- The US Dollar has continued to advance over recent hours, supported by Hawkish remarks from the Fed’s Kashkari.

- US Dollar strength is supported by market sentiment and fundamental factors.

- The US Dollar Index is testing the resistance level at 105.22 and may make a bullish breakout today.

- The best Forex opportunity to be long of the US Dollar looks likely to be in the USD/JPY currency pair, which has risen quite firmly so far today.

- Opportunities to go short of the EUR/USD currency pair look very limited due to the cluster of support levels nearby.

- There may be an opportunity to go short of the GBP/USD currency pair following a bearish reversal at $1.2529 or a breakdown below the support level at $1.2449.

Top Regulated Brokers

US Dollar Index (DXY): Technical Analysis

The US Dollar has advanced this week after falling strongly over the previous week. This recovery has seen a succession of three lows, with the bullish momentum now pausing as the price runs into the resistance level at 105.22.

This looks likely to be today’s pivotal point in the greenback, so if we see the price start to push above it by making two consecutive higher hourly closes there, it could give a good filter entry signal to get long of the USD.

The price would then have a lot of room to rise further as the next resistance level will not be reached until 105.81.

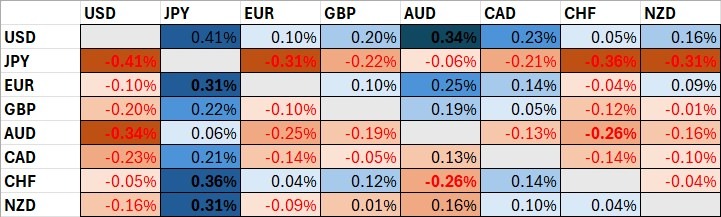

The table below shows that the US Dollar has been the strongest major currency so far today, while the Japanese Yen has been the weakest.

US Dollar Index (DXY): Fundamental Analysis

The US Dollar has benefited from a feeling in recent days that the recent selloff in the greenback was overdone, so we are seeing a natural bounce back. However, this is supported by a feeling that the outlook for the Fed is at least a bit more hawkish than had been though, which was given a tailwind a few hours ago when FOMC member Kashkari said that rates will have to be maintained or even hiked for some time yet.

USD/JPY Forecast: Technical Analysis

Recent gains by the US Dollar have been expressed most strongly against the weak Japanese Yen, which has declined in recent hours against every major currency. This is despite comments from the Bank of Japan’s Ueda hinting at earlier than expected rate hikes.

Traders will probably be wise to look for long trades, but it is unclear whether there are any good supportive entry points nearby. It might be best to day trade this pair and to look to enter long following minor pullbacks on shorter time frames, especially after the New York open settles.

EUR/USD Forecast: Technical Analysis

We have seen the US Dollar renew its gains here, pushing the price down to threaten a break below the support level at $1.0739.

Although we are seeing some bearish momentum, the EUR/USD currency pair looks a bit dangerous to trade as there are several support and resistance levels clustered near the current price. This is suggestive of choppy trading, especially in the absence of any major data releases scheduled for today.

It might be better to avoid this currency pair and to look to trade either the USD/JPY or the GBP/USD.

GBP/USD Forecast: Technical Analysis

Like its highly correlated currency pair the EUR/USD, the GBP/USD is showing some bearish momentum. However, the momentum is stronger and cleaner, and the structure of nearby support and resistance levels suggests that the price is likely to move lower more easily here than in the EUR/USD.

I think two consecutive lower hourly closes below $1.2477 during the first half of today’s London session could be a good short trade entry signal if there is no large lower wick on the second candlestick.

Of course, the potential reward to the next support level at $1.2449 should be considered against the risk required by whatever stop loss you will use.

An even stronger signal would be the same bearish breakdown but below $1.2449.

Not sure which broker to choose? We've made a list of the best USD forex brokers for you.