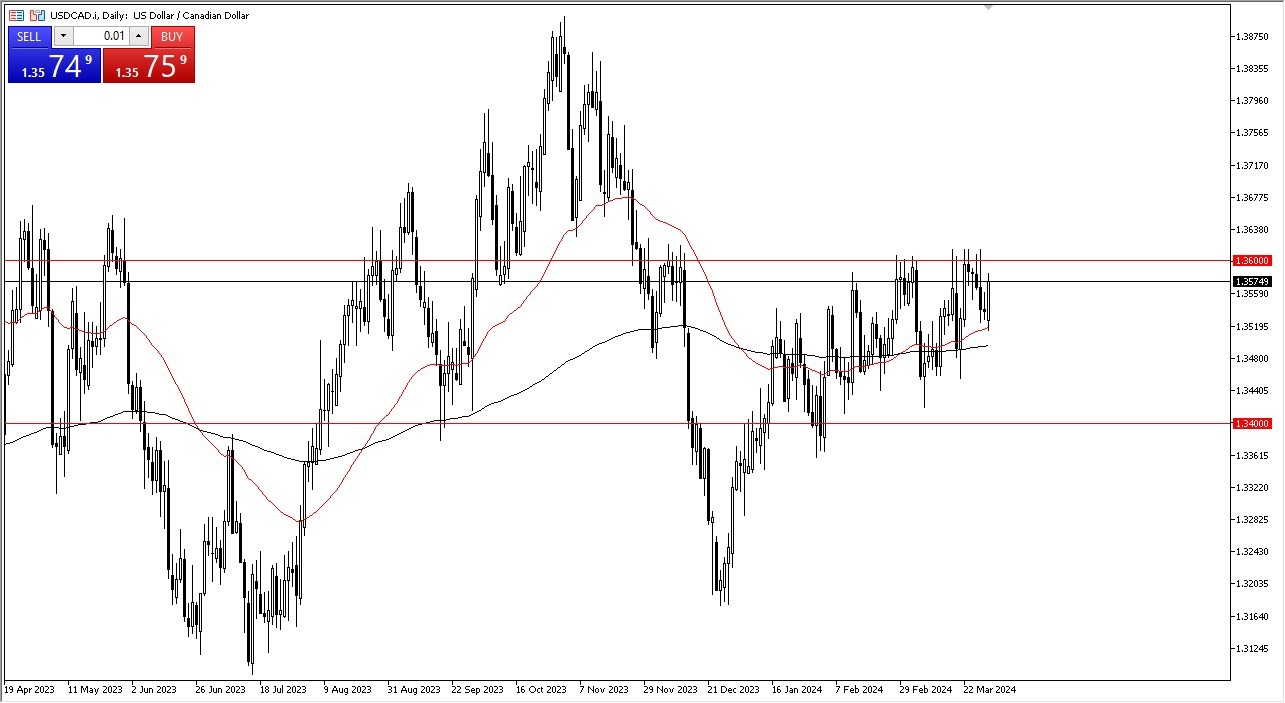

- The US dollar rallied rather significantly during the trading session on Monday, as the 50-Day EMA offered significant support.

- At this point, it looks like the market is ready to test the major resistance level above, which I see is the 1.36 level.

- The 1.36 level has been important multiple times, so I do think that if we break above there the market is likely to continue to go much higher.

All things being equal, this is a market that will continue to attract buyers on short-term dips, but at this point in time you have to keep in mind that we are still looking at this through the prism of a market that is in the consolidation region.

In general, I think this is a market that eventually will break out, and when it does, we may get a bit of a “FOMO Trading”, meaning that people will be chasing performance at that point. That being said, in the short term it’s likely that the resistance will remain strong. That being said, I do expect it’s only a matter of time before we see some type of short covering rally.

Top Regulated Brokers

Crude oil

Crude oil is strengthening, but quite frankly I don’t think that has the influence on this pair that it once did. Be careful of people who tell you to trade based on that, because it is a dynamic that has been changing quite drastically over the last couple of years. The United States now produces quite a bit more crude oil, and that’s something that you need to pay attention to. At this point, the Bank of Canada is likely to become a rate cutter quicker than the Federal Reserve, as inflation numbers out of America continue to be a bit sticky. At this point, then I think you got a situation where Canada will fall first, and then perhaps America.

Remember, the Canadian economy is heavily sensitive to the US economy, as it’s by far the largest destination for Canadian goods. You can think of it as a situation where if America falls, Canada gets destroyed, due to the fact that it’s like losing your biggest customer. That being said, I do think that North American general does much better than Europe, so while the Canadian dollar might get hammered against the greenback, and very well could perform much better against the Euro or the British pound.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.