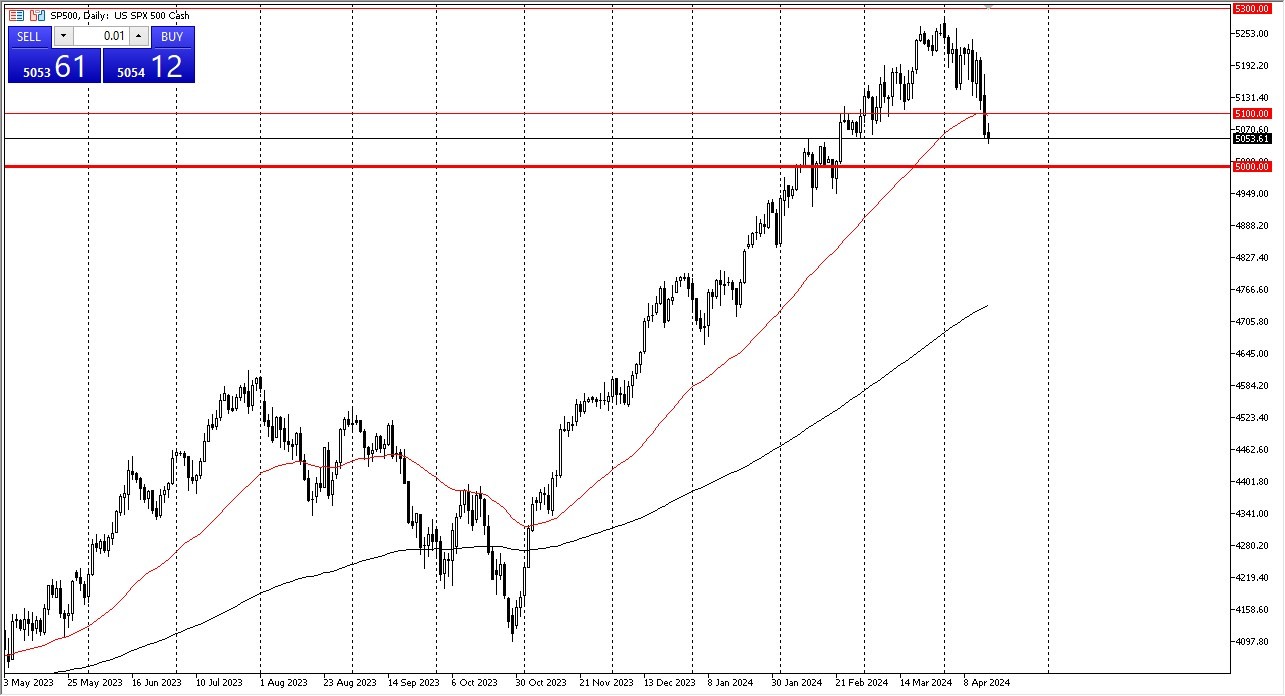

- The S&P 500 has gone back and forth during the course of the trading session on Tuesday, as it looks like we are trying to recover after the recent plunge.

- The 5100 level above should continue to be important, and if we can break above the 5100 level, which is subsequently the same thing is breaking above the 50-Day EMA, then I think the uptrend continues.

However, keep in mind that we are in the midst of earning season, so there will be more likely than not be a lot of noise and volatility, but that’s nothing new for this market. While we did have a very strong uptrend for some time, the reality is that sooner or later we had to give back some of these gains. All things being equal, the market is likely to continue to see a lot of upward momentum, especially as Wall Street comes back to the idea that eventually the Federal Reserve will loosen monetary policy. At the end of the day, it’s the only thing that people care about, and therefore the short-term pullback ends up being a buying opportunity more than anything else.

Buying On the Dips

I think this continues to be a market where plenty of traders will come in and pick up value on short-term pullbacks. The 50-Day EMA of course is the target initially, but once we break above there then I think we continue the overall uptrend. Underneath, we have the psychologically important 5000 level, which should offer a certain amount of support at any attempt to break down below there. In general, this is a market that I think continues to look for momentum to come back in and pick things up.

Top Regulated Brokers

If we were to break down below the 4900 level, then it would more likely than not kick off a much deeper correction, but at this point in time I don’t necessarily see that happening, and I do believe that this correction may have enough people interested in getting involved in this market to push things higher. In general, I expect a lot of volatility, but we are still very much in an uptrend more than anything else.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.