- In my daily analysis of the Forex world, the GBP/JPY pair has caught my attention.

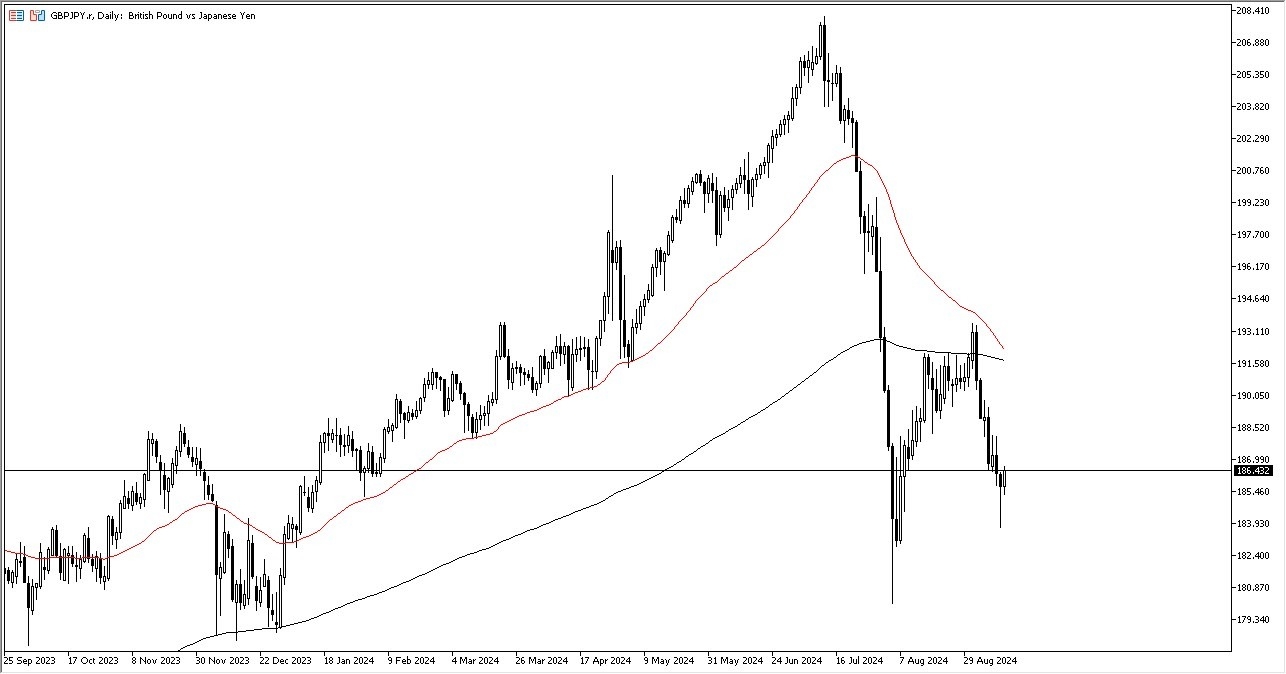

- All things being equal, this is a pair that is highly sensitive to risk appetite, and therefore you need to pay close attention to the market in general, as the ¥185 level is very important from a support standpoint.

- Ultimately, the market had formed a massive hammer during the trading session on Wednesday, only to turn around and show signs of strength during the Thursday session.

Is this a floor?

The question at this point in time will be whether or not there is going to be a bit of a floor in the market in this general vicinity, but there are a lot of questions asked of the markets as to whether or not we are going to see people be willing to jump in and take advantage of any type of “risk on behavior” that could come into the psyche.

Top Regulated Brokers

Ultimately, this is a market that I think continues to see a lot of noise and it, which is typical of “The Dragon”, which is obviously one of the premier carry trade markets. If we can go higher, the market could send the British pound to the ¥190 level, perhaps even the 200-Day EMA indicator. On the other hand, if we were to turn around and break down below the bottom of the hammer from the Wednesday session, the market could really start to fall at that point in time, perhaps initially reaching the ¥180 level. Anything below there could send this market plunging much lower and it would probably have a lot to do with the risk out there falling apart, that could send a lot of panic into the market, which will be supercharged buy this market.

I think this is a situation where we continue to see a lot of instability, and therefore you need to be cautious with your position size, but it certainly looks like we are at least trying to turn around and go higher.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.