sentiment.

Lower Prices as Noise Builds in WTI Crude Oil

There have been denials from many sides that the energy sector will feel the brunt of tariffs being levied on Canada and Mexico. The U.S certainly doesn’t want to see the price of energy suddenly rise. Large traders seemed to show they believe the price of WTI Crude Oil will not be affected by the political saga which is unfolding among the three nations. The ability to maintain a lower technical price range shows that some calm remains.

Yet, there are no guarantees for day traders and they should be extremely careful as they try to pursue WTI Crude Oil. Monday’s opening and trading the first two days of this week will demonstrate what large players believe. Speculators should also be braced for the potential of sudden rhetoric being heard in the coming days which could spark momentary volatility. Friday’s trading that went below the 72.000 ratio for the first time since January the 2nd may indicate large players are not concerned about tariffs.

Risk Management and WTI Crude Oil Near-Term

There is no doubt that President Trump negotiates in an aggressive manner. Large WTI Crude Oil traders are experienced and understand the dynamics of tough business talks better than most. Risk management by day traders will be crucial in the coming days to guard against unexpected developments news from the U.S, Mexico and Canada as they try to find a middle ground regarding tariffs.

The ability of WTI Crude Oil to not produce a nervous spike upwards late this past week shows that some bold speculators may believe the commodity is actually still in overbought territory.

Having traded above 79.000 USD in the middle of January, and the bearish turn downwards since then shows that behavioral sentiment tends to believe President Trump is in control of the situation and that tariffs will not affect price outlook.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 70.600 to 76.200

The ability of WTI Crude Oil to continue its bearish trend last week is a strong sign many large traders believe supply and production capabilities will grow under the Trump administration. Having touched lows late this past week also indicates selling pressure believes fundamentally lower prices are justified. However, tomorrow and Tuesday may see nervous conditions early which could be volatile depending on news flow generated globally because of tariff developments and fear of contagion.

Day traders should be very careful and use stop losses. If Monday’s trading starts and concludes with WTI Crude Oil maintaining its current price range, and showing the ability to test support ratios, this may indicate lower depths in the commodity could develop late in the week. The bid and ask spread in WTI Crude Oil should be watched as a clue early this week regarding nervousness too. Trading this week in the energy sector is going to get a lot of attention by the media.

Ready to trade our weekly forecast? Here’s a list of some of the best Oil trading platforms to check out.