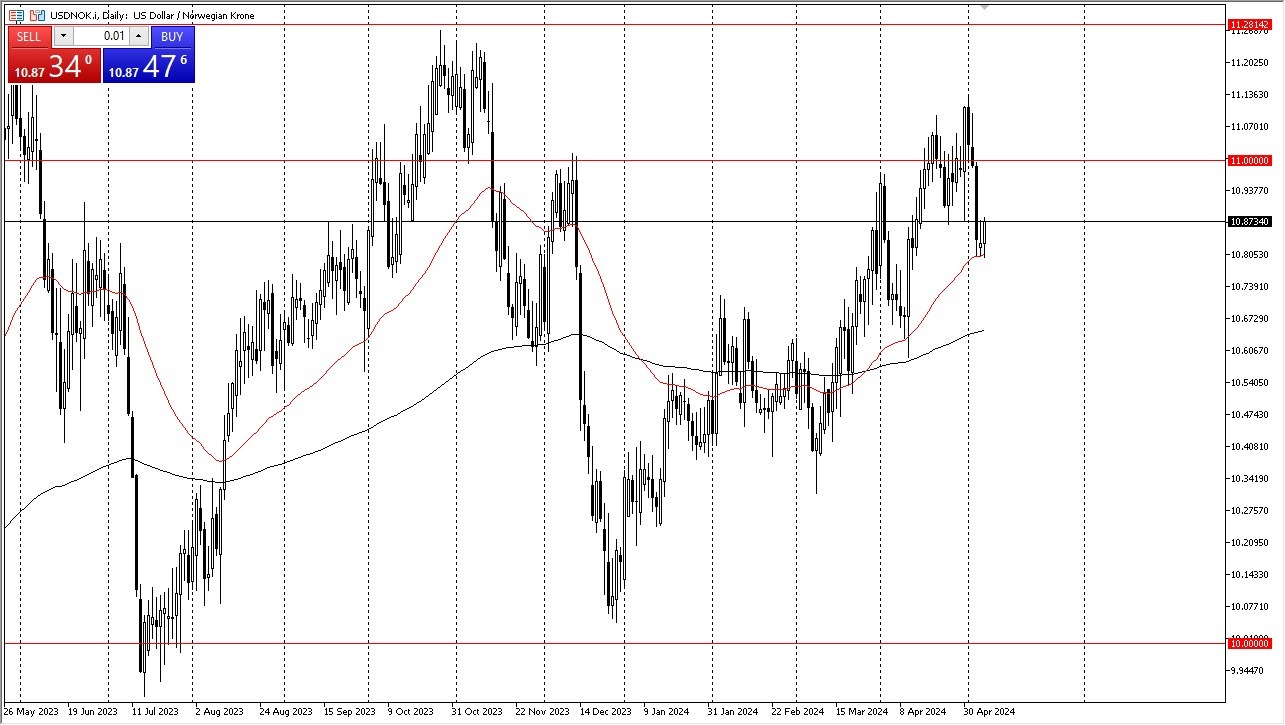

- The US dollar rallied a bit during the early hours on Tuesday as the 50-Day EMA offered a bit of support, as we have seen not only during the trading session on Tuesday, but several other days before that.

- Ultimately, this is a market that continues to pay close attention to the overall US dollar strength, and although the Norwegian krone can get a bit of help from crude oil, the reality is that the US dollar is strong against almost everything.

Short-term pullbacks will continue to get bought into, despite the fact that we have seen a lot of negativity over the last couple of days. The 11 NOK level has been an area of significant noise, and therefore I think you have to pay close attention to. If we can break above the 11 NOK level, then I think it’s possible that the market could continue to go looking to the 11.13 NOK level, possibly opening up the move to the 11.28 NOK level.

Top Regulated Brokers

In general, this is a pair that I think opens up the possibility of a move to the upside and therefore I think you have to be cautious trying to short this market. While the interest rate differential between the 2 currencies is minimal, the reality is that the US dollar overtake the Norwegian krone due to the fact that it is a safety currency and of course it’s very likely that the Federal Reserve is going to keep its interest rates higher for longer.

The alternate scenario

If we were to break down below the 10.73 NOK level, then we have to start looking at the 200-Day EMA as a potential support level. That is an area that I think given enough time could be a major determining factor as to where we go in the longer term. The market has been bullish for some time, and I think that continues to be the case, but you will have to pay close attention to the interest rate markets as they will dictate where we go next. The higher the interest rates in America, the better the US dollar tends to look.

Not sure which broker to choose? We've made a list of the best forex brokers for you.