- During my daily analysis of major currency pairs, the GBP/USD pair has caught my attention due to the fact that it has been so negative.

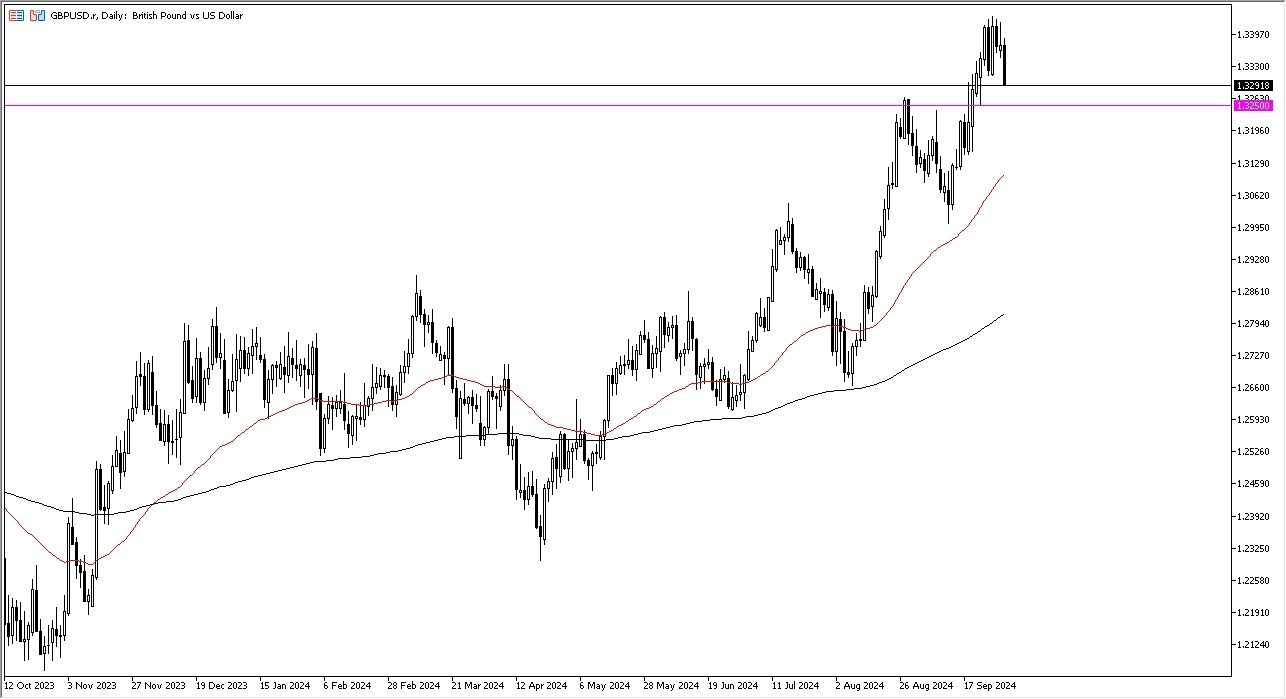

- The 1.3250 level underneath is an area that’s been important multiple times going back multiple years, so therefore it should make a certain amount of sense that it will continue to attract traders in both directions.

- At this point, I think the British pound giving up some of this gain that we had enjoyed over the last couple of weeks makes a certain amount of sense, because quite frankly nothing can go in one direction forever.

Ultimately, I do think that the British Pound continues to Rally against the US dollar, unless of course we see some type of major run toward safety. After all, the market is likely to favor the US dollar when people are concerned about the overall growth situation globally, and of course it’s a mechanism in order to get involved in the US Treasury market. After all, that’s where large funds run to when they are trying to protect wealth.

Top Regulated Brokers

Technical Analysis

Ultimately, the 1.3250 level is an area that I think will continue to see a lot of interest, but even if we were to break down below that level, then it’s possible that we could go looking to the 1.31 level, which sits right around the 50 Day EMA. That of course will determine the overall trend, and a lot of people use it as a way to determine whether we are in a short-term rally, or perhaps a longer-term one. Keep in mind that the market continues to be very volatile, and that makes a certain amount of sense.

The Bank of England of course recently decided to sit still, keeping interest rates higher than many other central banks around the world, while the Federal Reserve ended up slashing 50 basis points from its interest rate, showing that perhaps they are suddenly getting very dovish. Because of this, the interest rate differential has been all but blown up between these 2 currencies, and therefore any time there is a “risk on move”, the US dollar tends to suffer.

Ready to trade our daily GBP/USD Forex analysis? Here are the best regulated trading platforms UK to choose from.