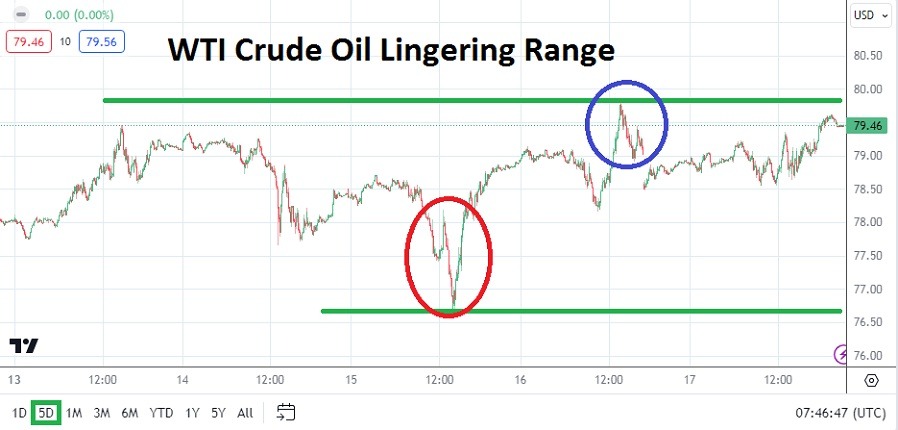

The price range of WTI Crude Oil was a rather polite affair for speculators this week after mid-term lows were challenged on Wednesday of this past week.

- The price of WTI Crude Oil went into this weekend near the 79.460 ratio; this after a low around the 76.700 value was touched on Wednesday.

- While the lows challenged in the middle of the week hit prices last seen in late February, some buying did generate and on Thursday and a high of 79.800 came into sight.

- However, the range of WTI Crude Oil remained within a fairly solid channel taking into consideration the results seen in the commodity since the start of this month.

Since the beginning of May, when WTI Crude Oil literarily dropped below the 80.000 USD price, the commodity has actually seen a rather tight price range which has allowed day traders to test their technical perspectives. The finish for WTI Crude Oil going into the weekend essentially closed trading near marks the commodity was testing on Monday and Tuesday of last week. The move lower needs to be considered and what happens next will be intriguing. The price of WTI Crude Oil has not traversed above 80.000 USD since the 1st of May.

U.S Economic Data and Demand for WTI Crude Oil

As the price of WTI Crude Oil remains within sight but below the 80.000 USD mark, supply and demand for the commodity remains durable. U.S demand for energy over the mid-term may come into question taking into consideration signs the U.S economy is dampening, but having closed the week of trading within sight of 80.000 USD should be considered by speculators. And experienced traders know Crude Oil demand is unlikely to suddenly vanish.

Early trading this week should be watched to see if risk appetite continues to creep into the broad financial markets, if the price of WTI Crude Oil remains comfortably below the 80.000 ratio this may be viewed as a positive by participants in equities and Forex. Tomorrow’s opening in WTI Crude Oil should be examined and if trading remains polite, and sees the commodity pushed backwards to support levels again, this could open the door for more selling to be generated. The price range of WTI Crude Oil is traversing the higher elements of its range for May and resistance levels around the 79.500 to 79.650 values should be monitored early.

Top Regulated Brokers

Lingering Price Range and Technical Perspectives

If trading early this week continues to demonstrate a top level of WTI Crude Oil that continues to get pushed backwards when current resistance levels are tested, this could open the door for lower values. However, the ability of WTI Crude Oil to bounce with price velocity on Wednesday after seeing sharp selling may be a sign that sentiment remains nervous.

- Once again the 78.000 to 77.000 price levels below could provide intriguing windows to test additional support levels lower.

- If WTI Crude Oil opens with lower values early this week and support levels see sustained tests but do not falter, technical traders may start to look for reversals higher to simply see if the price range remains intact.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 75.800 to 81.300

WTI Crude Oil has seen rather quiet trading the past few weeks and this may continue in the coming days unless there is a sudden news development from the Middle East. Traders may want to use current support and resistance levels in order to test market conditions and the prevailing range. Traders are advised to continue to practicing the use of stop losses to guard against unknown developments which could cause a sudden spike in the price of WTI Crude Oil.

Energy traders are among the most experienced commodity speculators around, and know how to remain tranquil. The price of WTI Crude Oil the past few weeks has shown a lower range with occasional tests of new lows. If the world stays quiet in the coming days, technical traders may enjoy speculative opportunities in the commodity.

Ready to trade our Crude Oil weekly forecast? Here are the best Oil trading brokers to choose from.