The USD/PKR has incrementally traded higher, but the currency pair remains locked in a government controlled official exchange rate that is not in tune with the global Forex market.

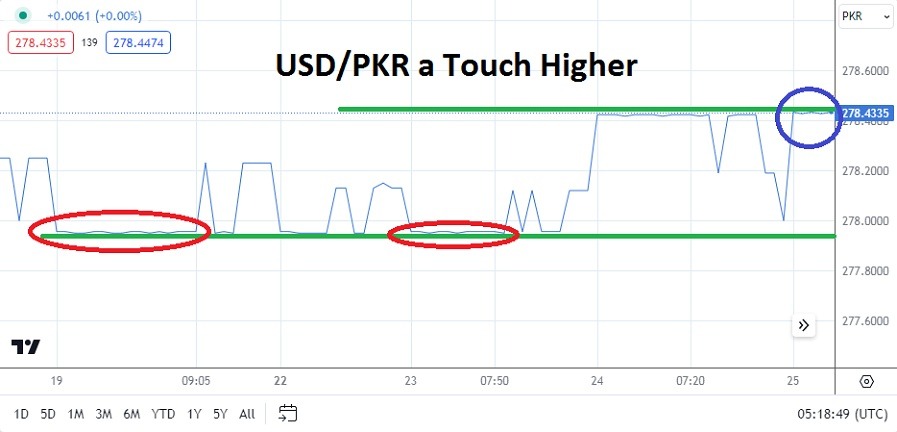

- The USD/PKR has an official exchange rate at the time of this writing near the 278.4335 ratio. Its value as of this morning is fractionally higher than yesterday’s apex values.

- The currency pair has been allowed to move higher in the past two days, but speculating on the USD/PKR remains speculatively difficult and dangerous.

- The low for the USD/PKR which is listed shows a value around the 277.9495 level on Tuesday, and this has been the official depth of the currency pair displayed since the 18th of April.

Yes, the USD/PKR is trading near highs it has not seen the 2nd of April. Yes, the U.S Federal Reserve has made it clear that it is unlikely to decrease the Federal Funds Rate in the mid-term. Yes, the U.S will release important Gross Domestic Product statistics today, which includes the GDP Price Index. But this information has little effect on the official exchange rate issue by the Pakistan government for the USD/PKR.

Incremental Climb Perhaps an Admission of Forex Reality

While speculators may look at the USD/PKR and believe it is oversold, and that the currency pair needs to trickle higher, which would correlate to the global Forex market, logic may not mean much. Yes, it has incrementally traded higher since touching a low of nearly 277.4960 on the 3rd of April, but the process has been slow. And speculators who are enticed by the potential of buying the USD/PKR should remember the currency pair can be ‘reported’ to have traded lower with a sudden announcement.

Meaning that while looking for patient increment higher pushes in the USD/PKR from a speculative perspective, the official rate can simply be presented as lower and wipe out traders using too much leverage and unprepared for such diversions. The costs of pursuing the USD/PKR on brokerage platforms also need to be monitored because of the need to hold positions overnight. The central bank of Pakistan may ‘need’ to admit the Pakistan Rupee should be weaker, but they are not inclined to do so.

Top Regulated Brokers

Forex Correlations and the USD/PKR

The potential of actually selling the USD/PKR and using a take profit order to catch the declines of the currency pair is a speculative opportunity. The moves lower in the USD/PKR are often more volatile than upwards movement, this because the Pakistan government is making ‘corrections’ to the exchange rate. But this is a pure form of gambling on policy that is hard to predict.

- If the USD/PKR were a free floating Forex pair its value would have produced a stronger bullish trend.

- Perhaps the Pakistan government will allow the USD/PKR to show some small signs of correlating to the broad Forex market. But speculators of the currency pair need to be cautious.

- Traders that have the ability to look for higher values in the USD/PKR are welcome to try and pursue the price action, but their tasks remains difficult.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.4400

Current Support: 278.4300

High Target: 278.4450

Low Target: 278.2550

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Pakistan to check out.