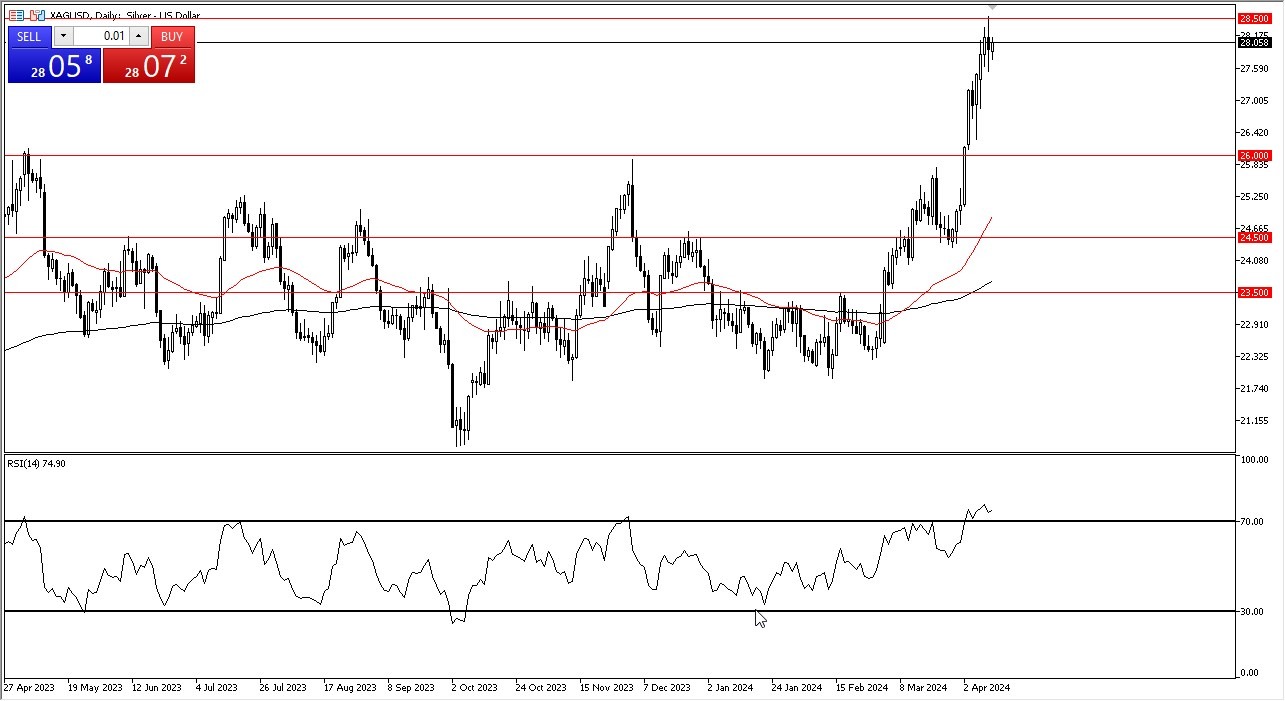

- Silver continues to hang around near the highs as the market has seen an inordinate amount of bullish pressure.

- At this point, we are over bond by just about any measure you can think of, and the $28.50 level should continue to be a significant barrier as it is a longer term resistance barrier with the Relative Strength Index well above 70.

Mean Reversion Trade?

I do think that some type of “reversion to the mean” will happen, meaning that we should get some type of pullback. That pullback should be thought of as a potential buying opportunity as it offers cheap silver. As long as we can stay above the crucial $26 area, I think you will continue to see people press this market to the upside.

Top Regulated Brokers

All of that being said, if we break down below $26, then you have to ask whether or not we are going to reenter the previous consolidation area. That had been important for so long. Either way, silver does look a little bit stretched, and even gold is starting to show signs of hesitation. Now pay attention to gold because it does tend to lead silver, and therefore you may get a little bit of a heads up.

All of that being said, if we were to break above the $28.50 level, especially on a daily close, that really could send a lot of money into this market, perhaps sending silver looking towards the $30 level, although I think we need some type of consolidation to work off the froth before that actually happens. This is a market that will continue to be a lot of volatility, but in the end, it looks as if the buyers are still very much in control of silver pricing overall.

I think that sooner or later, we will have to make a bigger decision as to whether or not silver markets con hang onto the momentum. I am not sure about that – but I do know that the market isn’t one you can short anytime soon.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from