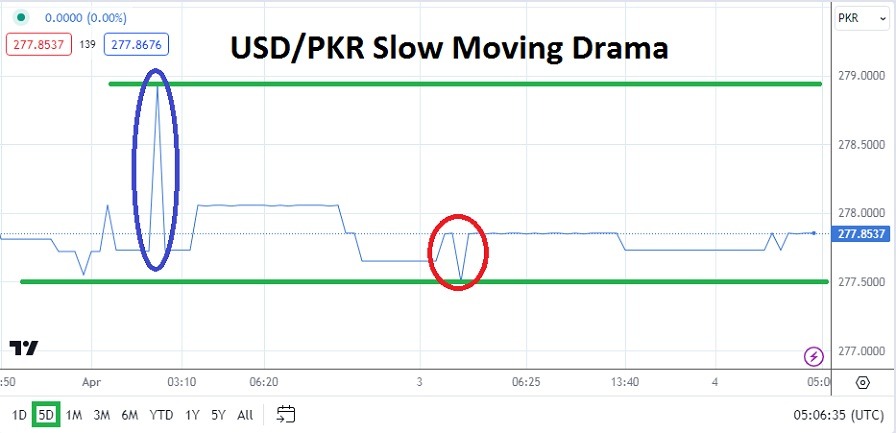

- As of this morning’s writing the USD/PKR is near the 277.8537 mark per the official Pakistan government listed price.

- Speculators of the currency pair are likely trying to trade on broker platforms and the pursuit of the USD/PKR remains a challenging endeavor.

- However, the slow steady price movement of the USD/PKR towards new low is technically interesting. The problem is the cost of admission into the speculative game of trading the USD/PKR.

The currency pair is now touching a price level last seen in the middle of October 2023. The Pakistan government has controlled the price of the USD/PKR with a solid grip per official exchange rates. Correlation to the broad Forex market globally has very little to do with USD centric activities. In order to trade the USD/PKR on a broker’s platform it is likely a trader is enduring high transaction costs, overnight fees, and perhaps other charges in order to speculate.

Trading the USD/PKR in a Free Floating Market is Not Happening

Traders of the USD/PKR outside of Pakistan may look at the currency pair and not pay particular attention to the notion the Pakistan Rupee is heavily controlled. The USD/PKR does not trade in a free floating Forex landscape. The government has been vigilant about illegal trading of the USD/PKR inside of Pakistan since September and this has ‘helped’ the currency pair become tamer. Before interventions which included IMF rhetoric and Pakistan government policy change the USD/PKR was trading above 305.0000 in early September of 2023.

Trading of the USD/PKR must be done with the realization there appears to be a slow technical move lower that might prove to be an opportunity for speculators, but the ability to hold onto a position for a long enough duration without getting chewed up by fees is not easy. Tomorrow’s U.S Non-Farm Employment Change numbers could get the emotions of USD/PKR traders moving, but there are many doubts about if the currency pair will be influenced by the data.

Top Regulated Brokers

Timing the Moves of the USD/PKR is a Dangerous Game for Speculators

While the USD/PKR did achieve new lows and touched the 277.5000 level yesterday like it did last week, there have also been slight spikes higher per the official transactions. The move higher Tuesday of this week to the 278.9290 level was brief, but it might have been quite painful for a bearish speculator who was overleveraged and not using stop loss orders.

- Timing moves in the USD/PKR is difficult because there is very little chance of knowing when a large move will occur in the currency pair if a person is outside the government sphere and banking circles involving of Pakistan.

- Traders hoping for reactions near-term from the USD/PKR and a potential move downwards again incrementally need to use take profit orders and have the ability to wait for the possibility. In the meantime, however, things could go wrong and knock you out of a trade with a sudden reversal higher.

Pakistani Rupee Short Term Outlook:

Current Resistance: 277.9290

Current Support: 277.7390

High Target: 278.1000

Low Target: 277.5510

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Pakistan to check out.