- The British pound has plunged much lower against the Swiss franc, yet again during the trading session on Thursday.

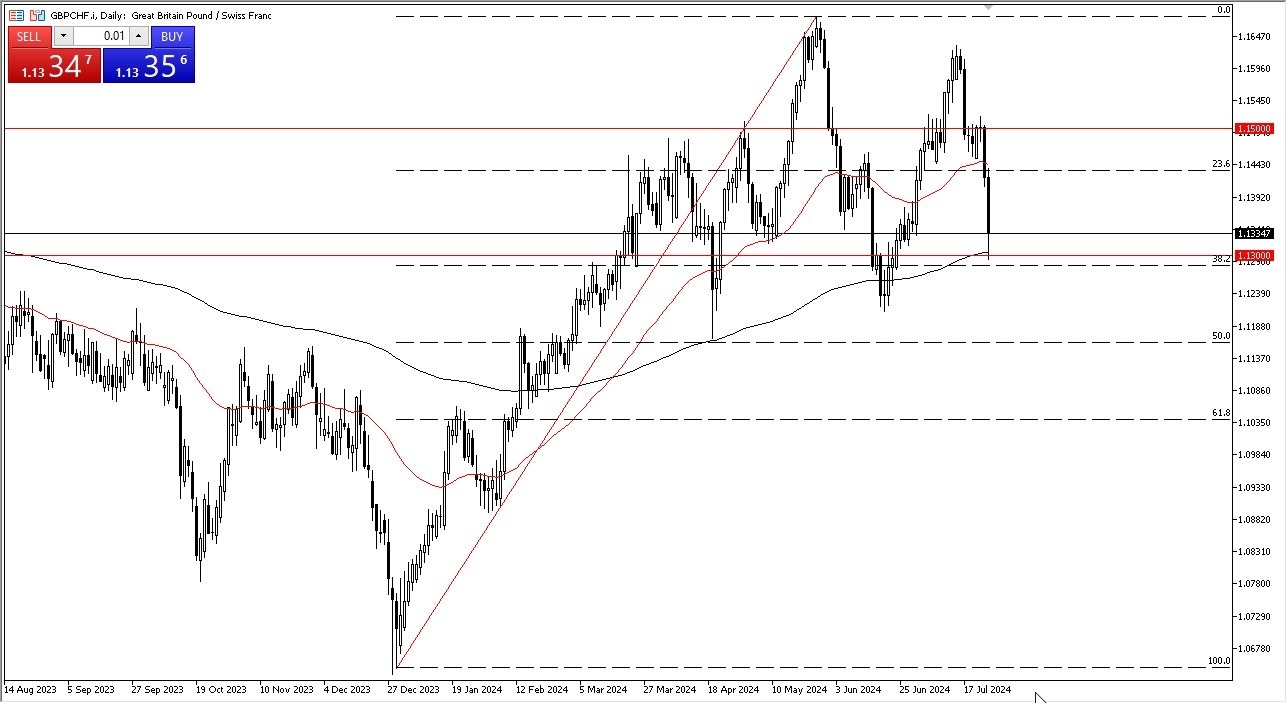

- In my daily analysis, the first thing that I noticed is that we reached the 200-day EMA, but then did show signs of support.

- It's probably worth noting that we also have the 38.2% Fibonacci retracement level in that area is the crucial large round psychologically significant figure of 1.13.

With that being said, I think you've got a situation where value hunters are trying to get involved here, but it is going to be a very noisy affair. After all, we have seen a massive amount of damage done to risk appetite around the world and this pair is very sensitive to risk appetite.

That being said, they say that fortune favors the bold as it were, and this is an area of value. That doesn't mean that it's easy and it doesn't mean that you need to jump in with a huge amount. But what it does suggest is that perhaps there is the possibility of a bounce from here.

Top Regulated Brokers

On the Downside…

If we were to break down below the 1.1275 level, then I think you've got a situation where we break down a little bit more significantly, perhaps down to the 50% Fibonacci retrace level. However, the interest rate differential continues to favor holding this pair despite the fact that it's been a bit of a bloodbath over the last couple of days. I'm a buyer, but I'm a cautious buyer just starting to dip my toes back into the water here.

All that being said, in the meantime you get paid to hang on to this pair so you can think of it more or less as an investment if you traded with the appropriate size. Getting over levered to this pair can be very dangerous, so make sure that you are not overexposed. However, I do think that over the next couple of days we are going to see this pair turn right back around and start rising.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.