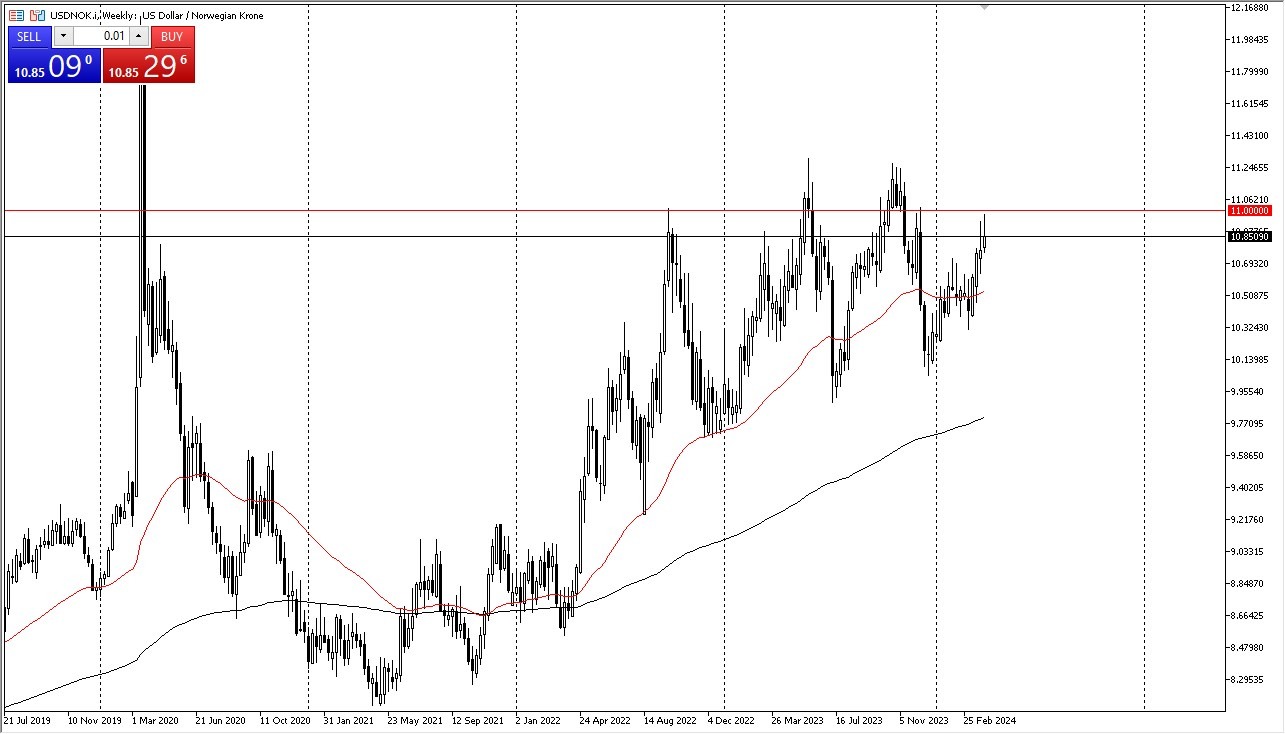

- The US dollar has rallied significantly during the course of the trading session on Tuesday, as we have seen the Norwegian krone get hit early during the trading session, but we continue to see the 11 NOK level offer resistance as the market has pulled back from there.

- In fact, looks like we are trying to form some type of shooting star, which suggests that perhaps the US dollar is a little overdone.

One of the things that could have been driving this pair is the fact that interest rates in America continue to rise, as traders are trying to bet on the Federal Reserve remaining very tight. Ultimately, this is a market that is a little bit out there when you worry about the Federal Reserve, but it does have a certain amount of influence on it. The 11 NOK level is an area that’s been important multiple times, that extends to the 11.25 NOK level. That region should continue to be a bit of a ceiling.

Top Regulated Brokers

If we do pull back from here, it’s likely that we could go down to the 10.50 NOK level, where the 50-Day EMA currently sits. If we break down below there, then it opens up a move down to the 10 NOK level. This is a pair that typically is more of a swing trading pair, and we do have a nice little range that we can work in that is currently 1.0 NOK wide. However, if we were to break above the 11.25 NOK level, then the US dollar could really start to take off, perhaps trading as high as 12 NOK rather shortly.

Crude Oil and a Secondary Indicator

The Norwegian krone does get a little bit of help from crude oil, but that’s going to be a bit different against the US dollar as the Americans are pumping out more oil than they have in years. Because of this, the pair could also be used as an indicator that you can use in order to trade the NOK against other currencies as well.

For additional & up-to-date info on brokers please see our Forex brokers list.