- The US dollar has rallied rather significantly against the Canadian dollar during the trading session on Friday.

- This makes perfect sense, considering both countries released employment figures during the day, and of course there was a major divergence between the results.

In Canada, the Canadians lost 2,200 jobs, instead of the expected 40,700 for the month of March. In the United States, the headline number was 303,000 added for the month of March, above the anticipated 212,004 that same timeframe. Because of this, it makes perfect sense that the US dollar took off against the Canadian dollar.

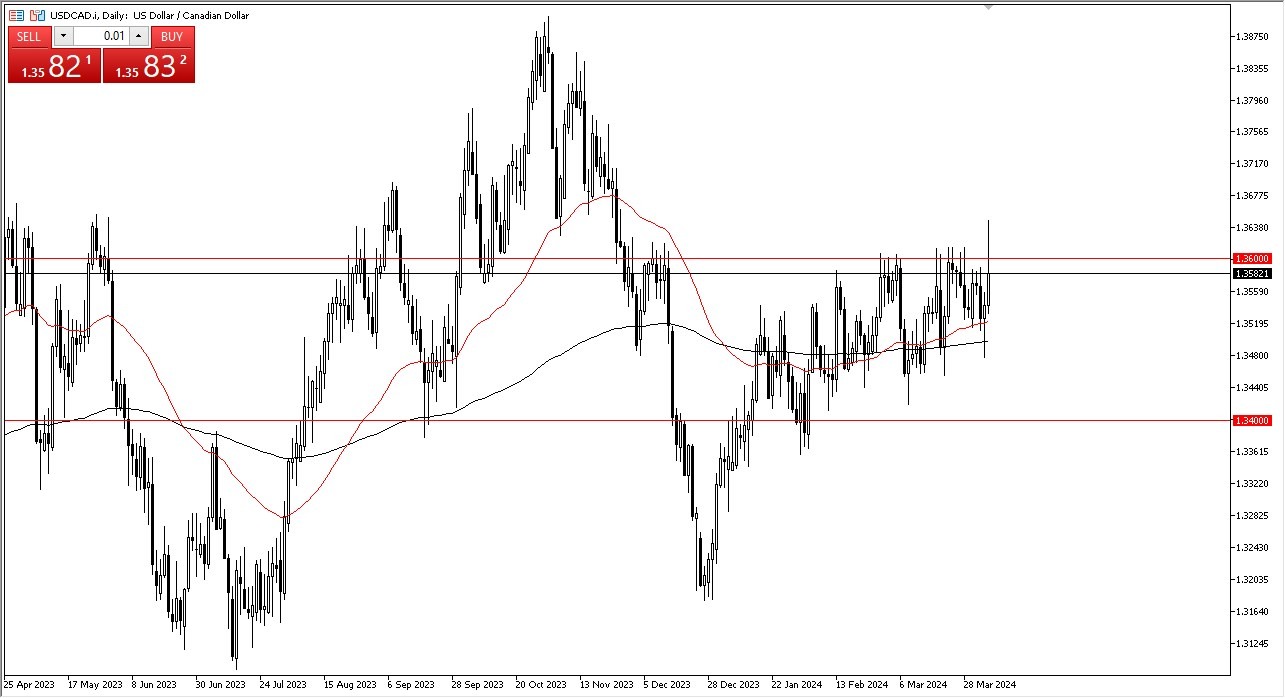

That being said, we are still very much struggling with the 1.36 level as we close out for the week. This is an area that has previously been resistance in the fact that we pierced it is a very strong sign, but it also suggests that perhaps is going to take quite a bit of effort to continue to climb at this point in time. If we can break above the top of the candlestick, then it’s likely that we could send this market looking to the 1.3750 level.

Top Regulated Brokers

Volatility Should Continue

The volatility in this market should continue to be very noisy, as we have to deal with the employment situation, and the idea that there is so much commerce between the 2 countries that it’s never really a smooth move it seems. Underneath, we have the 50-Day EMA offering support, which is followed very quickly by the 1.35 level and of course the 200-Day EMA. If we were to break down below there, then the market could go looking to the 1.34 level underneath.

In general, I think this is a situation where we have a lot of noisy behavior, and I think this is a situation where we continue to see volatility or at the very least the lot of choppiness. I don’t have any interest in shorting this pair, but I do like the idea of buying short-term pullbacks to take advantage of value in the greenback if and when it occurs. Ultimately, I do think that this market goes much higher given enough time in this marketplace.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.