- Silver markets have had a very rough couple of sessions, and as we head into the FOMC meeting, I think we will probably continue to see a bit of trouble when it comes to this market.

After all, silver is highly sensitive to risk appetite and perhaps even more so the interest rate market. I anticipate that if Wall Street doesn’t get exactly what once out of Jerome Powell and the FOMC press conference, we could see some of the riskier assets such as silver get absolutely pummeled.

Top Regulated Brokers

It’s all up in the air

I’m not going to lie; I wish I knew what to do with silver but quite frankly it’s going to come down to the FOMC reaction. There’s no way to know how people will read into whatever it is chairman Powell says, because quite frankly the market has shown itself willing to see what once to see more than once. Because of this, this is a market that will be extraordinarily volatile.

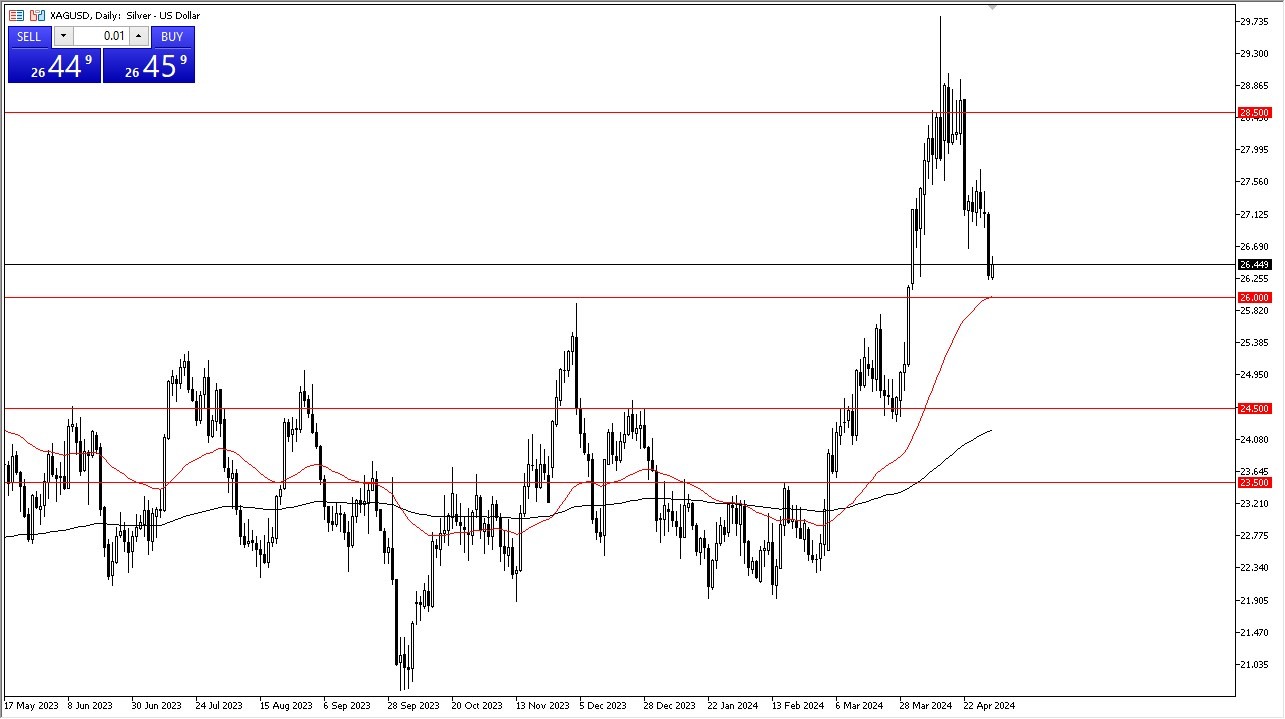

That being said, there is a little bit of technical analysis that we can pay attention to. For example, the $26 level remains crucial, and if we can stay above there then we have a real shot at potentially stabilizing the market and continuing the uptrend. However, if we were to drop below the $26 level on a daily close, I think at that point in time you would see silver in real trouble. In that environment, silver will more likely than not jump back into the consolidation phase that it’s been in for what seemed like a lifetime. Because of this, I think that the next 24 hours could be some of the most important hours of the year.

All this being said, you need to be very cautious with your position sizing, which is sound advice when it comes to trading silver under normal circumstances. In this environment, it could be the difference between blowing up your account or living to fight another day. Be very cautious, but we are still above that crucial floor as I write this article, so you do have to assume that there are buyers out there.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.