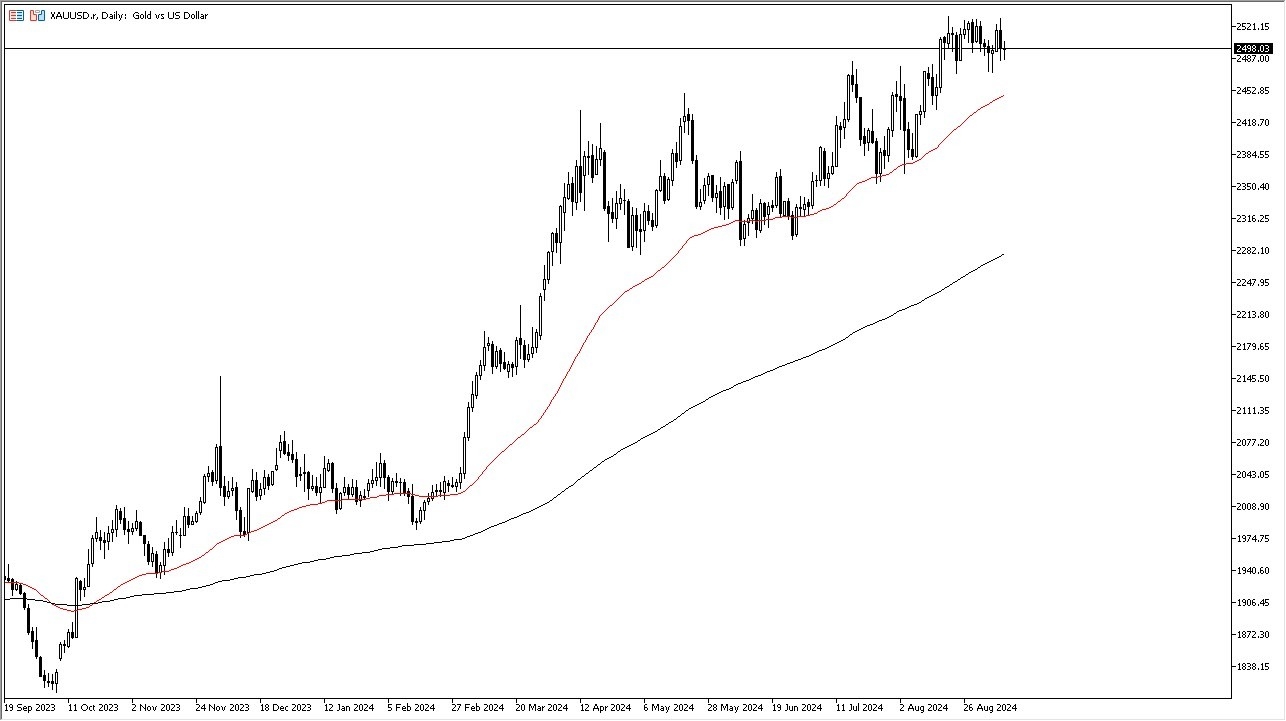

- The gold market has gone back and forth as its in the trading session on Monday, as we continue to look a bit lost.

- `We have been consolidating for a while, and I think we will continue to do so until the next fundamental factor comes along.

- It could be a situation where we are waiting for the Federal Reserve to finally come out and admit that there are going to be massive amounts of rate cuts, but I think the market's already well aware of that.

All things being equal, the $2,500 level, of course, attracts a lot of attention, but if we can break above the $2,525 level, I think that gold really takes off. Underneath, we have massive amounts of support in multiple areas, including the $2,480 level. The 50-day EMA underneath, of course, is an area that I think a lot of people are going to be paying attention to. In general, this is a situation where I think any time it dips, there will be buyers.

Top Regulated Brokers

Interest Rates and More

This is a situation where there are interest rates falling around the world and that does make gold more attractive. But we also have the central banks around the world buying gold hand over fist. So, with all of that being said, I think there are plenty of buyers out there. Beyond that, we also have geopolitical events and of course wars.

I think as things stand right now, there's no real argument to short the gold market, and I do think that it is probably only a matter of time before we not only reach the $2,525 level, but also that we go much higher than that. Gold is in a bullish market, and there's nothing on this chart or in the fundamentals at the moment that suggests it's going to change.

Ready to trade our gold daily analysis and predictions? We’ve made a list of the best Gold trading platforms worth trading with.