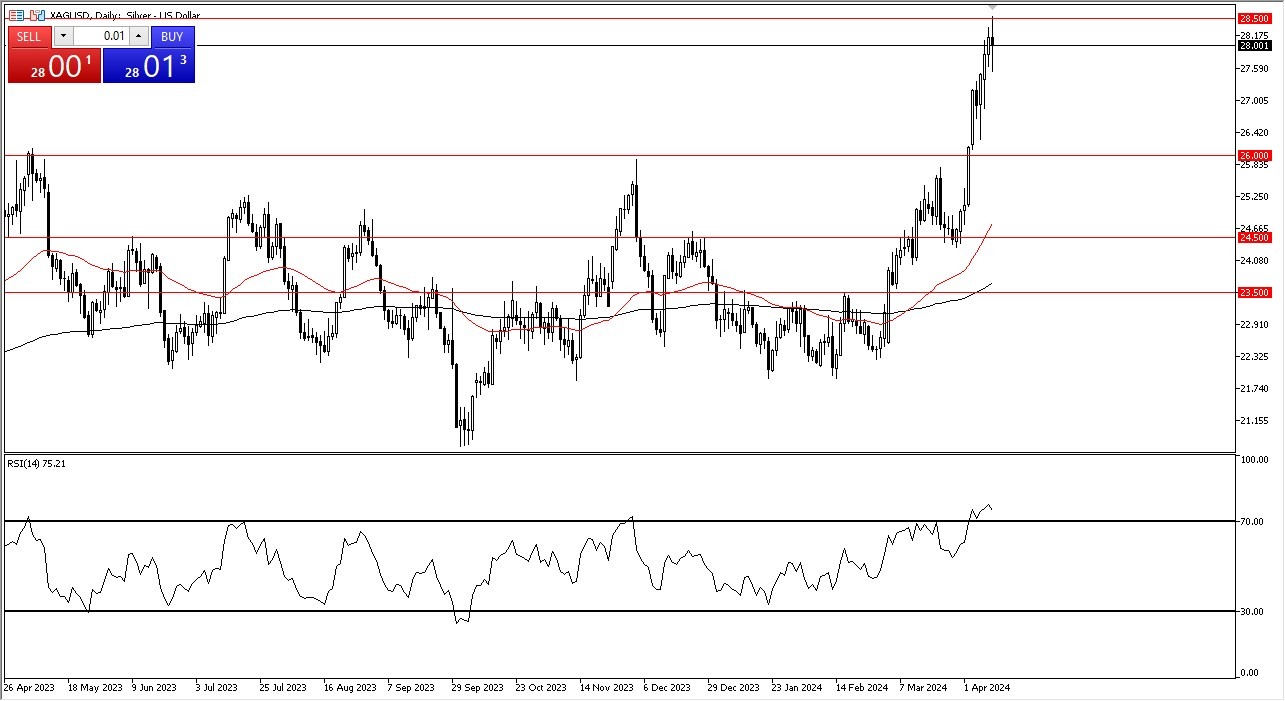

- The silver market has been all over the place during the course of the trading session on Thursday, as the $28.50 level is an area that has been imported multiple times in the past, so the fact that we have pulled back from there is not a huge surprise.

- Furthermore, we had the CPI numbers come out hotter than anticipated, so that has shown itself to be negative for precious metals in general.

Silver of course will be even more exposed to selling pressure due to the fact that it is also an industrial metal that people look to play the “green revolution” trade. In other words, there’s a lot of crosscurrents.

Technical Analysis

The $28.50 level has been a major resistance barrier multiple times in the past, and at this point in time we are certainly overbought. The Relative Strength Index is currently trading above the 70 level, which signifies that we might be overbought. A simple glance at the chart also tells you the same thing, and the fact that we have seen so much volatility during the trading session on Wednesday suggest that perhaps we had seen a significant amount of profit-taking during the day as well.

Top Regulated Brokers

If we were to break down below the bottom of the candlestick for the trading session on Wednesday, I think it is likely to send the silver market toward the $26 level. Any type of bounce from that area were more likely than not end up being a buying opportunity. On the other hand, if we break down below the $26 level, then I think the uptrend in silver is over.

Keep in mind that silver has been manipulated for years, as J.P. Morgan has had to pay massive fines of millions of dollars for doing that very act. In other words, it’s probably only a matter of time before we start to see that same type of behavior yet again. Remember, this is a paper contract and not a deliverable one, which is a completely different scenario. Quite frankly, there is more “paper silver” out there than there is real silver in the world. Because of this, the silver market always acts a bit strange and as we are overstretched, I think you probably cannot be a buyer here.

Ready to trade our Forex daily analysis and predictions? Here are the best Silver trading brokers to choose from.