- The US Dollar has continued to advance following its bullish breakout in late March from a consolidating triangle formation.

- US Dollar strength is supported by market sentiment and fundamental factors.

- The best Forex opportunity to be long of the US Dollar looks likely to be in the USD/JPY currency pair, which has risen powerfully to a new 34-year high.

- There may be an opportunity to go short of the EUR/USD currency pair at $1.0700, as the next most attractive trade among these three major pairs.

- There may be an opportunity to go short of the GBP/USD currency pair at $1.2500.

US Dollar Index (DXY): Technical Analysis

The US Dollar has continued to advance following its bullish breakout beyond the dominant narrowing triangle formation on 22nd March. The breakout saw a perfect retracement to the other side of the broken upper trend line of the triangle, which then acted as excellent support. This is a textbook Forex breakout and retest.

A further bullish technical development has come from the weak bullish breakout beyond the key former resistance level shown in the price chart below at 105.64.

The US Dollar Index is trading at a new 5-month high today, which is bullish, but well into the London session the price has given up most of today’s earlier gains, which suggests we may see at least a pause in the upwards movement.

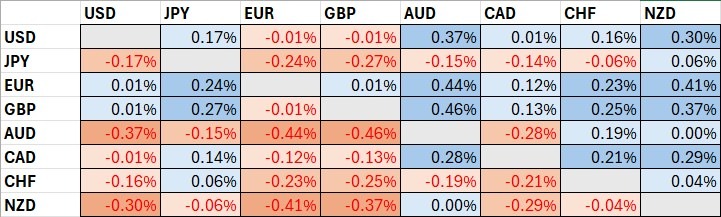

The table below shows that the Euro and the British Pound have been the strongest major currencies so far today, although they are barely ahead of the strong US Dollar, while the Asian currencies have been the weakest.

Top Regulated Brokers

US Dollar Index (DXY): Fundamental Analysis

The US Dollar has several fundamental and sentimental reasons for its recent and current strength:

- Tension between Israel and Iran following Iran’s largescale attack on Israel last weekend, which now seems likely to trigger Israeli retaliation. This creates risk-off sentiment which tends to strengthen the US Dollar as a safe haven.

- Higher than expected US CPI data released last week has lowered expectations that the Fed will cut rates in the near term, which gives the Dollar a boost via its yield.

- Selloffs in stock markets often result in US Dollar inflows.

USD/JPY Forecast: Technical Analysis

Recent gains by the US Dollar have been expressed most strongly and dramatically against the weak Japanese Yen. Until a few days ago, it was widely thought that the Bank of Japan, backed by the Japanese government, would fight hard to defend the ¥152 handle in the USD/JPY currency pair. However, when the bullish breakout beyond this level eventually came, the response from the Japanese financial establishment was weak, and the price has continued to rise – it is currently trading at a new 34-year high.

Traders will probably be wise to look for long trades, but it is unclear whether there are any good supportive entry points nearby. It might be better to day trade this pair and to look to enter long following minor pullbacks on shorter time frames, especially after the New York open settles.

EUR/USD Forecast: Technical Analysis

The US Dollar has also reached its strongest point against the Euro in 5 months, but the downwards movement here today is very muted, unlike against the Japanese Yen. The failure to move down get weight from the fact that the price seems to be finding support at the expected support level of $1.0610. The EUR/USD currency pair tends to like to make deep retracements even when it trends, so a bullish pullback today would not be surprising. The best approach may be to look for a short trade here only when the price reaches and rejects the nearest resistance level at $1.0699, which has the advantage of confluence with the round number at $1.0700. A more aggressive approach could be to wait for a bearish breakdown below the next lower support level at $1.0592.

GBP/USD Forecast: Technical Analysis

The US Dollar has reached its highest point against the British Pound in 4.5 months, making the British Pound the strongest major currency against the greenback. We see the price action here today behaving very similarly to the EUR/USD currency pair, which is no surprise as these pairs tend to be very positively correlated.

The main technical difference here is that unlike the EUR/USD, the price is not sitting on support, although it is currently refusing to fall, with the Dollar giving up its gains so far today against the British Pound.

The recent price action looks quite bearish, with yesterday’s candlestick being both a bearish pin bar and an inside bar.

The nearest resistance level at $1.2506 is very confluent with the major round number at $1.2500, so a retracement back to this area following by a bearish reversal could be a nice short trade entry opportunity. I do not want to enter a short trade on a breakdown to a new low as we would then be very close to the next support level at $1.2376.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.