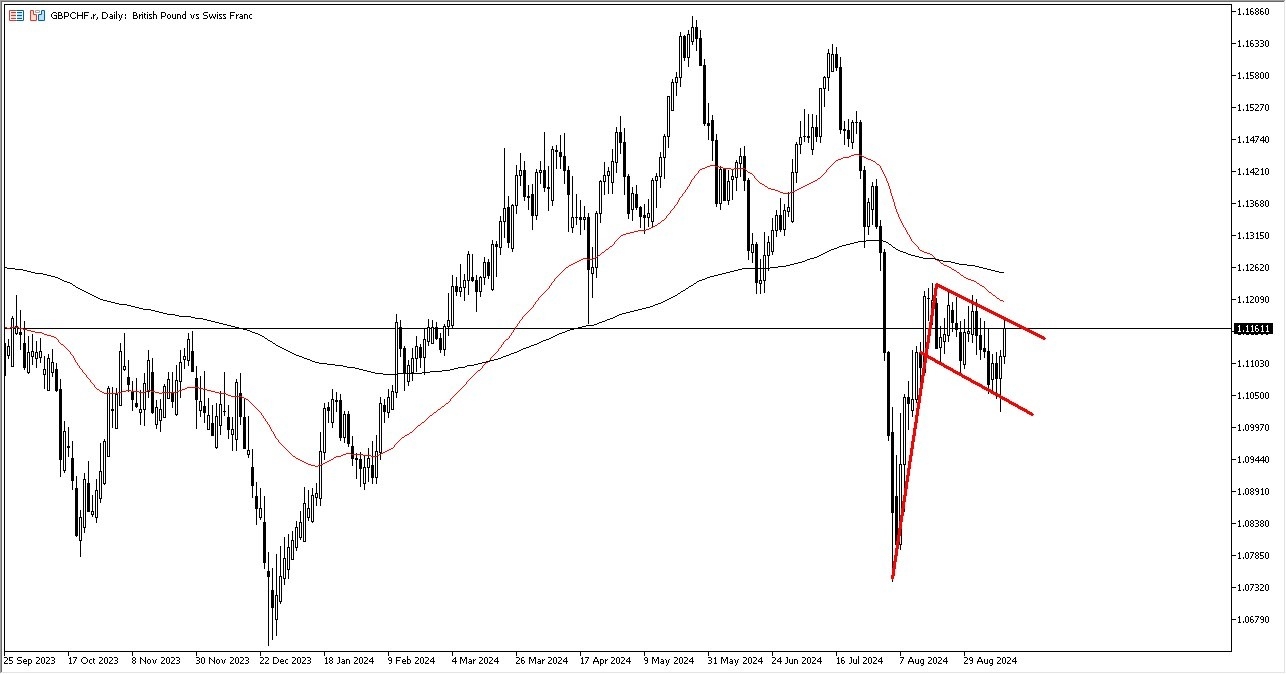

- The British pound has rallied rather significantly against the Swiss Franc as it looks like we are continuing to try to do something about the bullish flag that we had been in for a while.

- Ultimately this is a market that I think will continue to be very noisy but at the end of the day we also have a situation where if we can get above the 50 day EMA, the market can certainly take off to the outside, perhaps really pick up a lot of momentum.

- This will be especially true based on the measured move as technical traders could be looking at an attempt to get all the way back to the highs in the 1.1650 region.

Keep in mind, this is a market that has a lot of external pressures on it, being risk on risk off, that is. And if we do see more risk taking, it does make a certain amount of sense that the Swiss franc suffers, and the British pound tends to be a rather big mover against the franc in those times.

On the other hand…

Top Regulated Brokers

On the other hand, if we get a lot of concerns out there, we could very well see the Swiss franc strengthen, and therefore this pair pull back. I would anticipate that the bottom of the flag, being close to the 1.10 level, will remain very supportive going into the future. This is an area that obviously will have a lot of options traders interested in, and of course technical traders to rely on big, round, psychologically significant numbers.

That of course is something that we need to pay attention to because if we were to break down below the 1.10 level, then we could start to see this pair crumble again. But at this point, I do think that the Swiss franc is probably a little overbought against many currencies, even if it's not this one. And therefore, external pressures may come into this market as a result.

Want to trade our daily forex analysis and predictions? Here's a list of the best FX brokers in Switzerland to check out.