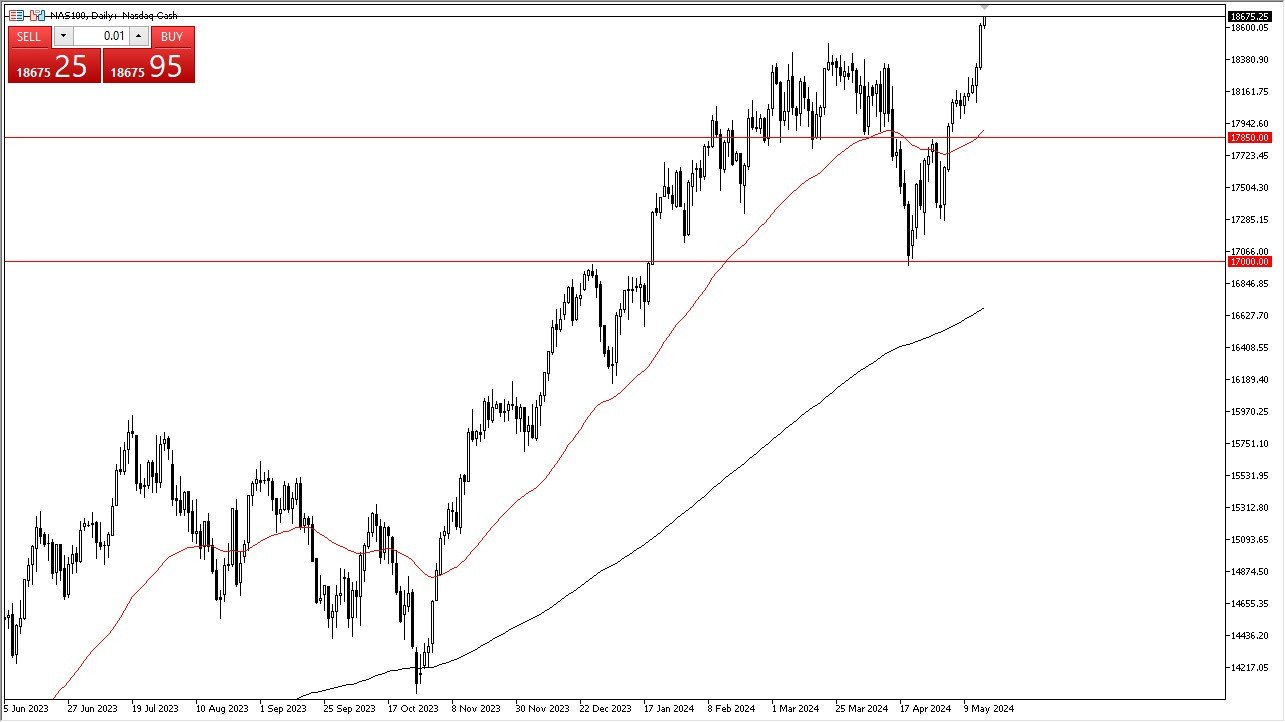

- The NASDAQ 100 rallied again during the early hours on Thursday as we continue to see plenty of momentum.

- The momentum in this market has been quite remarkable, and at this point in time I think it continues to feed upon itself.

After all, the bulk of stock indices in the United States are driven by algorithmic trading, and then of course the NASDAQ 100 is not an equal weighted index, and therefore if you get all of the right stocks moving in the same direction, it has an outsized influence on the market.

Technical Analysis

Quite simply put, the technical analysis on this market is extraordinarily bullish. We have just broken to a fresh, new high during the trading session on Wednesday, and Thursday looks as if it is going to be more of the same bullish pressure. In general, I do think this is a market that will eventually find its way much higher, perhaps as high as the 20,000 level. This is not to say that there will be the occasional pullback, just that buyers are almost certainly willing to come back in.

Top Regulated Brokers

Wall Street and the Federal Reserve

Wall Street continues to wait for its handout from the Federal Reserve, and the latest CPI numbers have Wall Street spending a narrative that inflation is finally slowing down because it is the first number that came in as expected instead of being hotter than anticipated. Because of this, Wall Street is off to the races, already starting to price in the idea of easy money coming down the road. This is obviously folly, but the reality is that the NASDAQ 100 is driven quite drastically by momentum more than anything else, so you cannot fight this nonsense.

Short-term pullback should continue to be buying opportunities, and I think Wall Street will continue to find one reason or another to get this market to go even higher. As far as support is concerned, I see support at the 18,500 level, and then again at the 17,850 level where the 50 day EMA is currently sitting.

Ready to trade the NASDAQ 100 Index? Here are the best CFD brokers to choose from.