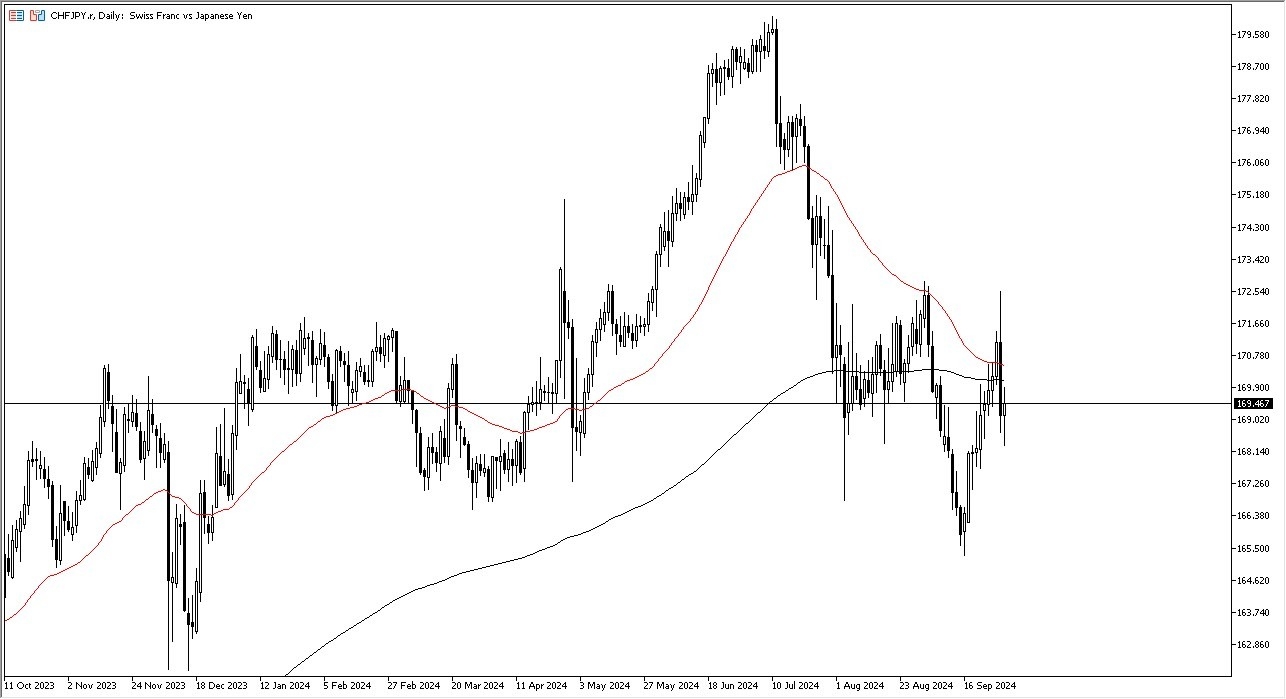

- I have been paying attention to the supportive area that we are sitting on, and in this particular market looks as if the ¥160 level continues to be a major region of importance.

- It’s worth noting that yen related pairs across the board all bounced a bit, and it suggests that perhaps the idea of the Japanese yen strengthening wildly is probably a bit overdone.

Technical Analysis

The 200 Day EMA sits just above, and that of course is an area that we need to pay close attention to. Furthermore, it’s also right around the ¥170 level, and of course we have the 50 Day EMA sitting just above there. All things being equal, looks like we are trying to get close to forming a so-called “death cross”, but I don’t see that as being very likely to influence the market, unless of course we have seen a complete shift in attitude.

Top Regulated Brokers

Because of this, the market is likely to continue to see a lot of volatility and choppiness, but I also recognize that this is a scenario where you are looking at 2 safety currencies, so therefore this could give you an idea as to how to play the so-called “carry trade”, which is when you short a currency with very little in the way of interest rates backing it and buying one that is stronger. For example, the AUD/JPY pair favors the Australian dollar with all things being equal, because you get paid at the end of every day to own it. You can say the same thing about the AUD/CHF pair, so the CHF/JPY pair essentially becomes a signal as to which one of the 2 currencies you are looking to short against higher yielding ones under most circumstances.

Obviously, we have seen a lot of Swiss franc strength, but it pales in comparison to what the Japanese yen has done until recently. The question now is whether or not the “short Japanese yen trade” is coming back into the picture. This chart could be one of the first places that you get an answer to that question.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.