WTI Crude Oil went into the weekend around 81.920 as the commodity finished Friday near lows and perhaps taught a lesson to inexperienced traders.

- The ability of WTI Crude Oil to finish last week’s trading below the 82.000 USD level likely served as an important lesson for traders who are new to the speculative game of commodity wagering.

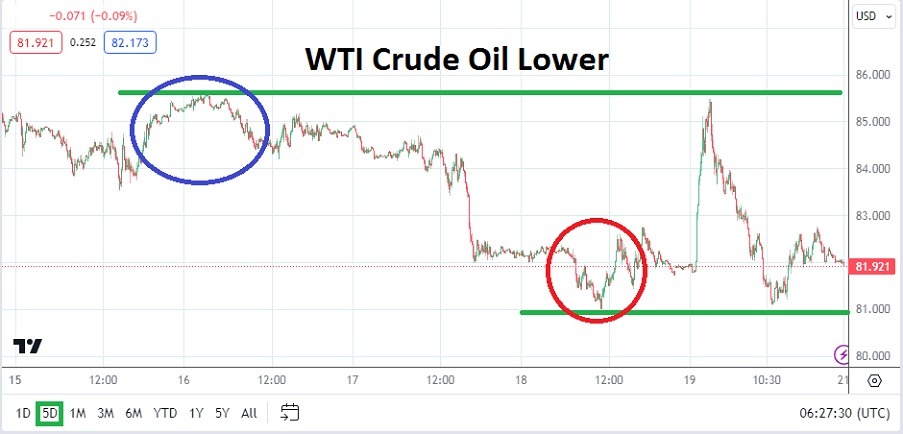

- The price of WTI Crude Oil started last week around the 85.000 ratio, this after the previous weekend’s loud developments between Iran and Israel.

- However, after opening on Monday the price of the commodity actually began to trader lower after the initial burst of value.

- While some people in the media were screaming about the potential of higher prices in WTI Crude Oil, panic never set into the marketplace.

A clear sign that large WTI Crude Oil players weren’t overwhelmingly concerned by the noise from the Middle East was the reality that price levels in the commodity never came close last week to the highs seen on Friday the 12th of April, which touched the 87.000 mark momentarily. In fact, WTI Crude Oil touched a low on Monday around the 83.530 price.

Calm Trading and Experience Dealing with Middle East Drama

Inexperienced WTI Crude Oil traders may have thought fear would drive the price of the commodity to new highs but that did not happen. Instead WTI Crude Oil remained within its known technical range as news between Iran and Israel developed over the week.

This past Friday when WTI Crude Oil was trading around the 81.800 level, news was reported within international media about counterstrikes in the Middle East, but importantly Iran and Israel for the most part remained quiet. The price of WTI momentarily did shoot up to the 85.550 vicinity, which tested highs seen on Tuesday of last week, but then large players took the commodity lower again. And by the end of trading as the weekend began to draw close, WTI Crude Oil was selling off and suddenly testing values it had begun the day with, and now speculators have to decide on what happens next.

Top Regulated Brokers

Middle East Calm and Supply Issues for WTI Crude Oil

While some traders may not accept the use of the word ‘calm’ to describe what has happened in the Middle East the past couple of days, the fact is Iran and Israel seemingly have found a political equilibrium. Not to say things will not suddenly boil again, but for the moment the Middle East region seems as if it is back to work. The price of WTI Crude Oil may actually become focused again on supply and demand issues.

- The lower price of WTI Crude Oil is now touching values not seen since the last week of March.

- The ability of the commodity to remain within sight of the 82.000 level is intriguing and some traders may suspect the commodity has been slightly oversold.

- However, the ability to trade lower after a major week of Middle East news events may point to the notion that some large player believe WTI Crude Oil had become speculatively too high since late in the first week of April.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 80.430 to 85.750

News from the Middle East is not going to disappear. Traders will have to keep their ears open to the possibility of developments which are loud. However, traders also need to understand that energy speculators who have experience are accustomed to sabre rattling from the Middle East. If WTI Crude Oil remains under 82.000 USD per barrel early this week, this will likely be considered a bearish sign and point to the potential of a slightly lower price developing.

If momentum is found downwards over the next couple of days, the 81.000 USD level should be watched. The last time the price of the commodity was below the 80.000 ratio was on the 15th of March. The ability of WTI Crude Oil to trade below 80.000 this week may seem absurd to many traders, including me, but we have to remember the market is always correct. Bullish traders who believe demand is going to emerge from economies globally that are showing some incremental signs of improvement, may believe the current price range will dominate and that looking for upside when technical lows are challenged is a correct betting stance.

Ready to trade our Crude Oil weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.