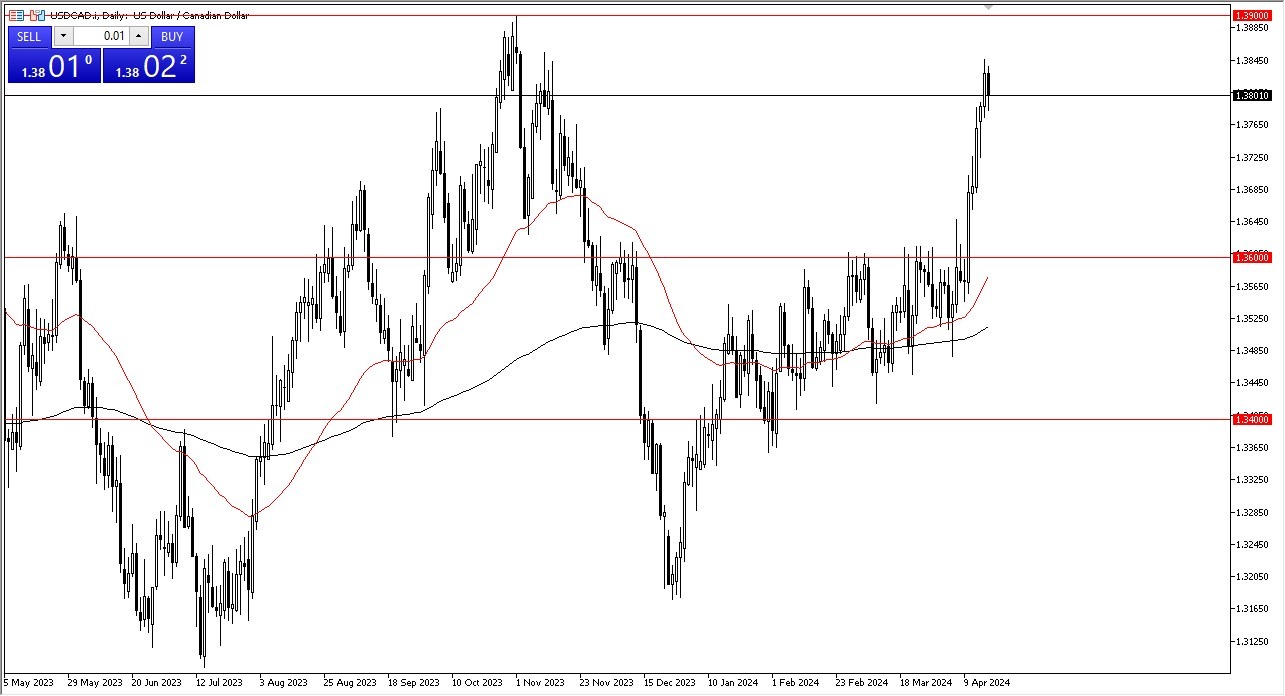

- The US dollar has fallen a bit against the Canadian dollar during the trading session on Wednesday, as we continue to see a lot of volatility.

- That being said, this is a market that has been extraordinarily bullish for some time, and we are most certainly overbought at this point.

- All things being equal, this is a situation where buyers will more likely than not be looking for some type of pullback in order to get involved again.

Technical Analysis

The technical analysis in this market is quite simple, it’s a market that is extraordinarily strong and it is most certainly overbought. The 50-Day EMA is all the way down at the 1.36 level, and therefore we could pull back quite drastically and still find plenty of buyers. Speaking of the 1.36 level, it’s likely that it will offer support based upon previous resistance. All things being equal, this is a market that needs to find a little bit of value so traders will be interested in getting involved again.

Top Regulated Brokers

Bank of Canada

The Bank of Canada is very likely to have some issues as far as I can tell, due to the fact that the Canadian economy certainly seems to be struggling and with that being the case, it’s likely that we will continue to see the Canadian dollar softened. Crude oil markets typically have a major influence on this market, but this dynamic has been changing as of late, due to the fact that the United States produces so much crude oil now. I think a lot of this comes down to the Bank of Canada, and the fact that it plays 2nd fiddle to the Federal Reserve. Interest rates in America have been rising for some time, and therefore I think you have a situation where it does make a lot of sense that the Americans continue to see a stronger currency.

Above, we have the 1.39 level as a significant resistance barrier, and if we can break above there then I think the market could truly start to take off to the upside. That being said, it is going to be difficult to make that happen, so I think short-term pullbacks are necessary in order to build up the necessary pressure and interest for bullish traders to get involved.

Ready to trade our daily Forex forecast? Here’s some of the top trading account in Canada to check out.