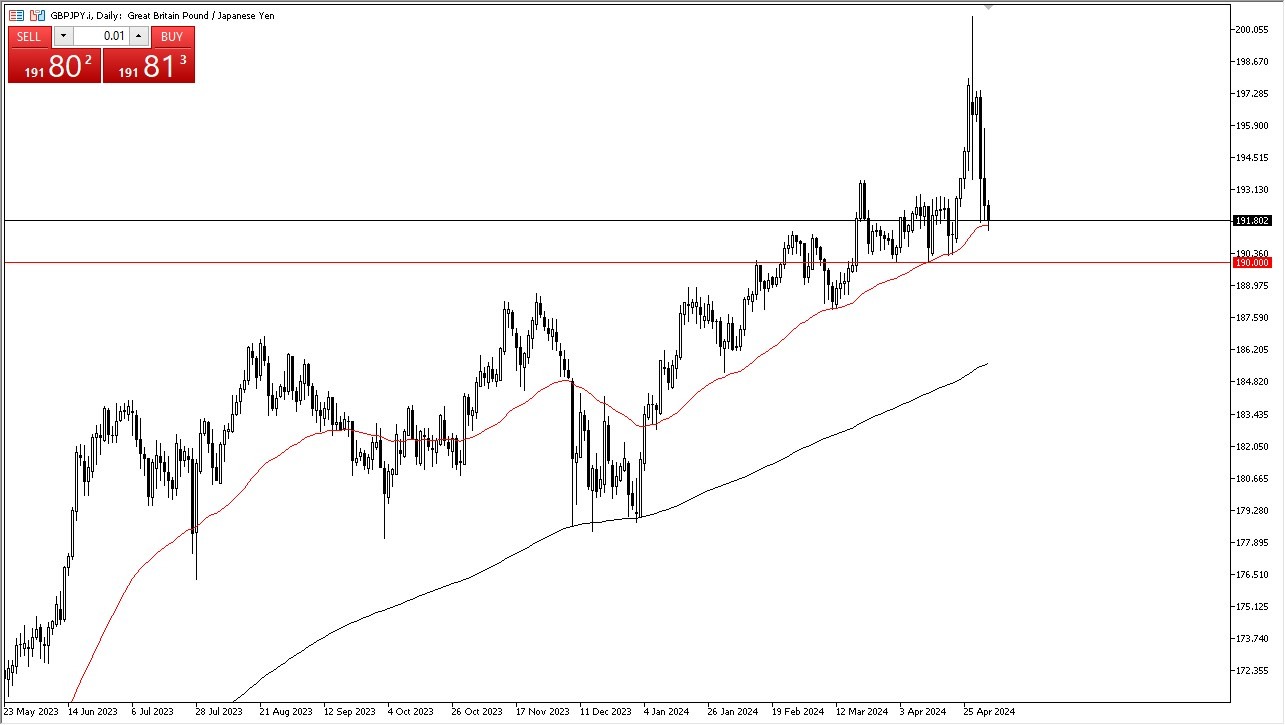

- The British pound has fallen again during the trading session on Friday, to seeing the crucial 50-Day EMA.

- What’s even more important to me though is the fact that we are in an area that has a lot of noise and it, as we had consolidated previously.

- At this point, I can only ask the question as to whether or not this is the major dip that turns the market around, or if it is a situation where we continue to plunge.

At this point, I’m looking at the ¥190 level as a major barrier for short-sellers, and I do think that eventually we will get a little bit of a bounce. I am keeping an eye on the ¥192.50 level, because we can turn around a break above there, then I’m willing to get long again. After all, the interest rate differential between the 2 economies is wide enough to drive a truck through, and therefore you do get paid to hang on to this pair. That doesn’t necessarily mean that it has to go higher, but it certainly makes the move higher a lot less painful than a move lower.

Top Regulated Brokers

Bank of Japan

Keep in mind that the biggest driver of where we go next is going to be the Bank of Japan, as they have intervened a few times recently, and therefore they have strengthen the Japanese yen. That being said, it doesn’t necessarily look like they have changed the trend, so I’m just simply waiting for other people to get involved in the market before start buying again. I made quite a bit of money via the swap over the last couple of months, and I plan on doing that again.

From a longer-term standpoint, the Bank of Japan can’t do much as far as interest rates are concerned, mainly due to the fact that Japan has an even worse debt problem than the United States, which is really saying something. At this point, this is a market that should continue to go higher, but a little bit of patience probably goes a long way as you will get paid to simply wait for traders to get involved. However, if we were to break down below the 189 you level, then it will be interesting to see what happens next.

For additional & up-to-date info on brokers please see our Forex brokers list.