- The New Zealand dollar try to rally in the very early hours of Monday, but then fell apart, as we have seen risk appetite take a bit of a hit in multiple markets.

- Remember, the New Zealand dollar is considered to be a “risk on currency”, as it is highly levered to the commodity markets that head toward Asia.

All things being equal, this is a market that got a little overstretched, and therefore I think you’ve got a situation where a pullback was necessary anyway, and therefore traders would just be looking for some type of reason to start selling. The US dollar will of course be a proxy for safety, due to the fact that the Treasury market is denominated in the same US dollars, and people could go looking toward the safety of the bond market, as they are worried about the overall global outlook. After all, it looks like we are starting to see cracks in the global economy, and if that’s going to be the case, the New Zealand dollar of course is going to take it on the chin if that is in fact what happens.

Top Regulated Brokers

Wild swings

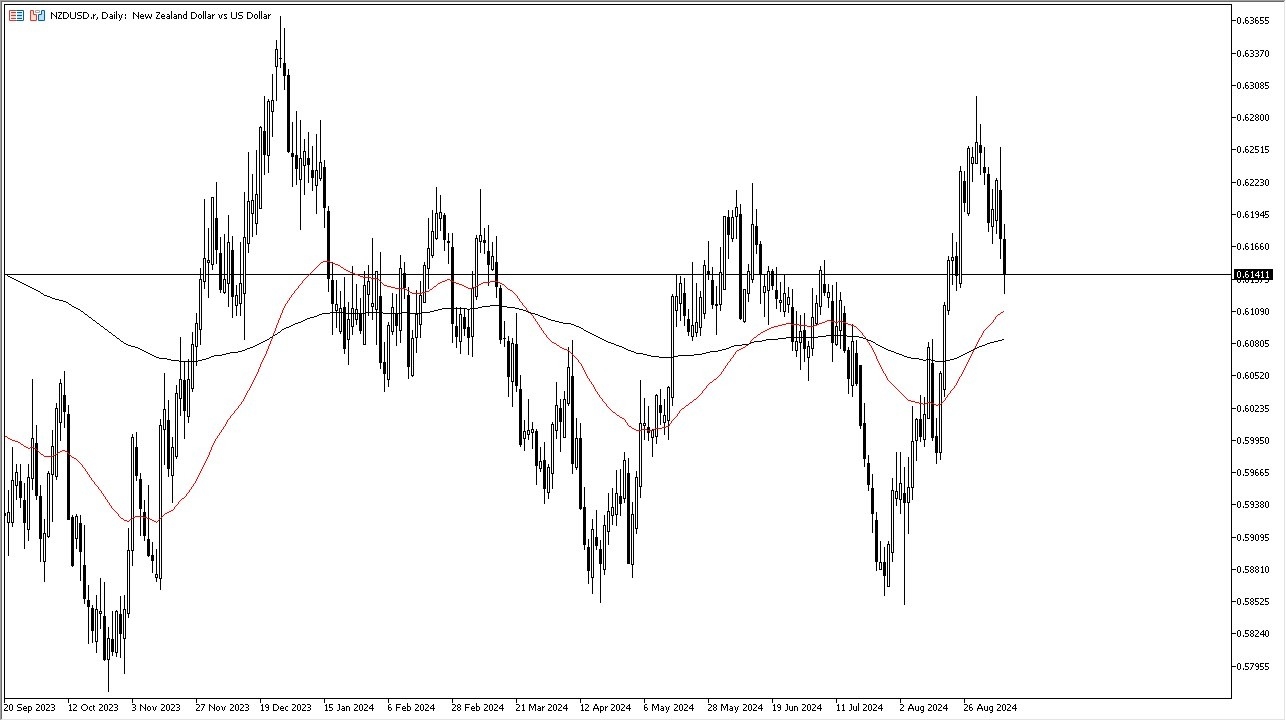

The market continues to see wild swings, and therefore I’m not surprised at all to see that we have also bounced from the lows in the early hours of New York trading. I think at this point in time, the 50 Day EMA, which currently sits at the 0.6110 level is going to be a short-term support level. Anything underneath there then opens up the possibility of a move to the 200 Day EMA indicator, an indicator that a lot of people will be paying close attention to. Anything below there then opens up quite a bit of selling pressure as it would be a major breach of technical support.

Regardless, I think we will see a lot of volatility as traders are trying to figure out what to do next. The volatility will probably only get worse going forward, but it’s worth noting that there is a limited amount of economic announcements during the week, so that could give the USD/NZD market a little bit of a short-term floor regardless.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.