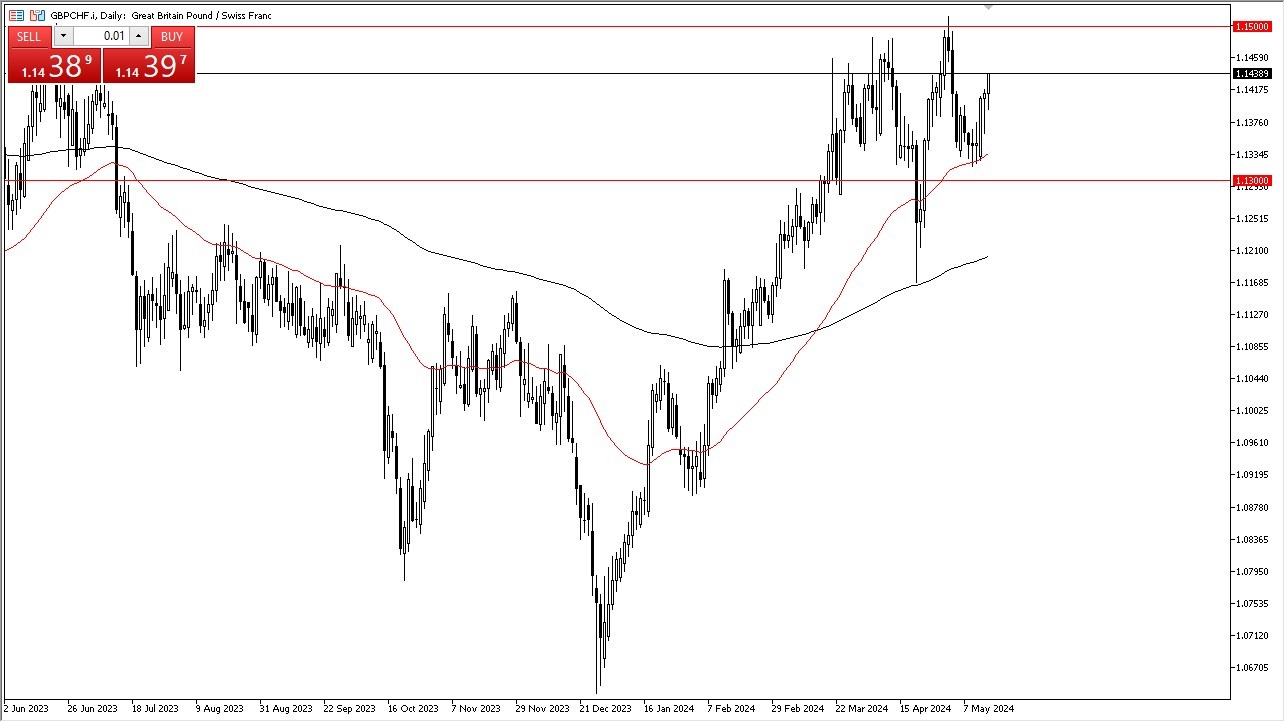

- You can see that we initially pulled back just a bit during the early hours on Wednesday in the British pound against the Swiss franc pair but have also turned around to show signs of life.

- Ultimately, the interest rate differential, continues to be a major driver of where we go next, and therefore it does make sense to be in a long position in this market as you get paid at the end of the day to hold it.

The question now is going to be whether or not the 1.15 level above continues to hold as resistance, because if it doesn't, that opens up a huge move higher and could send this market reaching a 1.20 level before it is all said and done. Speaking of the interest rate differential, it is a country mile wide and therefore you have to pay to short the GBP/CHF pair.

Top Regulated Brokers

Shorting is impossible in this environment

I have no interest in doing that in an environment where the interest rates are everything. It makes sense that every dip ends up being a buying opportunity. The 50 day EMA underneath has offered significant support multiple times now, and that sits just above the crucial 1.13 level that I think a lot of people are paying attention to. Also, with this, I remain buy on the dips and I do think eventually we squeeze to the upside, but it's going to take a certain amount of momentum building to make that happen.

How easy that is. Well, we'll have to wait and see. But right now, it certainly looks like we're going to go ahead and attempt that breakout. Given the behavior of the market over the last couple of months, it's also worth noting that we had an extremely bullish run to the upside to get here. And since then, have seen a lot of choppiness but resilient bullish pressure, which tells me that the market still looks very strong. I believe that it is only a matter of time before we can break above the 1.15 level, and really start moving.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.