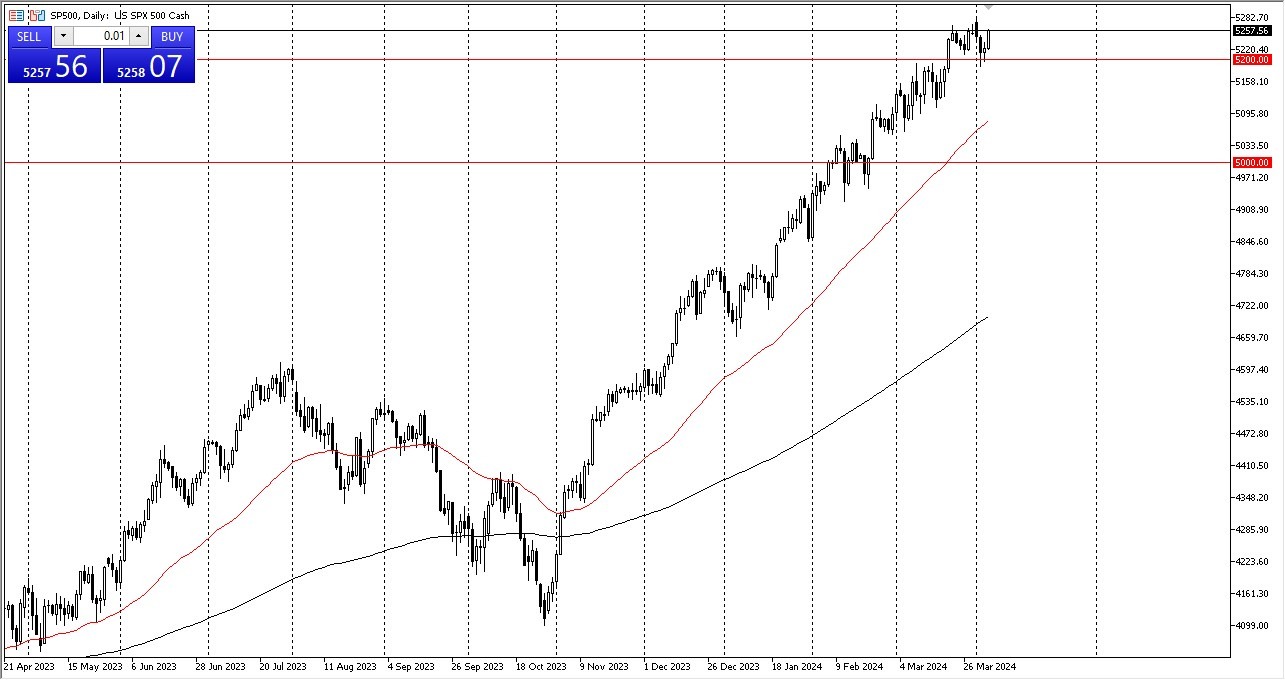

- You can see that the S&P 500 looks very strong.

- I think at this point in time we will continue to see a lot of buyers coming in on dips to take advantage of the value that appears on each pullback.

- It is worth noting that today is the jobs number. Keep in mind that the jobs number is often a major mover of markets in general, and therefore you need to be very cautious with your position sizing as you can take massive losses if it goes against you.

That is going to come as a significant amount of volatility. Short-Term pullbacks, I think see plenty of support at the 5200 level and then possibly even lower than that. The 50 day EMA is currently racing towards the 5100 level. And therefore, I think that is going to act as a floor. We have been at a 45 degree angle rising for some time, and I think that probably continues to be the case.

Top Regulated Brokers

Noisy Behavior Expected

I would expect a lot of noisy behavior during the course of the trading session on Friday, as per usual, but this is a market that's bullish, and I think the market will try to convince itself one way or the other that the Federal Reserve is going to cut rates regardless of what the jobs number tells us, and therefore it remains buy on the dip.

I have no interest in shorting, although you can make an argument, perhaps for taking profit heading into the announcement. Worst case scenario, I suspect we get a short term pullback that only gets bought into. Hunting for value of course is the way that a lot of traders will be looking at this market, I think it does offer value from time to time. A little bit of caution and a bit more patience probably pays off in this market going forward, so remember this as we continue to see stock markets on Wall Street get stretched a bit.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.