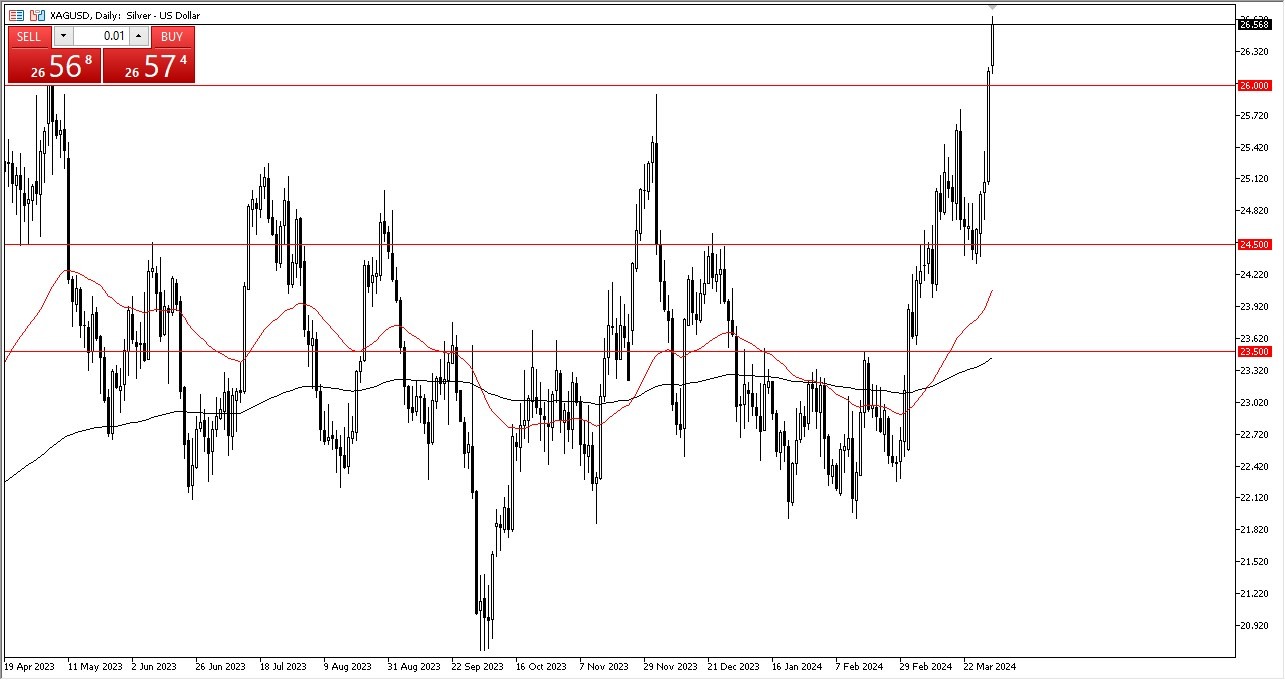

- Silver has shot straight up in the air during the early hours on Wednesday as we continue to see a lot of momentum.

- This is a market that recently had broken above the crucial $26 level, an area that a lot of people will, of course, pay close attention to due to the fact that it is, barrier that has been important multiple times in the past.

- That being said, it’s worth noting that markets are starting to focus on a multitude of issues at the same time, and that typically causes a lot of volatility in precious metals markets.

In general, this is a market that I think is looking to go higher, and there are a whole plethora of reasons that may be the case. For example, you have to keep in mind that it is a precious metal. So, a lot of people look at it for safety, but it does play back seat to gold when it comes to that.

Top Regulated Brokers

The overall attitude of the market

In the silver market right now, I see a lot of bullish pressure that every time pull the market pulls back. It should end up finding plenty of buyers. The $24.50 level underneath is a massive support level as well. with the 50 day EMA, racing towards that area. So, at this point, you're just looking at each pullback as an opportunity to get long, silver, and eventually we will continue to go above the $26.50 level and then eventually $27.

In general, I just don't see any reason to short this market other than the fact that commercials in the futures markets are definitely slanted to the downside. So do keep that in the back of your mind, as the markets will continue to look at this through the prism of whether or not we are in panic, or if we are simply jumping around due to the idea of profligate spending by all of the world’s major economies.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.