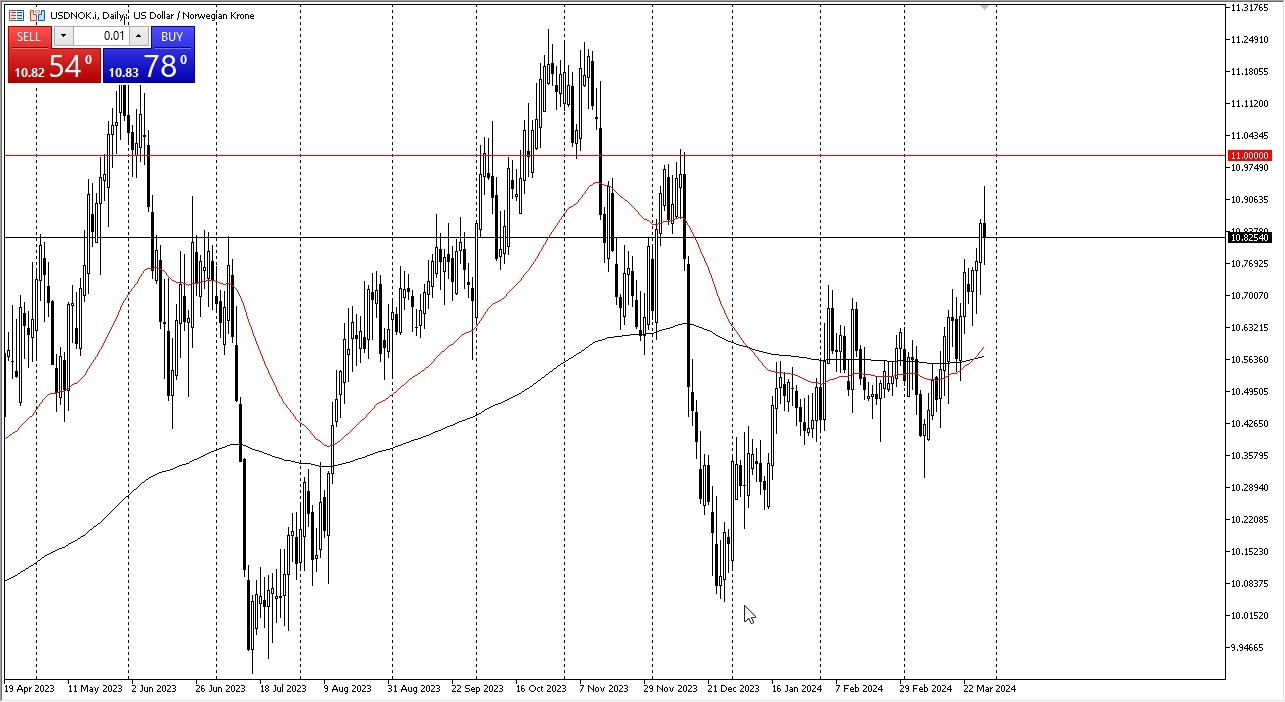

- The US dollar has been very volatile against the Norwegian krone during the training session on Friday, kicking out a huge wick to the upside and to the downside for the same session.

- This typically means that we are running into a bit of trouble and that is part of the reason I am analyzing this pair today.

Another reason that I’m paying close attention to the Norwegian krone is the fact that it is so highly levered to the crude oil market. Quite frankly, the crude oil market looks like it’s ready to break out and that could be a bit of a boon for this currency, at least in the short term. To the upside, we have the 11 NOK level offering significant resistance, as it is an area where we see a lot of selling pressure, and therefore to be interesting to see whether or not we can break above there. That being said, you should also pay close attention the fact that the Norges Bank suggested that they were going to leave interest rates alone for a while, so they are essentially in the same batch as the Federal Reserve when it comes to what they may do have the next couple of months.

Crude oil might lead the way

If the crude oil markets rise another couple of dollars, we may see the 11 NOK level hold as resistance, offering a selling opportunity. Furthermore, you have to pay close attention to the very volatile candlestick on Friday and understand that a breakout of this range would more likely than not attract a certain amount of FOMO trading. If we can break above the 11 NOK level, then I think the US dollar will take off to the 11.20 NOK level given enough time.

Top Regulated Brokers

If we break down below the bottom of the candlestick, we could go looking to the 10.7 NOK level, which is also backed up by the recent “golden cross”, where the 50-Day EMA has broken above the 200-Day EMA. In general, we could get a short-term pullback and then a surge higher, but it’ll come down to not only crude oil, but what the US dollar is doing against other currencies. I think the big take away from this pair is simply setting up for an inflection point that you need to be paying attention to.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.