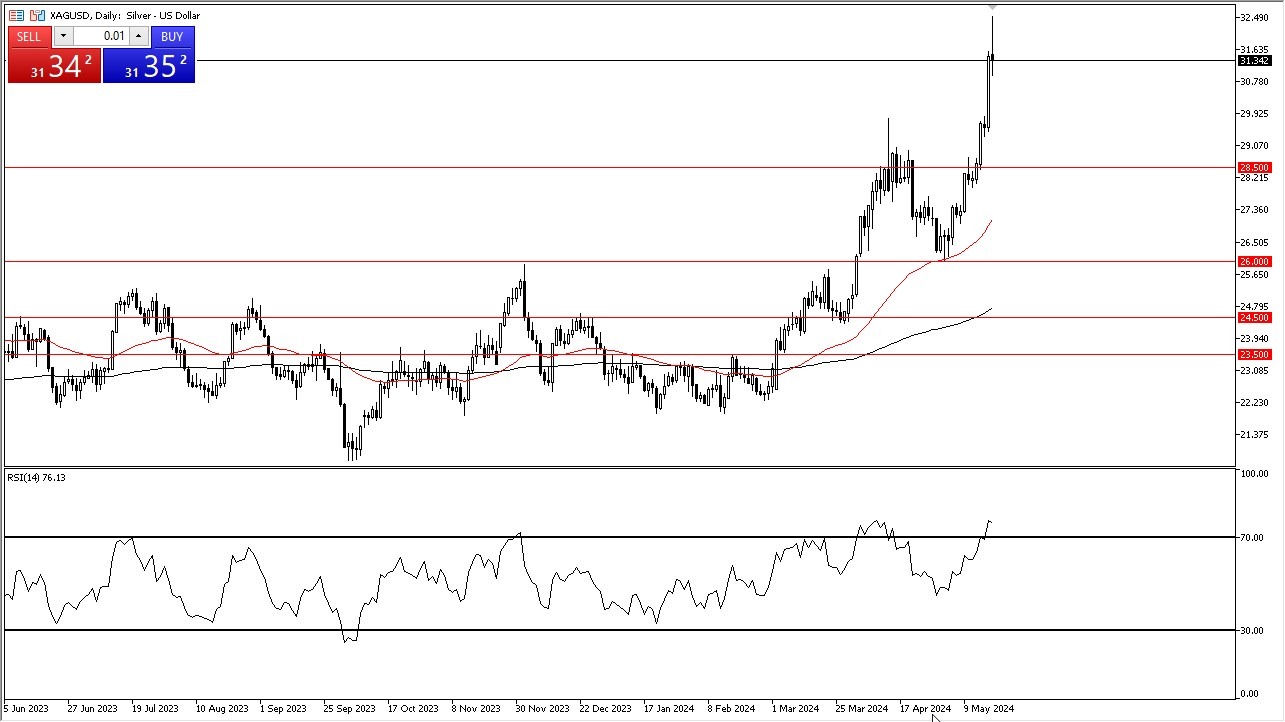

- The silver market initially shot higher in the early hours on Monday, reaching the $32.50 level before collapsing again.

- At this point, I think we have a lot of different things moving the market at the same time, and you have to be very cautious about what you're doing here.

- Silver is overbought and even hit well above the 70 level on the relative strength index, actually touching 78.

This tells me that there is high potential for some type of significant pullback. If we fall from here, then it's likely that there are plenty of buyers maybe near 30, but maybe $28.50 level.

A short-term pullback is a potential buying opportunity in the market that's very strong, but these short squeezes are something that are very difficult to get a grasp on. You never really know when they're going to end and when they do, they normally end in tears.

I remember the last silver short squeeze, the last real one where we got above $30 and pretty much every retail trader I know got wiped out because they tend to over invest in the market. They most certainly stay too long. The action that we've seen in the morning has probably wiped out an untold number of retail accounts. After all, we hit $32.50 and then dropped below the $31 level in the European session. It's hard to tell what the Americans will do with this, but at this point in time, it certainly looks like a breakdown as possible.

Top Regulated Brokers

Massive Danger Currently in this Market

In fact, I just pulled up the charts, and we're down 30 cents since I started doing my analysis of silver. Long story short, I think the analysis and silver is you needed to pull back rather significantly and stabilize if you want to get involved. If you're already long of silver, and I suspect many of you are, do not get married to this position. It might be time to move your stop losses closer to the price action.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.