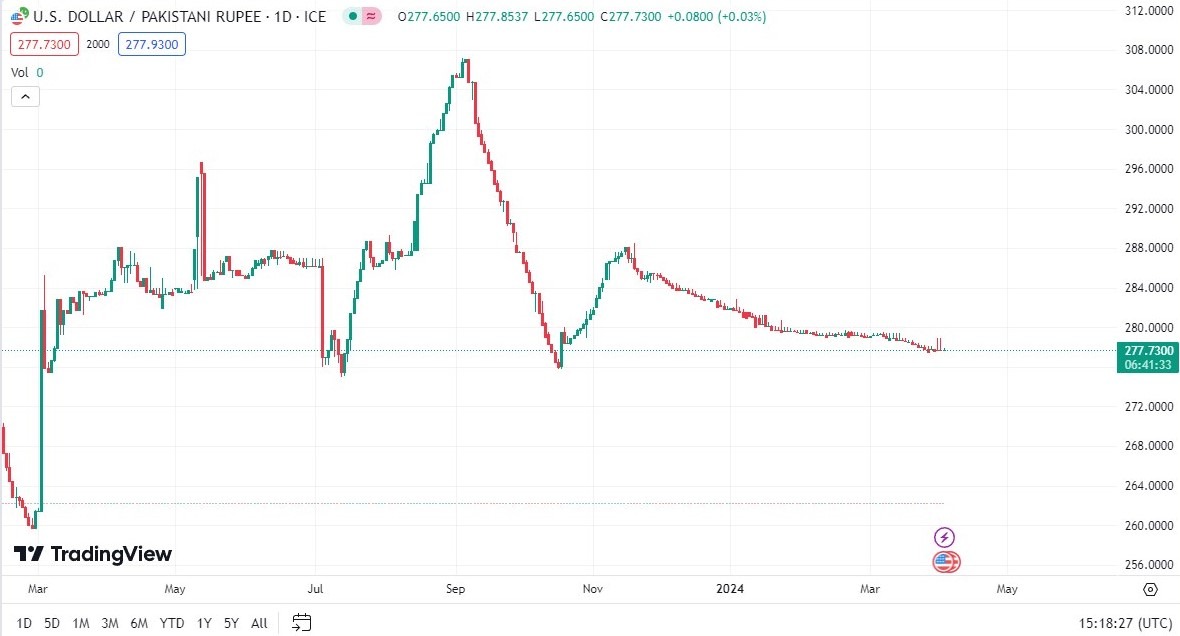

- The Pakistani Rupee continues to gain strength against the US dollar, trading down to the 277.73 level early during the trading session on Wednesday.

- Ultimately, this is a market that I think continues to see a lot of noisy behavior, because it is so short-term focus.

- In general, this is a situation where the trading public continues to believe that the Federal Reserve will cut rates later this year, and therefore the US dollar is starting to drop against the Pakistani Rupee.

Keep in mind that this is a pair that isn’t freely floated, and therefore we will see a lot of interference due to the central bank of Pakistan. Quite frankly, this is a very thin market and therefore it makes a lot of sense that the central bankers have their hand on the scales. In other words, if the US dollar is starting to lose strength against certain emerging market currencies, it does make sense that we continue to go lower, but the Pakistanis will keep this from being a free fall.

Top Forex Brokers

Interest rate differential

Needless to say, Pakistan with its 22% interest rate is going to continue to attract a certain amount of trading into the country, but ultimately this is a situation where market participants will continue to see a lot of negativity, although it will move at a snail’s pace. If you have the ability to trade this pair, you could benefit from a daily paycheck, but the reality is that very few places offer this currency pair. Having said that, it is in a slow and steady decline toward the 270 area, but it may take 6 months or more to get there.

As things stand right now, buying this pair is almost impossible, but if we were to break above the 280 level, it could open up a move to the 282.50 level above. That doesn’t seem very likely, but if we get some type of major “risk off” type of move, then it could be possible.

Ready to trade our Forex daily analysis and predictions? Here are the best Pakistan trading brokers to choose from.