- The NASDAQ 100 has gone back and forth during the early hours on Wednesday, as we wait for the crucial FOMC meeting and results.

- After all, there will be an interest rate statement, followed by a crucial press conference.

- In fact, I believe the press conference will be what leads to where the market goes next. Quite frankly, this is all about one person, and that’s going to be Jerome Powell.

Technical Analysis

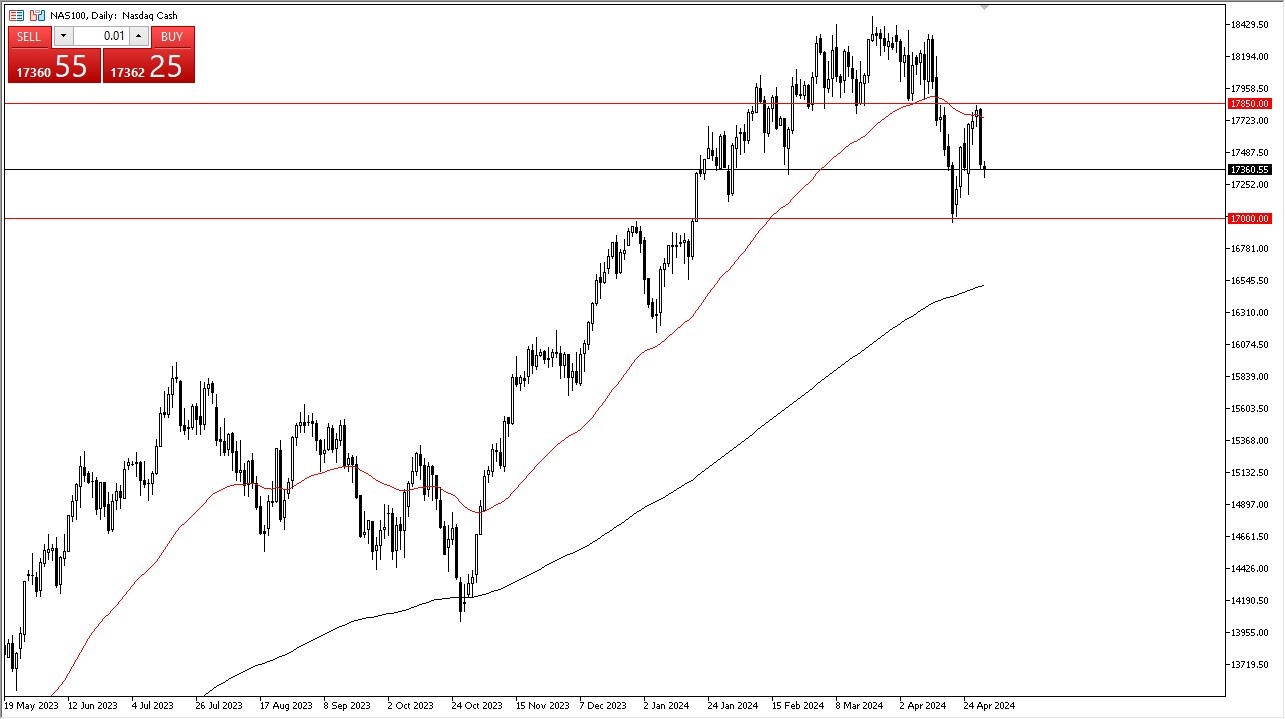

The technical analysis for this market is rather strong, although we have seen a significant pullback recently. Underneath, I see the 17,000 level as a major support level that a lot of traders will be paying close attention to. That’s an area that previously had been resistance, so I would anticipate that there should be a certain amount of “market memory” in the picture, and therefore I think a lot of people will be looking to get involved if we pull back to that region. In that area, I would expect to see a lot of “value hunters.”

Top Regulated Brokers

On the other hand, if we turn around and start going higher, we could go looking to the 17,850 level, which sits just above the 50-Day EMA. The market had seen a lot of support their previously, so there should also be a certain amount of “market memory” in that region as well. Overall, this is a market that has been consolidating for a while, but the action on Tuesday was quite concerning if you are bullish.

Going back to the FOMC situation, a lot of this is going to come down to how hawkish Jerome Powell sounds. If he sounds overly hawkish, then the NASDAQ 100 will certainly fall. I think a lot of traders are concerned about that, and it is worth noting that at one point, there was an expected 6 interest rate cuts this year. Now we are barely above a 50% chance of an interest rate cut in December. In other words, inflation isn’t going anywhere and I think a lot of people are going to have to keep that in mind, which of course works against the idea of yields falling anytime soon.

Ready to trade the NASDAQ 100? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.