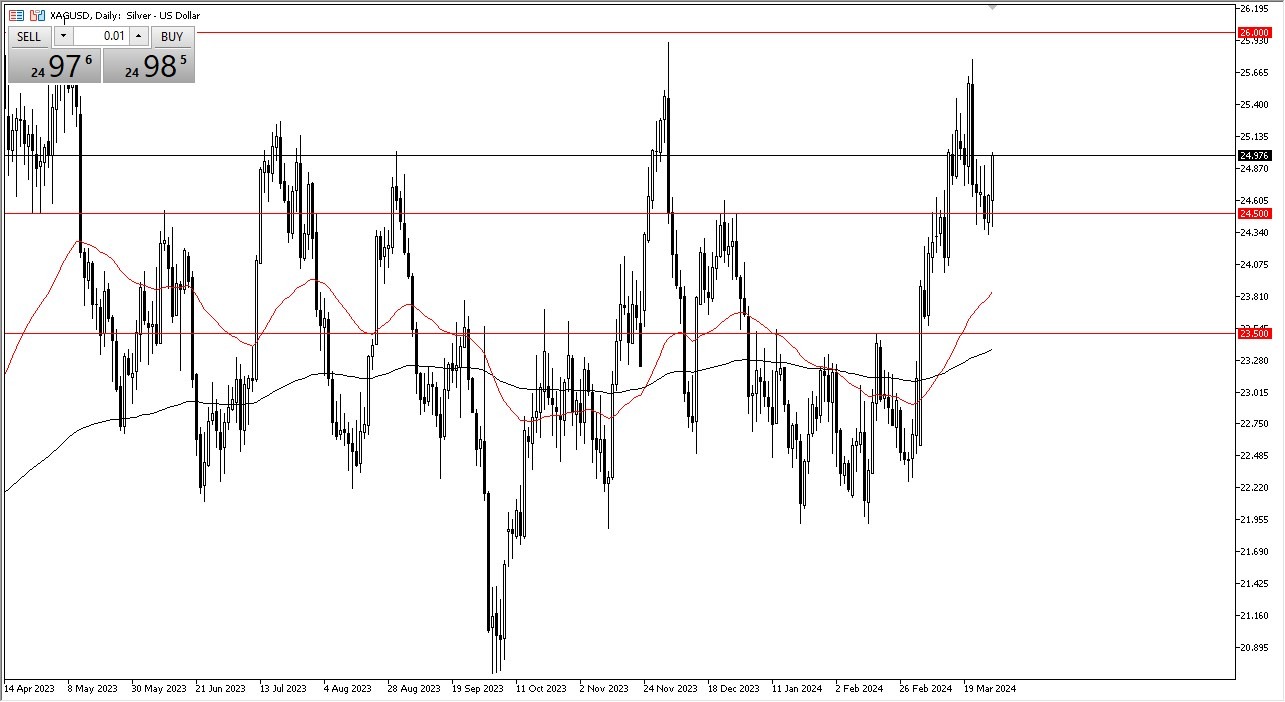

- Silver was closed during the Friday session, but when we look at the Thursday candlestick, it's obvious that there is a lot of bullish pressure.

- We did pull back just a bit on Thursday to dip just below the $24.50 level and then took off towards the $25 level.

- I think at this point in time, we continue to see a lot of short-term pullbacks that we can take advantage of.

More Consolidation? Maybe.

I do think that silver more likely than not will continue to consolidate between $24.50 and $26 level above is resistance. So, I think we're going to see a lot of sideways noise, but ultimately you have to be much more designed, your trading plans to go in and pick up value as it starts to show itself via pullback. If we were to break down below the $24.30 level, then it's possible that we could go down to the 50-day EMA. The 50-day EMA being broken to the downside would open up the possibility of a move down to the $23.50 level. While the $26 level is an obvious target, you should keep in mind that it is a major resistance barrier, and if we do break above there,

Top Regulated Brokers

it would kick off a lot of FOMO trading in this market. I don't see that happening, at least not anytime soon, but if it were to happen, that would indeed be something rather special. So, I'm bullish, but I also recognize that we are going to stay in a particular range. Because of this, you need to be conscious with your position size but also recognize that silver does tend to be noisy and therefore your position sizing will be crucial. Ultimately, this is a market that is more bullish than anything else, but it also has so much in the way of resistance above that it will lag behind gold.

Pullbacks at this point in time continue to be buying opportunities and I think a lot of value hunters will continue to take advantage of silver. Keep in mind that silver does tend to be more of a short term type of market than anything else, and therefore position sizing makes a huge difference as volatility can cause major problems.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.