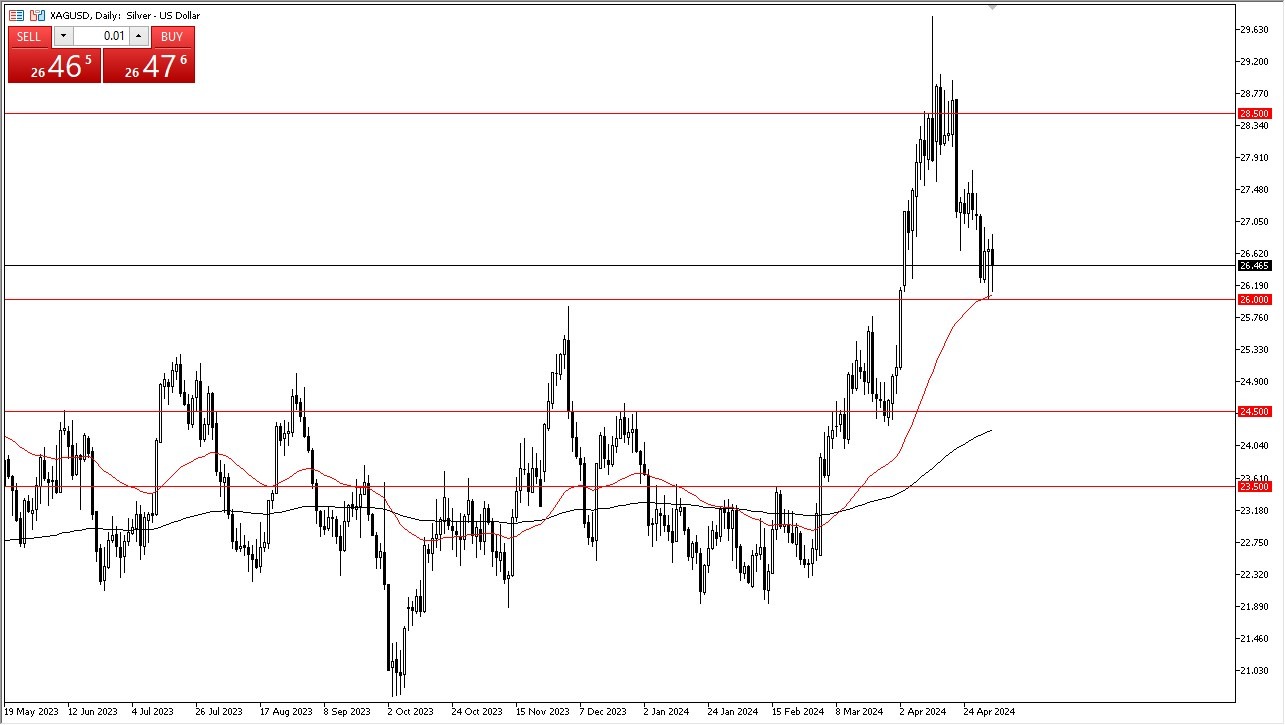

- Silver initially fell significantly during the trading session on Friday, but then turned around to show signs of hesitation.

- Ultimately, this is a market that I think continues to see a lot of noisy behavior, but it’s worth noting that the silver market is a little bit different than the gold market, in the sense that it is not as driven by geopolitics as gold is.

However, you have to keep an eye on the interest rate market, because as interest rates rally, that can cause downward pressure on the silver, just as falling rates can lift silver. All things being equal, this is a market that has bounce rather significantly from the crucial $26 level, which is worth noting via technical analysis. However, another thing that you need to keep in mind is that when you are trading silver, you are also trading in industrial metal, so therefore it does behave quite a bit differently.

Top Regulated Brokers

Technical Analysis

The technical analysis is that we continue to find support near the $26 level. The $26 level is a significant area of resistance, and therefore it is an area that I expect to see a lot of “market memory” acts, as it had previously been both resistance and support multiple times over the last several years. The fact that we bounce from there during the trading session on Friday is a very bullish sign, but it can also be said the same thing about Thursday and therefore I wonder whether or not we are going to have any momentum? At this point, momentum will be the most important thing to see and if we can break above the $27 level, then it opens up the possibility of a move to the $20.50 level.

In general, I think you will see a lot of volatility, but that’s nothing new for the silver market, as we have seen a lot of volatility over the last several months. All things being equal, this is a market that I think continues to see a lot of erratic behavior, but at this point in time it’s probably only a matter of time before we do see buyers jump in and pick this market up. However, if we were to break down below the only $5.50 level, then we could see this market truly unravel, perhaps dropping down to the 200-Day EMA.

Ready to trade our daily forex analysis? Here are the best Silver trading platforms to choose from.