- The US dollar has initially dipped against the Canadian dollar during trading on Wednesday, which makes a certain amount of sense, considering that we had shot straight up in the air during the day on Tuesday.

- We also have had to worry about the FOMC meeting, so, a little bit of profit taking makes a lot of sense.

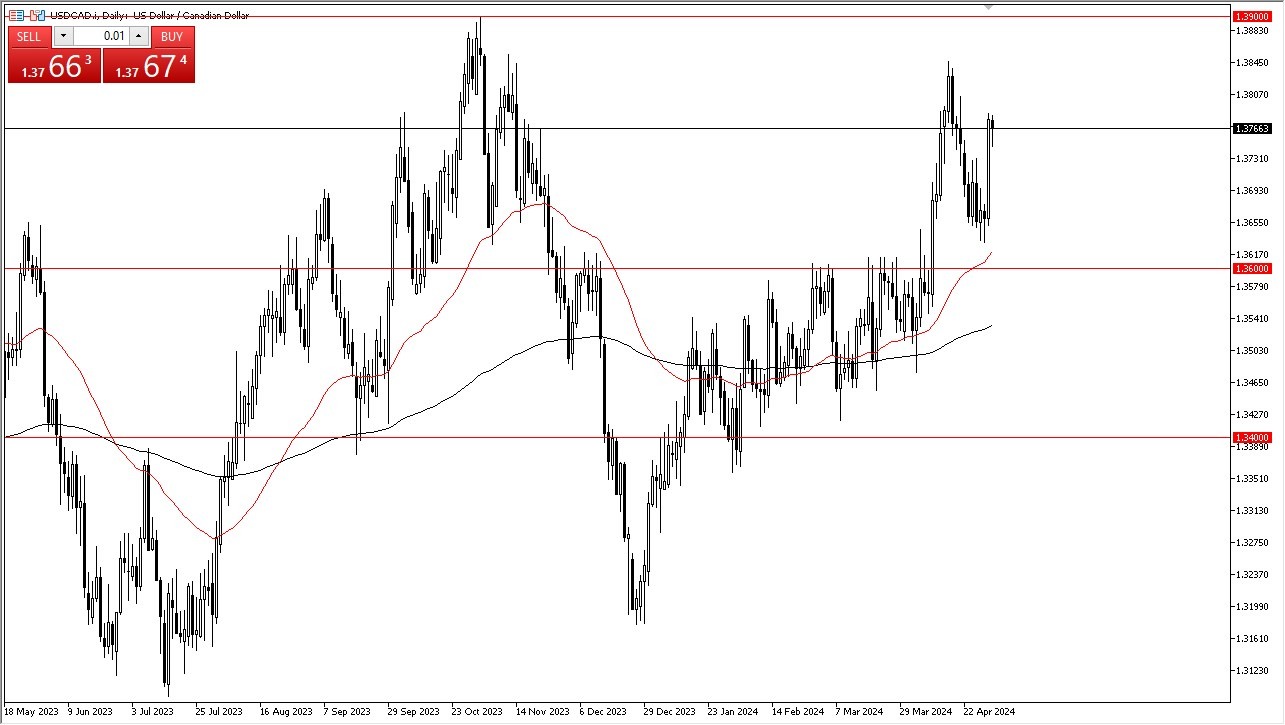

However, the trend to the upside is very much intact and I think at this point in time the market is one that you will be looking to buy dips in. Underneath I see the 50 day EMA offering a significant amount of support just above the 1.36 level. 1.36 is an area that has been important multiple times as resistance and has shown itself to be full of market memory.

Top Regulated Brokers

Tuesday was impressive.

In general, the size of the candlestick on Tuesday does tend to dictate that we will eventually go higher, and I think at this point, the short-term pullbacks make a lot of sense as entry points. If we can continue to find buyers and interest rates in America remain fairly tight, then the U.S. dollar could very well go looking to the 1.39 level, which is an area that previously had been very resistant.

On the other hand, if we were to break down below the 1.36 level and the 50-day EMA as a result, then we could go looking to the 1.35 level which is near the 200-day EMA. In general, I do like buying the dollar of the Canadian dollar as the Canadian economy itself has plenty of issues. With this, I think we will remain bullish over the longer term, I think it’s probably only a matter of time before we make a bigger move. With the inflationary problems in the United States, we may see higher rates for much longer than anticipated. With that being said, a lot of this will come down to what we see during the press conference on Wednesday, but at the end of the day, I think the trend is set.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you.