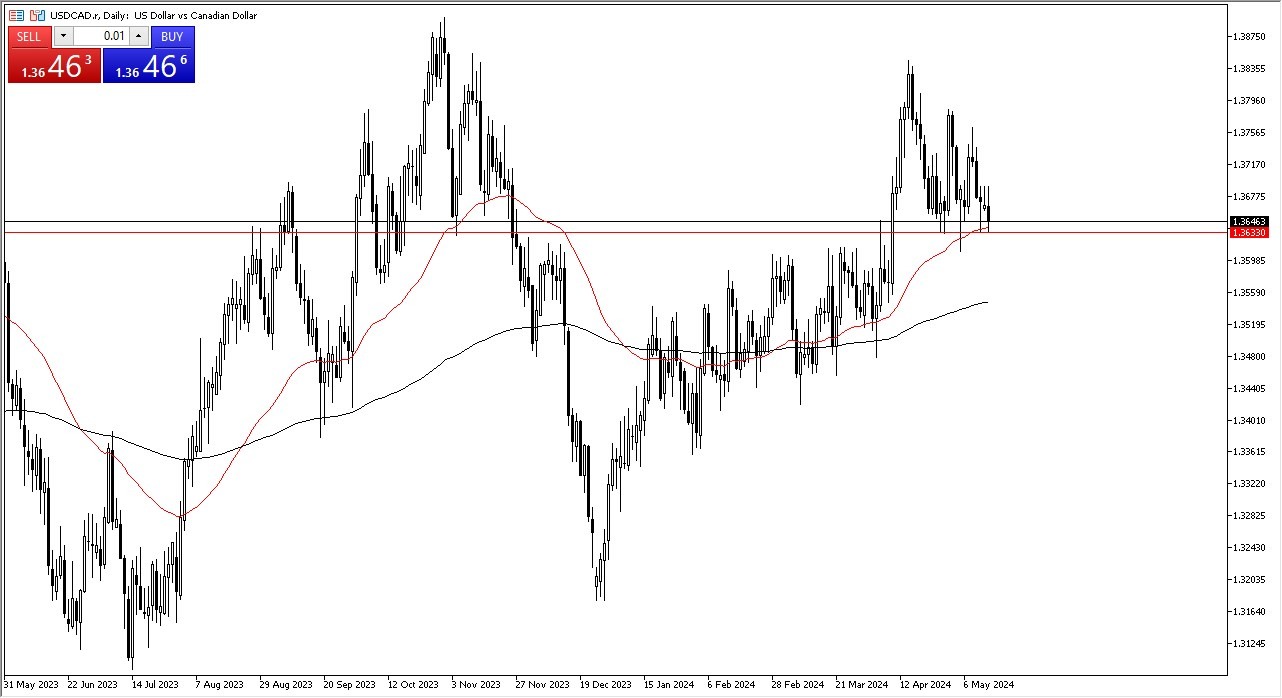

- The US dollar has been all over the place during the trading session on Tuesday against the Canadian dollar, as we continue to test a major support level.

- The 1.3633 level has been very important multiple times in the past, and we did bounce from there during the pullback that we had seen on Tuesday.

- It’s also worth noting that the 50-Day EMA sits in that general vicinity, and it is offering support in and of itself.

Equally interesting is that we have seen the 1.3690 level offer significant resistance over the last 3 sessions in a row and has been like a brick wall. Because of this, I think we can get above that level, then it’s an obvious sign that the US dollar should continue to strengthen against the Canadian dollar.

Top Regulated Brokers

Intertwined Economies

It’s worth noting that the US and the Canadian economies are highly intertwined, and therefore this pair does tend to be very choppy over the longer term. That being said, it’s worth noting also that if we continue to see more “risk off behavior”, then we could see the Canadian dollar strengthening, with this pair dropping. On the other hand, if inflation continues to be an issue, the Federal Reserve will have to keep the interest rate very tight. That does help the US dollar, as interest rates are more attractive in America. Furthermore, we have geopolitical problems out there, a lot of the time traders will run into the US dollar and US Treasury market for safety.

With both of these currencies seemingly somewhat supported around the world, the be interesting to see how this plays out. I think at this point we are forming a bit of a bullish flag, or maybe trying to carve out some type of consolidation area. That being said, if we do break down then I think it is very difficult to imagine a scenario where the market simply breaks down through all of that support easily. It is because of this that I believe that the downside is somewhat limited, and then eventually the US dollar will turn things around again.

Ready to trade our daily Forex forecast? Here’s some of the top trading account in Canada to check out.