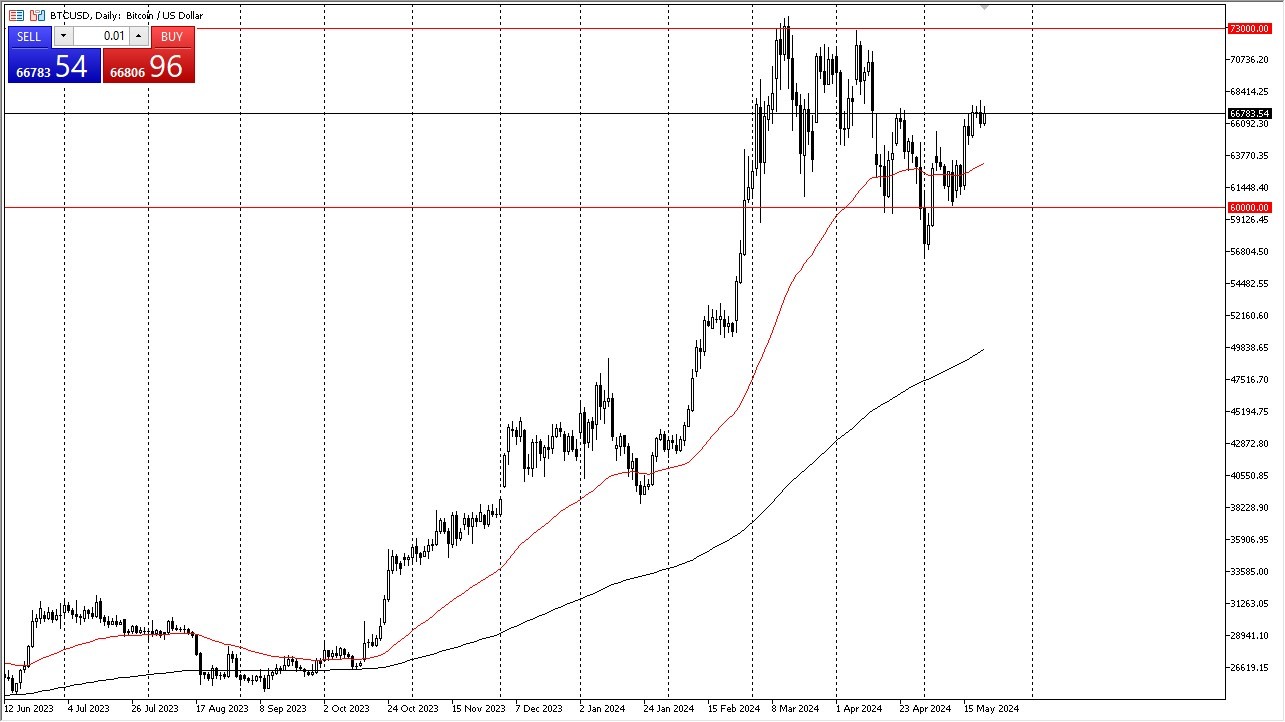

- Bitcoin continues to hang around the $67 level and I think this is an area where we have seen a lot of problems.

- With that being the case, it's not a huge surprise to see that we are just hanging around here.

- Short-term pullbacks I do believe end up being buying opportunities and I also recognize that we are still digesting that massive move from before.

Now the question is why are we taking so long? Well, a 92% gain in a market in six weeks is extraordinary. It's not normal. And now that you have institutional traders involved, that kind of nonsense won't happen anymore. They will treat this like an index, and it will probably move more like the S&P 500.

The Market Has Changed, You Should as Well.

Top Regulated Brokers

The days of 15% gains in 24 hours are probably all been about done for Bitcoin, but that doesn't mean that it's a negative asset. It just means that grinding higher is probably more the norm than the straight shot in the air type of moves that we've seen multiple times in the past. Because of this, I do think that you'll get an opportunity to buy on the dip. And when you see a pullback, you have to look at it through that prism. The 50 day EMA hangs right around the $63,000 level. And then after that, you have the $60,000 level. If we can break above $68,000, then we could go looking to the $73,000 level above, which was a major and obvious resistance point.

The $73,000 level being broken to the upside would obviously be extraordinarily bullish, and I think a lot of traders would get involved in the market at that point. It could very well open up a move to the $75,000 level, and possibly even as high as the $80,000 level as well. Regardless, I think you continue to buy dips more than not, and therefore it’s a market that I have no interest in trying to sell due to the fact that it just simply won’t give up the upward trajectory.

Ready to trade Bitcoin in USD? We’ve shortlisted the best MT4 crypto brokers in the industry for you.