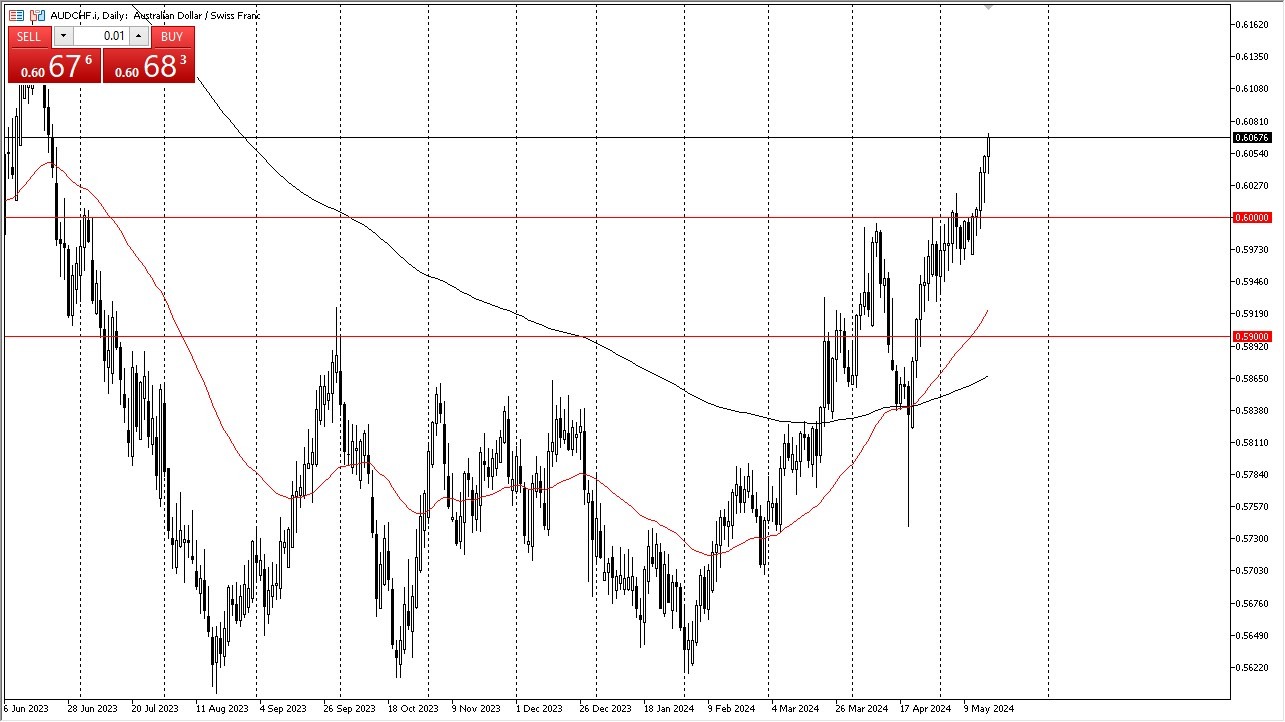

- The Aussie dollar initially pulled back just a bit during the trading session on Friday, but then turned around to show signs of strength against the Swiss franc as we continue to go higher.

- The 0.60 level underneath is an area that a lot of people have paid close attention to, and now that we are breaking above that huge area, I think it's an obvious breakout.

In fact, you see this in the Swiss franc against almost all currencies. It's not just the Australian dollar. The one outlier, of course being the US dollar. So, it is what it is. All things being equal, I like the idea of buying dips, and I do believe that the 0.60 level should continue to be support on any type of pullback.

Top Regulated Brokers

If we were to break down below there and then clear the 0.59 level, then I would be pretty much convinced that the market just isn't going to rally. Now that being said, AUD/CHF is a market that I think goes much higher. Perhaps go looking to the 0.6150 level and then eventually 0.63. The interest rate differential continues to favor the Australian dollar.

Interest Rates

Carry trade seems to be the one thing that you can see across the forex world right now. People are looking for interest rate to be paid. At the end of the day, they're looking for that positive swap. I have no interest in shorting this market. And really at this point in time, I'm only looking for an opportunity to add to the already existing position.

Furthermore, you have to keep in mind that the Australian dollar is highly influenced by the commodity markets, which of course are very strong. So that's just a bit of a double whammy to the upside for this market. With this, I remain bullish, and am looking to add to my position sooner rather than later. After all, the interest rates favor this, and the commodity markets also do the same. I believe this could be the beginning of an overall cycle.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.